Stocks rallied yesterday as the bulls ran in and gave another go – successful, after an extended naptime. Stock investors are coming to grips with less rate cuts in 2024, and they are mostly indifferent.

Chipping away. Have you heard? The Nasdaq 100 closed at an all-time high yesterday. You may be thinking, “wait, what, isn’t the world in turmoil, the remaining actionless, inflation still too high?” I can’t argue with any of those thoughts, but I have to remind you, AS I HAVE SO MANY TIMES IN THE PAST, that the stock market is always attempting to reflect the next regime. “Regime” is a Wall Street term of art referring to a time period in the markets marked by a specific set of economic, market, psychological, political, and emotional conditions all mashed together to affect the way the markets behave. Remember way back when the pandemic started, and the market gave us a gut check unlike what most of us have never experienced in a lifetime? Do you remember rationing toilet paper and considering wild theories on how to make your own hand sanitizer? Do you remember exhausted nurses crouched against walls crying with sores on their faces from wearing 2 and 3 facemasks for 20-hour shifts only to bring themselves to their feet and head straight back to their patients? Sorry about that graphic reminder, but I want to underscore how scary it felt and how it was quite rational to believe, at that moment, that the world was crashing, and that the last place to keep your hard-earned retirement nest egg was the stock market. Come on, you remember. That my friends, was a market regime. Now let’s get a bit more upbeat. Shall we?

Suddenly markets began to recover. Many investors were initially confused. Companies were literally shuttering their doors. Rats owned the city streets. How? Markets began to focus on the time AFTER the pandemic, even before there was any hope of a credible therapy for COVID. The rest is mostly history, but that was a stark example of the forward-looking nature of the markets. Today, thankfully, the situation is far less extreme, but the markets continue to operate as they have since 1792 when stockbrokers organized themselves under a buttonwood tree on Wall Street. We invest in stocks based on their ability to bring future returns, and the more potential for them to grow in the future… the better. Agree? Sure, you do. Now let’s get real current… like YESTERDAY.

Yesterday morning Taiwan Semiconductor, AKA TSMC (ticker: TSM) came out with a glowing forecast for semiconductors in the year ahead. As you might guess, the stock rallied on the news. Ultimately the tech-dominated Nasdaq 100 followed suit, ultimately logging that new all-time high I referred to at the head of the note. Ok, you are probably thinking “thanks for that blinding glimpse of the obvious, Marko!” But that is not my point. My point is that semiconductors are in just about everything and anything we buy these days… even some toilets. If a manufacturer expects a surge in demand, they must FIRST call their rep at their semiconductor supplier because there are typically long lead times. So, if you really want to know what is going to happen with tech sales in, say 9 to 24 months, you may want to invite a semiconductor salesperson to your club for a round of golf… or at least for one of those whip cream-topped Starbucks drinks.

Did you know that most of your favorite tech companies use chips manufactured by TSMC? That’s right Apple, NVIDIA, AMD, Qualcomm, and even Huawei all use, or have used, TSMC to produce semiconductor products for them. Are you getting the message yet? TSMC and companies like them are bullish when they see orders piling up and orders piling up means that their customers are bullish about their prospects 9 to 24 months from now. Should I go on? I won’t, but I will give you a bonus chart because it is Friday. This chart shows TSMC and the S&P500 Hardware Industry Index. I am hoping that, just by eyeballing it, you will see that TSMC trend reversals tend to predate moves in the index. I am also hoping that you notice that TSMC, after yesterday’s news, had a bullish breakout. Of course, there are no guarantees – there never are, but if you are looking for signs that things may be improving IN THE NEXT REGIME, this can certainly be one of them.

WHAT’S SHAKIN’ THIS MORNIN’

International Business Machines Corp (IBM) shares are higher by +2.19% after Evercore upgraded the stock to OUTPERFORM and raised its target to $200. Evercore expects IBM to benefit from AI tailwinds. Dividend yield: 3.97%. Potential average analyst target upside: -7.1% WHY IS THIS NEGATIVE? Because the current share price is above the median analyst target price. While this may be viewed as the stock being expensive, it does not mean that it will not continue to gain.

State Street Corp (STT) shares are up by +5.61% after the company announced that it beat EPS and Revenue estimates. The company reported that it had record inflows in Q4. In the past month, 11 analysts have increased their targets while none have lowered them. Dividend yield: 3.71%. Potential average analyst target upside: +12.1%

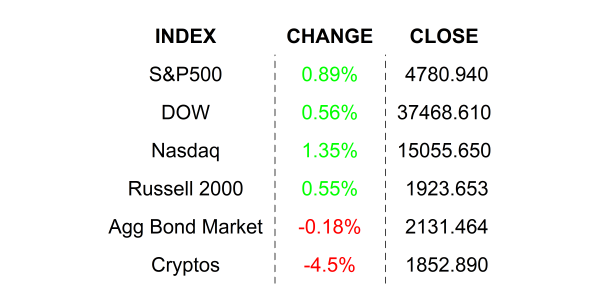

YESTERDAY’S MARKETS

NEXT UP

- University of Michigan Sentiment (Jan) may have inched higher to 70.1 from 69.7.

- Existing Home Sales (Dec) are expected to have gained by +0.3% after climbing by +0.8% in November.

- Fed speakers today:

- Next week: lots of earnings as well as Leading Economic Index, flash PMIs, GDP, Durable Goods Orders, PCE Deflator, and more housing numbers. Check in on Monday for calendars and details.

.png)