Stocks struggled in yesterday’s session as investors settled in for a long 2024, just a few weeks old. Fed speak is not hawkish, but it’s not dovish either – traders want more.

Take the long way home. There is some crazy stuff going on in the world, and US markets, for the most part, have leveled their gaze elsewhere. But is that wise? Let’s think about that for a minute, or two. The Israel – Hamas conflict is horrible, but on the global financial stage, the largest impacts can be felt in companies that have large R&D centers in Israel, as many citizens leave their desks for the battlefield. Israel also has a burgeoning startup community with many technology and biotechnology companies originating from the country. As Israel is not an energy producing country nor a manufacturing economy, the conflict has not quite made it onto the front page of the business section. However, as the conflict widens to Iran and Yemen, the calculous may change.

The most obvious initial impact has been on crude oil. Just about any conflict in the greater middle east causes crude oil prices to move to upside. Iran is, after all, a top 10 oil producer, producing roughly 3.67 million barrels a day, though that only represents 4% of global production. Despite this and certain sanctions, any disruption in oil supply from Iran can have an impact on crude oil prices, and it most likely has as it is at the center of much of the conflict going on in the middle east recently. A regional conflict which may include Iran’s neighbors could have an even larger impact on energy prices, and that too, is likely to have impacted recent price movements in crude prices, which initially climbed but have since pulled back somewhat. So, is that it, minimal to no impact?

Well, not quite. Moving to the Red Sea and Suez Canal is where the real conflict and immediate potential problems lie. Now, I know that I don’t have to go through the recent news in the Red Sea, but I do have to underscore that shipping in the region has certainly been disrupted as Yemen, and more specifically the region dominated by Houthis sits right at the strategic chokepoint at the mouth of the Red Sea. I decided to plot a map to give you a good idea of just how important the marine thoroughfare is. Have a quick look then keep reading.

Foremost, I want to apologize to those of you who like to print out my report, because this map is best viewed electronically. On it you can see all the little blue arrows which is all the bulk and tanker shipping in the region within the past 30 days. What I am hoping that you notice is the concentration of ships traveling to and from Asia up into the Red Sea, through the Suez Canal, and into the Mediterranean Sea and on to Europe. Can you see it? It’s quite dense. Next, please note the concentration of shipping that rounds the cape of Africa, travels up the coast to the north Atlantic and on to Europe. These are the two primary shipping routes from Asia to Europe. One can easily eyeball that the distance around the cape is longer than that through the Red Sea / Suez Canal route. In shipping, distance is directly related to cost. In logistics, distance also has an impact… you know, delivery time. You may have heard that many major shippers have rerouted their vessels around the cape rather than risk navigating past Yemen into the Red Sea, and that is already having an impact. Just recently, Tesla announced that its production lines in Germany ground to a halt as parts shipped from Asia were delayed. Can you give a guess why? That was a rhetorical question, you don’t have to answer it. These are the makings of a supply shock of sorts. Increased shipping costs and gummed up logistics routes. Sound familiar? Can you remember the last time we experienced something akin to this and what followed? How about inflation. Now, I want to be clear, that I am not sounding the alarm on inflation, but there will surely be impacts if hostilities continue to escalate. If you don’t believe me, take a look at my map once again. Imagine all the dense buildup of light blue arrows in the Red Sea completely disappearing with the only alternative being to round the cape of Africa. Oh, and one last thing. You may also notice that the majority of the traffic going through the Suez Canal ends up in Europe with only a small amount of traffic heading to the Americas. The implication there is that supply disruptions are likely to be concentrated in Europe. These have not made the headlines of the business section yet, but if things intensify, you can count on them making their way not only to the front of the business section, but to the front page of the paper itself.

BEFORE THE MORNING BELL

The Charles Schwab Corp (SCHW) shares are slightly higher by +0.37% in the premarket after the company announced that it beat EPS estimates on a slight Revenue miss. In the past 30 days 8 analysts have increased their price targets while 3 cut them. Dividend yield: 1.55%. Potential average analyst target upside: +16.5%.

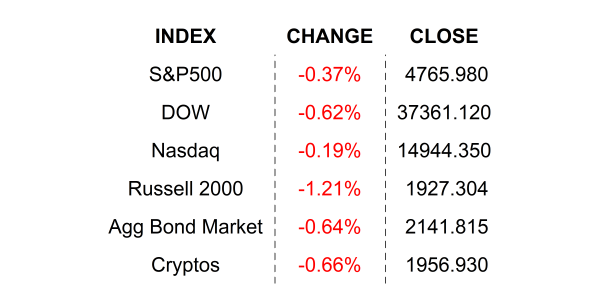

YESTERDAY’S MARKETS

NEXT UP

- Retail Sales (Dec) are expected to have risen by +0.4% after climbing by +0.3% in November.

- Industrial Production (Dec) may have slipped by -0.1% after gaining +0.2% in the prior period.

- NAHB Housing Market Index (Jan) likely increased to 39 from 37.

- Federal Reserve Beige Book will be released this afternoon.

- Fed Speakers today: Barr, Bowman, and Williams. Fed members have been very chatty lately, so pay attention.

.png)