Stocks rose yesterday after mixed earnings gave way to some optimism. GDP rose faster than economists were hoping, building the case for a soft…er landing.

If you must know. In yesterday’s note I wrote about the currentness (a real word 😉) of purchasing managers indexes versus the backward-looking, lagged snapshot of GDP. I thought that would be it on GDP, and that we could finally move on and focus on corporate earnings. But alas, the Bureau of Economic Analysis threw us a curveball yesterday when it released 2023Q4 GDP and it came in at +3.3%, far beyond the +2.0% economists were expecting. To be clear, it is looking back on what happened last year, so it technically should not affect stocks too much, but it can offer some insight into the current state of the economy and how it may support corporate growth. So, I thought it might be worth a closer look. My regular readers know that I always like to start with a chart, and I have given you a bit of a chart break lately, so here goes. Take a look at one of my fast-becoming favorite charts from Bloomberg then keep reading.

This chart shows some key components of GDP for the past 2 years. Looking at 2022, we can clearly see the effects of the Fed rate hikes that took place during that period. December 2021, saw a booming result, but we can witness some emerging problems. You see that big purple bar area shows a massive buildup in Private Inventories also known as CIPI by insider, econ geeks? That means that inventories were building up and not purchased. Why would that happen? It is likely that consumers were already pulling back due to rising inflation and expected rate-hiking, while simultaneously suppliers were cranking out goods as fast as possible earlier in the year to take advantage of “the good times” aka high prices and strong demand. Rate hikes started in earnest of Q1 of 2022 and you can see that everything except for Fixed Investment (gold bars), mostly attributed to corporate spending, was decreasing, which ultimately resulted in an economic contraction (the white line, GDP, is less than 0). In Q2 of 2022, companies obviously got some religion, and we can see that Personal Consumption Expenditures / PCE (the stuff WE, as consumers, buy) came back buying down some of that bloated inventory. For the remainder of 2022, consumers pulled their weight, helping GDP stay in the positive. Remember that inflation peaked at the beginning of Q3 that year. Corporate expenditures remained negative for the remainder of that year, but they did make a comeback in 2023, and in Q2 of that year companies carried the day as consumers took a rare break only growing by +0.55%. But consumers could not be put off for too long and we came running back with pocketbooks open in the final 2 quarters of last year. You can see that consumers, once again, did the heavy lifting.

One final note on that chart. That final blue bar, PCE, or what I often refer to as simply consumption, grew by +1.91%. Though it is not on this chart, I want to point out that in Q4 of 2019, just before the pandemic, with the Fed in rate-cut mode, consumption grew at +1.72%. According to that back-of-the-napkin analysis, we are not only back to normal, but even slightly beyond normal. Thanks, again, to the consumer. Consume wisely but, by all means folks, keep consuming. The economy appreciates you.

WHAT’S GROWING AND WHAT’S NOT THIS MORNING

Intel Corp (INTC) shares are off by -11.0% in the premarket after the company beat Q4 estimates but came up short of analysts’ expectations in its softer-than-expected Q1 guidance. The company expects to “unlock further efficiencies in 2024,” which can have a negative implication as that is often emphasized when companies are not expecting strong revenue growth. In the past month, 18 analysts have raised their targets while none lowered them. Dividend yield: 1.00% Potential average analyst target upside: -7.4%. WHY IS THIS NEGATIVE? Because the current share price is above the median analyst target. While this can be viewed as the stock being expensive, it does not mean it will not continue to climb,

American Express (AXP) shares are higher by +3.02% in the premarket after the company announced that it beat EPS on a slight Revenue miss. The company raised its quarterly dividend to $0.70 from $0.60, beating estimates. The company also gave full year guidance that exceeded median analyst targets. You are welcome, AXP investors 😉. In the past 30 days, 16 analysts have raised their price targets while 1 lowered them. Dividend yield: 1.27% Potential average analyst target upside: +3.7%.

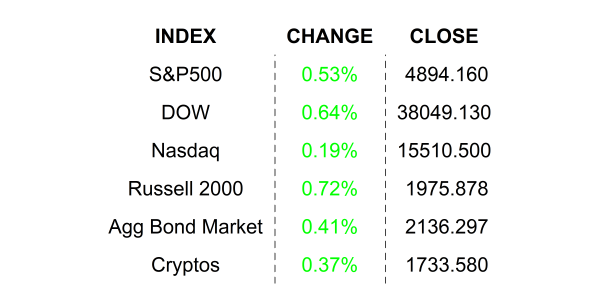

YESTERDAY’S MARKETS

NEXT UP

- Personal Income (Dec) is expected to have risen by +0.3% compared to a +0.4% rise in the prior month.

- Personal Spending (Dec) may have risen by +0.5% after climbing by +0.2% in November.

- PCE Deflator (Dec) is expected to come in at +2.6%, same as the prior period. Watch this series closely because you-know-who, THE FED, certainly will be.

- Pending Home Sales (Dec) are expected to have increased by +2.0% after coming in flat for November.

- Next week we have a busy earnings release schedule in addition to more housing data, Consumer Confidence, JOLTS Job Openings, FOMC Meeting, and monthly employment figures. It will be a busy week, so check in on Monday and get your weekly calendars for times and release details.

.png)