Stocks had a rough session, closing at their lows, as an ADP jobs report came in hotter than expected. Bond yields have been relentlessly climbing, forcing weak hand holders to sell, accentuating the decline.

Progress marches on. How is your week going? If you are away with family and friends, the weather is nice, and you have no access to your stock portfolio, you should be happy as a clam in high water. For my American readers, you probably know that last saying as, simply, “happy as a clam,” as history has forgotten the “…in high water” bit. For my non-American readers, clams are apparently happy when it’s high tide because they are less likely to be fetched up and… um, shucked… to be slurped down in a puddle of hot sauce. If you are on vacation and reading my note, let me say, plainly, I love you, and also, sorry to spoil your relaxation. If you hit the ground running on Tuesday like me, you are probably wishing that you were on vacation. Stocks did not exactly come out the gate strong, with the Nasdaq down -3.34% and the S&P down -1.7% as of last night’s close. Bonds have had an equally tough week with the 10-year Treasury Note yield gaining some +12 or so basis points through yesterday.

What do you suppose was the cause of all this negativity after that epic Santa Claus rally made last year’s returns respectable? Institutional investors follow a very recognizable pattern. They sell their losers in the last weeks of the year to start on the right foot in the new year. In the new year, they typically sell some of their big winners to free up cash to place bets on the next big thing. Now, there are no guarantees that the next best thing is going to outpace their existing winners, but the fact remains, that a lot of “professional” money managers feel like they have to show investors that they are “busy,” even if they have a conviction that their existing winners will keep winning. I am not necessarily condemning the pattern as much as simply, highlighting it for you. Actually, strike that, I am condemning it 😉.

Behind the institutional folks are everyday investors who were already on the edge in the last week of the year. Watching their hard-earned gains from last year wither away further, elicited a bit of subdued panic, causing them to fall back on the maxim “no one ever got fired for taking a profit.” I wouldn’t subscribe to that maxim, as indeed, many have been fired for taking a profit… too early. Some retail selling has, therefore, also contributed to the wet-noodle performance of stocks in these past few days.

There is one more thing that has overshadowed the market this week. Strong economic numbers! That’s right, strong economic numbers. FOMC minutes from the other day showed that members were not in a state of panic, looking to cut interest rates, however the minutes did make it clear that the hikes were pretty much done. Fed-speak this week was consistent with those minutes and the messaging prior to holiday, which is something like, “the plan is… there is no plan.” That can be taken as hawkish if you are nervous or a bear, indecisive if you are nervous or a bear, or not-dovish if you are just plain nervous. Additionally, there were some strong employment numbers in the past few days, which have some investors worried that the Fed will be displeased. To that, I say, “really?” It is clear that inflation is normalizing. It is also clear that the Fed, at this point, is done with its brake-slamming campaign. With inflation receding and interest rates expected to be here or lower by the end of the year, it would seem like there will be great opportunity for businesses to expand in 2024. Companies that laid off employees in 2022 and 2023 will take the opportunity to rehire fresh talent for the next stage of expansion, starting later this year into next. For that expansion to happen, it will take a strong economy. I am, therefore, encouraged when employment is healthy. Why? Because I am a long-term investor. That brings me to the final point, and I am sure that my regular readers have heard this from me in years past. We are only 3 sessions into 2024. There are 249 trading days left in the year! Pace yourself, or you will run out of steam before you even get to the first marker. In fact, if you are truly a long-term investor, even 249 days should mean very little to you. Be smart, stay balanced, stay focused. The tide always changes, and you will have plenty of time and opportunities to gather your clams.

WHAT’S RISING OR FALLING WITH THIS MORNING’S TIDE

United Rentals Inc (URI) shares are lower by -1.36% in the premarket after BNP Paribas downgraded the stock to UNDERPERFORM. In the past month, 6 analysts have raised their price targets, while 1 lowered. The company will announce earning at the end of the month. Dividend yield: 1.07%. Potential average analyst target upside: -4.6%. WHY IS THIS NEGATIVE? Because the stock’s price is above the median analyst target estimate. While that may be viewed as the stock being expensive, it does not mean that it will not continue to climb.

Norwegian Cruise Line Holdings Ltd (NCLH) shares are lower by -1.93% in the premarket after being downgraded to EQUAL WEIGHT by Wells Fargo. Norwegian’s forward PE of 23.72x is higher than the 18.14x median of its peer group. Potential average analyst target upside: +9.5%.

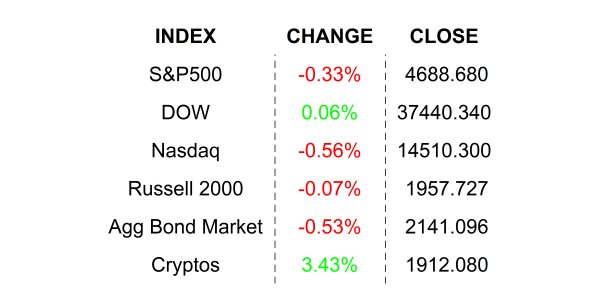

YESTERDAY’S MARKETS

NEXT UP

- Change in Nonfarm Payrolls (Dec) is expected to be +175k, slightly lower than November’s +199k print.

- Unemployment Rate (Dec) may have ticked up to 3.8% from 3.7%.

- Factory Orders (Nov) are expected to have risen by +2.4% after a -3.6% decline in the month prior.

- ISM Services Index (Dec) may have slipped to 52.5 from 52.7.

- Next week: Earnings season kicks off. In addition, we will get Consumer Price Index / CPI, weekly jobless claims, and Producer Price Index / PPI. Check in on Monday to download economics and earnings calendars.

.png)