Stocks had a mixed close on Friday after Intel’s weak outlook put some frost on recently hot semiconductor stocks. Inflation continues to moderate according to the latest PCE Deflator – still not perfect but in a better place, nonetheless.

Back straight eyes forward. Are you ready? The week ahead is so jampacked with information that it is likely to determine the fate of the markets… for now, at least. Let’s set the scene. According to the overnight swaps markets, there is a respectable probability that the Fed will cut interest rates by -25 basis by their March 20th meeting. What is respectable? Try 49.3%. Let’s just say “not small,” but to be classified as meaningful, that number would have to be north of the 50% mark. If we look out to the Fed’s May 1st meeting, that probability goes up to 82.9%, which on Wall Street is kind of a done deal. Going yet further, another -25 basis-point cut in June is likely, another in July, and possibly 2 more before the end of 2024, projecting that Fed Funds will end the year at around 4%. That is roughly -125 basis below today’s effective rate. Why am I giving you all of these stats? Because it reflects what the market is expecting. When I say “market,” I mean the folks who are actually plunking down bets on where they expect overnight rates to be in the future. There is just one big problem with that. The FOMC… you know, the stiff-banker-Fed members who ACTUALLY control the Fed Funds Rate, expect that it will be at around 4.5% by the end of the year. Begging the question “is the market overly confident in its monetary easing hopes?”

Ok, ok, I have kept you in suspense long enough. You know I couldn’t keep this up without some visual aid, like a chart 😉. Check out this next chart and follow me to the finish.

This chart shows the expected Fed Funds Rate at the end of 2024 (green line) and the S&P500 (blue line). Starting with the expected Fed Funds Rate, according to Futures, you can see that it peaked somewhere last October but trended downward ever since. This just means that the markets have increased their hopes of more rate cuts during that time period. During that same time period, wouldn’t you know it, the S&P500 gained some +19%. That is not a trivial move for stocks… just saying. So, it is fair to assume that expectations of a sympathetic Fed have been a principal driver of the recent bullishness in the stock market. This chart, albeit a simple view of a more complex reality, shows clearly that equity markets are excited about the prospect of lower interest rates. But what if the Fed does not capitulate? I think you would agree that it may not be well received by the bulls.

The FOMC will meet this coming Tuesday and Wednesday. It is largely expected that the Fed will hold interest rates steady. The only information, therefore, for the markets to get out of the meeting is the policy statement and the Chairman’s post-meeting comments. The release statement will be carefully crafted and most likely not offer any workable information. Powell’s Q&A, on the other hand, is likely to yield some insights into what the Central Bankers are thinking about future rates cuts. Now, I don’t have enough time to get into all of it today, but given recent economic releases, the Fed has little incentive to rush into rate cuts too soon, therefore, subsequently, the message is likely to be something similar to what we have already been hearing, which has the Fed acting at its own pace… more likely on par with its last projection and not what futures traders are hoping for.

Should the Chairman stay on message and avoid any overtly hawkish comments, then we will end up with very little guidance until the meeting minutes are released in late February. That leaves us with where the real rubber meets the road for stocks, earnings. We are only roughly a quarter way through earnings season and so far, companies are missing estimates at a higher-than-average rate. But more importantly, forward guidance has thrown us a few unexpected, negative curve balls. How earnings season wraps up will certainly impact the trajectory of stocks going forward.

In addition to the FOMC meeting and lots of earnings (tech, in particular), the calendar is chockablock with important economic numbers, the least of which is the monthly employment numbers from the Bureau of Labor Statistics, which are always market movers. But if you really want to know what is on the mind of the market, you just have to look at the above chart once again. Strap in tight and pay close attention.

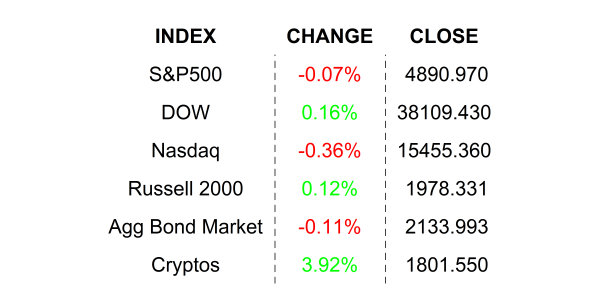

FRIDAY’S MARKETS

NEXT UP

- Dallas Fed Manufacturing Activity (Jan) may have declined to -11.8 from -9.3.

- Earnings after the closing bell: Cleveland-Cliffs, Alexandra Real Estate, Nucor, and Whirlpool.

- Later this week: lots of earnings along with housing numbers, more regional Fed reports, JOLTS Job Openings, FOMC Meeting, Consumer Confidence, monthly employment numbers, and a whole lot more. Download the attached economic and earnings calendars with times and details. As always, I highlighted the important numbers on the calendar. Also, don’t forget to check out my chartbook which I create from scratch each morning. I will give you some insight into where some major indexes might be heading.

.png)