Stocks had a mixed close in a choppy session where investors factored in the reality of less rate cuts and lackluster earnings growth. With the first presidential primary out of the way, market mindset will begin to ponder a world beyond the upcoming election – it could get tricky despite the winner.

What about the little guy. It has been a minute since I last talked to you about prices. Of course, I often speak of inflation in the context of what the Fed might do next and how that may impact your portfolios. This communique, after all, is fashioned as a daily market note. But there is the reality of absolute prices that simply cannot be ignored. Let’s assume that we are all saving money in one way or another for something or other in the future. It could be a home, a fancy car, a wedding, a vacation… THE REST OF YOUR LIFE aka retirement! We are doing the right thing according to the standard operating procedure in chapter 1 in the manual of life… we are foregoing opulence today and setting aside resources for the future. What, you skipped chapter 1? It’s OK, I am sure that your parents read you a fable about hard work and savings. Fill in your favorite allegory and pick your favorite cute rodent who works hard in autumn to prepare for winter while his friends bask in fading, warm sunrays of the season. If the fable is old enough, or your parents were from the old country like mine, the non-savers usually ended up in a not-so-enviable position… usually dead. So, fearing death, being responsible, loving travel, or coveting that classic car you always wanted takes planning and saving. Let’s say you take that first big step and actually begin to save.

You know that you cannot just pile up your acorns 🐿 in a hollowed-out tree stump because there they will have no chance to grow. Growth is not only good, but it is NECESSARY in order to compensate for price inflation. Now, I know that you are well aware of that concept, which is why you put your hard-earned savings into investments. In years past, retirement savers would choose a sizable allocation in bonds. Bonds let investors lock in a known rate of return and the ability to get principal back at maturity. Credit quality aside, the instrument is generally less risky than stocks because there is no market risk… if you hold the bonds to maturity. The problem is, somewhere in the 1990s through the early aughties (that’s a cool way of referring to 2000 – 2010), bond yields fell to levels that could not possibly keep up with inflation and wage growth. This caused many investors over 50 to begin to take more risk by allocating large amounts of their savings to the stock market. Thankfully, if done correctly, savers were not only able to outpace inflation, but they were able to make some respectable returns as well. Everything seemed like smooth sailing until 2020 when the reality check came to the table.

Stocks could go down… by a lot… IN ONE DAY! Scarier than that, bonds were yielding like 0%. So, the choices were risky stocks or… the hollowed-out tree stump. Thankfully stocks recovered and long-term-focused investors 😉 survived the day. However, a new threat emerged… high inflation. No problem, as long as stocks continued to return more than inflation. But another new threat emerged. An angry Fed and higher interest rates… and declining stocks. Higher interest rates suddenly made bonds a bit more attractive… if you consider a 5% yielding Treasury Note attractive. Hard to stomach when you compare that to annual returns that reached nearly +29% in 2019, +16% in 2020, and almost 17% in 2021. UNTIL YOU LOST -19% in 2022.

Ok, let’s step back from all this madness for a second. Let’s say you were prudent, you had a diversified portfolio, and you maintained your long-term focus. You got some respite from stress in 2023, though it was not always an easy path. You read in Mark’s daily note that inflation was receding. Then you go to book a family vacation because you haven’t been away since 2019 and you are absolutely shocked to find out that your favorite hotel which used to charge an extravagant $800 a night (but it was worth the indulgence for your family’s sake) now charges $1800 a night! That special bottle of wine you used to splurge on for $45 is now over $100! Oh, and that car you promised you would never drive but was always an option just in case, now costs over $50,000! I have to say it, sorry, but what about your grocery bill? A splurge visit which used to be $45 has become $60… FOR BASICS. Ouch… and ouch. Inflation is slowing, but prices are certainly not going down. We find ourselves in a tricky situation especially if retirement for you is coming up fast. Don’t let that discourage you from continuing to save and invest. However, paying close attention to how much you risk for what you expect to earn is more important now than ever.

WHAT’S HAPPENING IN THE PREMARKET

Netflix Inc (NFLX) shares are higher by +9.31% in the premarket after the company announced that it beat EPS and Revenues by +2.81% and +1.41% respectively. The company credits its success to strong subscriber growth. Management did, however warn, that it expected growth to wane in coming quarters. All forecasts were more or less in line with estimates as well. Now that they have forced me to pay for my kids to watch on my account, they are going to have to get creative 😉. The company’s forward PE at 29.37x is the highest by far in its peer-group. Potential average analyst target upside: +10.8%.

DuPont de Nemours Inc (DD) shares are off by -11.73% in the premarket after the company provided preliminary Q4 results and forward guidance, and guidance numbers were significantly off analysts’ estimates. The company cited destocking and weak demand from China as the cause. On a bright note, if you own semiconductor stocks, the company noted that it saw continued stabilization in its semiconductor segment. The company is scheduled to deliver earnings on 2/7. Dividend yield: 1.92%. Potential average analyst target upside: +10.8%.

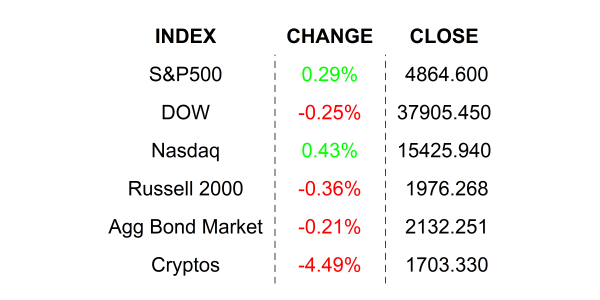

YESTERDAY’S MARKETS

NEXT UP

- S&P Global Flash Manufacturing PMI (Jan) may have declined to 47.6 from 47.9.

- S&P Global Flash Services PMI (Jan) is expected to have inched higher to 51.5 from 51.4.

- Earnings after the closing bell: IBM, ResMed, Lam Research, Tesla, SL Green, Knight-Swift Transportation, ServiceNow, United Rentals, and Las Vegas Sands.

.png)