Stocks bounced higher yesterday after positive-ish Fed comments. According to the New York Fed, Americans are lowering their expectations about inflation in the year ahead.

Don’t worry, be happy. I want to start out by saying that we are still in the woods. Yes, we are. Inflation is bad for the economy and bad for my budget. There is no other way to put it. However, it is also clear that, at this point, there is very little else that the Fed can do to slow the economy down, short of crashing the entire bus right into a wall… as many Feds have done in the past. This Fed has consumers on its side. I don’t know if it’s social media or the relentless consumerism of the millennials spending all their and their parents’ retirement money on the “necessities” or what, but consumers will simply not give up. That has really helped the economy stay buoyant prior to the pandemic and even now after the Fed quite literally wrenched the handbrake into “full brake” mode. Alas, the Fed has been given a gift. The economy has slowed sufficiently to allow inflation to moderate from untenable levels without contracting… yet.

It is a very delicate balance, and Fed members know it. Unfortunately, it is not as simple as just cutting rates to make the bulls happy and to vindicate the TV analysts who are talking their bull positions. Fed members are very aware that the Volcker Fed was planning a success party back in the mid-1970s to herald in its successful campaign against hyperinflation. The invitations went out and the Schlitz Beer was ordered. Unfortunately, before it could tally up the respondents, inflation came back… with a vengeance. Well, the beer was ultimately consumed, but only by Fed members to drown their sorrow as they actively fought inflation through the turn of the decade. That 2% handle would not show up until 1983. So yes, Powell’s Fed is very much aware of what memorialized Volcker as The (with a capital “T”) Inflation Fighter.

That said, no one is in any rush to lower interest rates until it is absolutely necessary. In fact, no one is in any rush to even hint that interest rates will be lowered, until absolutely necessary. But one can certainly sense that the winds are changing, if not slightly. After last Friday’s somewhat strong inflation numbers, which came on the back of a string of positive-but-not-too-positive numbers, many would have suspected that the Fed hawks may reemerge be. This has driven bond yields a bit higher in recent days. But, judging by yesterday’s Fed speakers, the hawks appear to be grounded at the moment. Yesterday, Atlanta Fed President Raphael Bostic said that inflation has slowed more than expected and that it is on track to reach the Fed’s +2% target. Bostic is a known hawk, for the record. Michelle Bowman, a known dove, took a more cautious approach, acknowledging progress but in no rush to cut rates too soon. Most of the recent Fed-speak has fallen between those not-too-extreme extremes. You know what? We should take that as a win, for the moment. Inflation will bop around, no doubt, but it is hopefully on a trend path to where everyone should be happy. Adding to all that, yesterday, the New York Fed released its Survey of Consumer Expectations for December, and the results show that consumers are expecting inflation to be around +3.1% within the year. The good news is that it is the lowest expectation in 2 years. That is great news for the Fed, who is most concerned about what is referred to as “built-in” inflation. SO, let’s take this as a win and focus on corporate health. We will have a lot to consider in the weeks to come as earnings season officially begins THIS WEEK. I would hold off on ordering the Schlitz Beer for now.

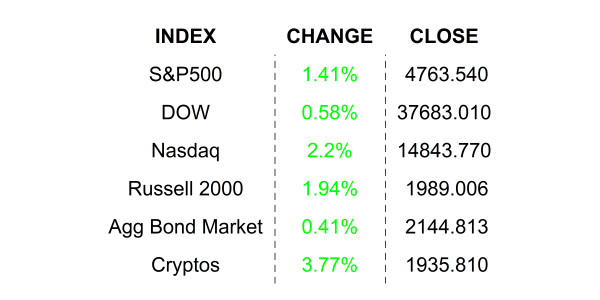

YESTERDAY’S MARKETS

NEXT UP

- NFIB Small Business Optimism (Dec) came in better than expected at 91.9 after printing 90.6 in November.

- Fed Governor Michael Barr will speak today.

.png)