Stocks posted solid gains yesterday as optimism about a benevolent Fed returned. The SEC somewhat reluctantly approved spot Bitcoin ETFs after drawing out the decision to last minute.

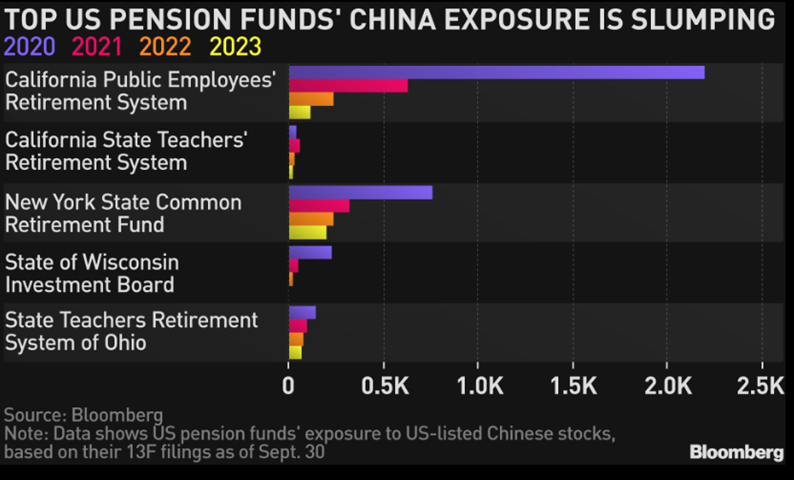

Read the fine print. I have been meaning to mention this for some time. My reluctance to do so was mostly about being misconstrued. But this morning in my research flythrough I came across a nicely prepared chart from, once again, my friends at Bloomberg. Check it out and keep reading.

I didn’t even have to mark this one up, as I often do with my signature orange pen. The title of the chart says it all. Top pension funds are pulling back on their exposure to Chinese stocks. If you didn’t believe the title, you simply have to just look at the bar graphs below. Now, here is where it gets tricky. Why do you think this is occurring?

Even if you don’t follow financial news, I am sure that you have heard about the wrangling between the US and China going back several years. Sure, there is a lot of nasty geopolitics playing out between the 2 largest global economies. But that is not the likely culprit for the decline in investment exposure. Can it be the following chart which shows the up, down, and mostly poor performance of popular Chinese stocks, as displayed by the iShares MSCI China ETF?

It’s true that if you are an investment manager with a holding that looks like the above chart, you are likely to have felt the burning desire to exit the position sometime in 2021, as you watched your losses build up. But no, pension funds don’t operate like that. They are more long-term oriented, not interested in short-term gains, but rather longer-term exposure. If they weren’t, we would most likely have seen an increase in exposure in 2022 in a retail-investor-style dip buying. But still, no.

So, what could possibly be the cause of this decrease? And, by the way, I would suspect that the departure goes beyond public pensions. You see, professional investors understand that they must take risk in order to get returns. They make investments based on careful research. If that research shows a high likelihood of success, then it is a matter of assessing the risk of the investment. A good example would be an investment in an upstart biotech company that has great prospects and a seasoned research team. As the company is in its pre-approval stage, there are clearly no revenues, and even more importantly, it may not even gain regulatory approval. HOWEVER, if the company does ultimately receive FDA approval, it would be a great windfall for the company… and its shareholders. Big risk, indeed, but big potential returns as payment for taking the risk. Ok, that type of risk is not for everyone, but I wanted to use it as an example of an extreme risk that does fit into the profile of institutional investors who have the resources to thoroughly research our example company and make an emotionless investment decision based on the old risk-reward framework. China is the second largest global economy, and it has great potential for growth and innovation which, like our fictional biotech company, has its risks. However, the risks are different in this case.

Imagine if you invested in Google back when the company was still… er, called Google, officially. As the company grew, doing everything right, so did its share price, and you got the returns commensurate with the risk you took, buying and holding the stock from its upstart days. You would be proud to have found the great opportunity. Imagine if, all of a sudden, some unknown government figure came out saying that the company should stop selling ads, and the CEO suddenly disappeared? You would be nervous, wouldn’t you? But it cuts both ways. Imagine if another unknown government figure announced that all companies should use Google exclusively… just a suggestion. That would be good for profits and likely for your investments, but it would also concern you, nonetheless. Unfortunately, over the past decade, we have seen many similar occurrences with high-flying, popular Chinese stocks. The problem for investors, especially ones that make non-emotional investment decisions, is that the risk of that happening to an investment can simply not be modeled with confidence. As mentioned above, they are perfectly capable of making highly risky investments where the risk is known and well understood. These “other”, non-traditional types of risks are simply becoming more untenable for institutional investors.

Now, I want to make it clear that I am not saying that your investments in Chinese stocks is likely to result in this. There are lots of exciting investment opportunities in China, however, if you decide to invest in one of them, you better be sure to factor in the risk of random government interference, and that may or may not fit your risk profile. And, by the way, most of the CEOs usually, ultimately resurface… with no comment.

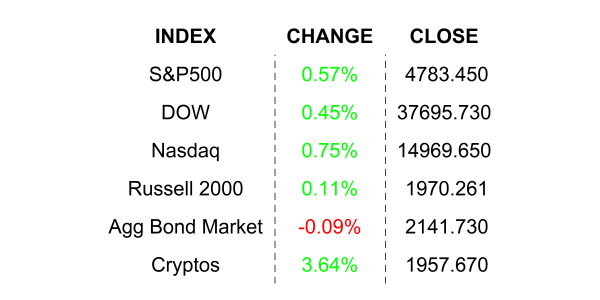

YESTERDAY’S MARKETS

NEXT UP

- Consumer Price Index / CPI (Dec) is expected to have ticked up slightly to +3.2% from November’s +3.1% read. The so-called core number is expected to have fallen to +3.8% from +4.0%. Pay close attention to this, there is lots of buzz around the validity of the projections.

- Initial Jobless Claims (Jan 6) is expected to come in at 210k, higher than last week’s 202k claims.

- Fed speakers today: Mester and Barkin.

.png)