Stocks took a bit of a beating yesterday as exhausted bulls watched some of their late-2023 gains melt away. There are still 8.8 million job vacancies in the US, still quite high by historical standards.

New normal. I love dogs and dogs seem to love me. I don’t dislike cats, pigs, horses, rabbits, fish, or fuzzy rodents, I just like dogs best. Despite her best efforts, my wife has had a dog by her side, in one way or another, for her ENTIRE life. I write this as my daughter’s dog Eloise, who has been vacationing at chez Malek, sits on my lap, keeping me company… and busy when I least want to be… and I love it. Ok, now that we got that out of the way, let’s get down to business… and we will come back to pets in a bit.

Yesterday, the Fed released the minutes from its last FOMC meeting. By reading through the well-crafted notes, it appears that the Fed is not as flush with doves as many would like to believe, and the minutes certainly had a hand in yesterday’s market declines. I was not too surprised, as I was confident that there would be no dovish revelations. The fact is that the Fed does not need to say anything at this point as things are normalizing. By “things” I mean inflation, economic growth, markets, etc. Those things don’t change overnight; it takes time for market forces to clear. Now, we are nowhere near normal, as defined by 2019 standards, but we are making good progress. Further, “normal”, going forward, may be quite different than it was in the past. Long-run mean inflation is around +2%, which is why the Fed so confidently uses it as a target, but +3% may be justified, given that the global economy is in a great transition. Bond yields were near zero for many years, to the point where low mortgage rates, almost negative T-bill yields, and 100% equity invested retirees became normal. There is nothing wrong with higher yields on bonds (unless you are a company who relies on them finance slapdash, senseless ventures). Inflation between +2% and +3% is also not so terrible, especially from a seller’s perspective. The reality is that the markets… all the markets, simply need to adjust to that new normal, and it takes time. But it is certainly happening. If you were a Fed governor and you saw progress being made, would you waste dry powder to spur things along? Of course, not, so we should expect the same from the Fed. It will only use those sweeteners when absolutely necessary.

Did you know that the US pet population grew by +6% in 2020? I don’t want to get into the biology of all that, but indeed, it does make sense as many clamored to bring pets into their homes during the pandemic. The trend continued into 2021 with a +4% increase. I lifted these statistics from an interesting article I read on my Bloomberg which reported Clorox’s opening of a new $100 million cat litter factory. The company hopes that the increased production capacity will help fill the gap of its now-shrinking cleaning products sales. Indeed, sales of those products are normalizing as well, after surging during the pandemic. I could say that we certainly have plenty of Clorox Wipes on hand in my house, but we are also surely buying less than we were in, say 2021. The thing about pets is that they are a 15 to 20-year commitment. The love part is easy, but the financial burden cannot be dismissed. Sellers of pet products have taken notice of these statistics and have rushed to fill the gap with all manner of goods and services, with Clorox being just one example.

Would you be surprised to learn that millennials make up 33% of pet ownership? Gen X makes up another 25% ownership. Those 2 groups are prime earners, and presumably willing to spend some of those earnings on pet products and services. It’s not just cat litter, food, and collars. No, a big part of it is pet health, and it’s not just specialty producers, its mainstream pharmaceuticals companies and consumer discretionary companies like Merck, Nestle, Colgate-Palmolive, and yes Clorox. Those companies have certainly benefited from this recent surge in pet ownership. But alas, growth there is normalizing as well as ownership growth is expected to return back to its normal +1%. In terms of the investment opportunity, you can check out the chart below. It is the Proshares Pet Care ETF, PAWZ. I am sure I don’t have to tell you what the ETF invests in, nor do I have to explain the chart itself. I will let you figure those out as my new furry best friend is ready for her morning jaunt in my garden.

WHAT’S SCRATCHING AT THE DOOR THIS MORNING

Walgreens Boots Alliance Inc (WBA) shares are higher by +3.25% in the premarket after the company beat EPS and Revenue estimates by +7.19% and +4.77% respectively. The company reiterated its full-year guidance which was in line with estimates. The company also announced a dividend cut. Dividend yield: 7.51%. Potential average analyst target upside: +3.25%

CBRE Group (CBRE) shares are lower by -5.87% after Evercore cut its rating to INLINE from OUTPERFORM. Evercore sees limited upside for the company which it expects will be impacted by lower fees, industrywide. Potential average analyst target upside: +2.9%

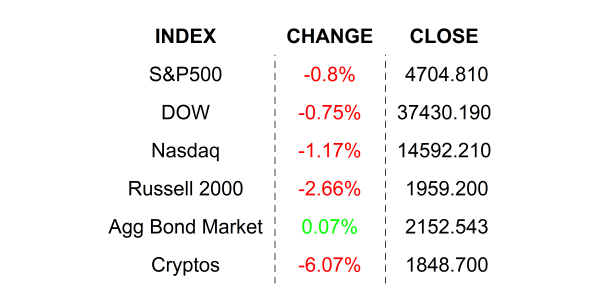

YESTERDAY’S MARKETS

NEXT UP

- ADP Employment Change (Dec) is expected to show +125k new jobs added, more than last month’s +103k additions.

- Initial Jobless Claims (Dec 30) is expected to come in at 216k, slightly lower than last week’s 218k claims.

- S&P Global US Services PMI (Dec) is expected to come in at 51.3, level with earlier flash estimates.

.png)