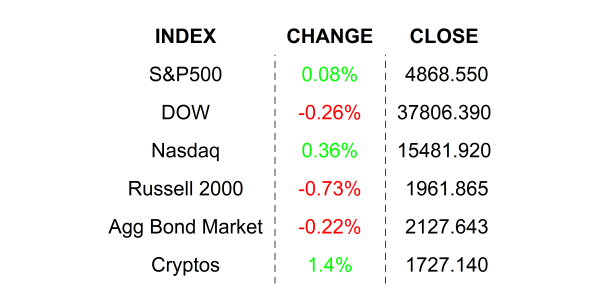

Stocks had a mixed close yesterday as indexes struggled to maintain earlier gains. Fast running bulls need their rest and the recent run in stocks has simply sapped them.

Rubber meets road. Today, we are due to receive a very important economic number. We will get a first look at the first estimate of US Gross Domestic Product / GDP for… Q…4. Q4, as in the one that started last October. Can you even remember what you were doing on October 1st of last year? GDP is indeed an extremely important number, no question, but it has to be viewed in context. Imagine if you are lined up on the starting line of an important race and the competitor next to you looks over and says, “I won this race last year!” That is a great accomplishment, and it should certainly not be overlooked, but really not super relevant, especially if last year’s race took place on a warm, sunny day and the race you are about to run is taking place on a cold, rainy day.

Remember, as stock investors, we are always attempting to capture future performance. Do you think the value of IBM today should be based on what happened in the US economy last year? I hope you answered “no” immediately. For IBM, we would surely like to know economic conditions today, tomorrow, and beyond, because those will affect the company’s financial performance, which very much IS factored into the IBM’s share price today. You with me? Good!

Enter, one of my favorite economic indicators, the Purchasing Managers Index, or PMI. These are based on surveys of business managers on their takes of the current conditions and what they expect conditions to be like down the road. They are queried on things like current orders, backlogs, inventory, hiring, and prices. It’s like having a cousin who works in Apple’s supply chain department call you and tell you that they just received a HUGE order that was beyond what was expected. For the record, that could be considered insider trading, which is ILLEGAL, so don’t do that, PLEASE. But assuming it were completely legal, you would certainly like to know that information. Well, PMIs are just about as close as you are going to get to that… minus the orange jumpsuit.

PMIs are diffusion indexes which indicate expansion when they are above 50 and contraction when they are below. There are two major PMI releases per month. One is ISM and the other is S&P Global, formerly known as Markit. S&P Global provides an early view, which is referred to by some as a flash release, and later in the month, it publishes a final number. So, the S&P release is an early look at a very current economic strength indicator. Now that is something that we should find interesting. Those early looks were released yesterday and both the services component as well as the manufacturing component came in above expectations and, more importantly, above 50. That is positive news as those PMIs spent the better part of 2021 and 2022 declining, while 2023 witnessed the indexes struggling to turn back to a positive trend. To be clear, one can hardly call 50.3, which was the Manufacturing PMI, a breakout, but it is a sign of health that economists were not expecting.

Will it move the ticker on Fed policy? Probably not. Will it move the ticker on IBM’s stock price? Probably not. But it is certainly something to factor into a larger macro model, and if you were hoping for a soft landing, you would certainly put that in the “positive” column. Regardless, PMIs like yesterday’s release, give us an early look at what insiders are expecting for the future. If you would like to get an early look at what happened in the economy more than 3 months ago, please enjoy this morning’s GDP release.

WHAT IS HAPPENING, RIGHT NOW, IN THE PRE-MARKET

International Business Machines Corp (IBM) shares are higher by +7.41% in the premarket after it announced that it beat EPS and Revenues by +2.97% and +0.53% respectively. The company provided full-year cash flow guidance that exceeded analysts’ expectations – cash is king… always. The company credits its bullish prospects to increased demand for its cloud and AI offerings. Dividend yield: +7.45%. Potential average analyst target upside: -4.2%. WHY IS THIS NEGATIVE? Because the current share price is above the median analyst target. While this can be viewed as the stock being expensive, it does not mean it will not continue to climb.

Tesla Inc (TSLA) shares are lower by -8.42% in the premarket after the company announced that it missed EPS and Revenue estimates. While it did not provide forward guidance, Musk did suggest that growth was expected to slow in the year ahead. Price cutting to induce more demand ate into profits in 2023, according to management. In the past month, 3 analysts have raised their price targets while 24 have lowered them. Potential average analyst target upside: +10.8%.

Also, this morning. Alaska Air, Dow Inc, Southwest Airlines, Blackstone, Sherwin-Williams, Comcast, and American Airlines all beat on EPS and Revenues, while Virtu, Northrop Grumman, Xerox, and Valero came up short.

YESTERDAY’S MARKETS

NEXT UP

- Quarterly Annualized GDP (Q4) is expected to come in at +2.0%, lower than prior quarter’s +4.9% growth.

- Durable Goods Orders (Dec) may have slowed to +1.5% from +5.4%.

- Initial Jobless Claims (Jan 20) is expected to come in at 200k, higher than last week’s 187k claims.

- New Home Sales (Dec) probably rose by +10.0% after sliding by -12.2% in November.

- Earnings after the closing bell: KLA Corp, Western Digital, L3Harris, Intel, Visa, Capital One, and T-Mobile.

.png)