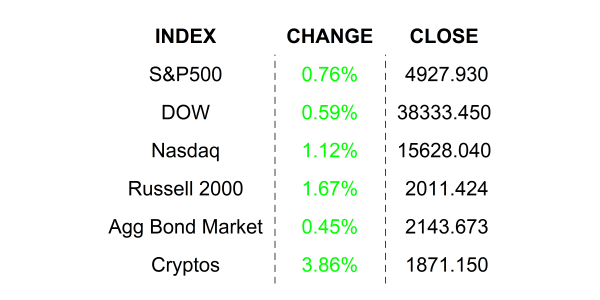

Stocks rallied yesterday, spurred into record territory by a smaller than expected Treasury funding announcement that drove yields lower. The move highlights the increasing reliance stocks have on the once-sleepy bond market.

Think before you speak, bruv. I couldn’t help but to use one of my favorite British slang words in this tagline because it just flowed nicely. “Bruv” is a slang word for brother. So, let’s get to business now that we got that out of the way, sis. I saw a headline this morning quoting some major person at some major bank. That person dubbed themself a “quant”, which implies that they rely on numbers to make their predictions, LIKE ME. The person said something to the effect that the recent gains in what is now being termed as the “magnificent seven” are akin to the dotcom bubble. And we know how that turned out. NOT GOOD… if you weren’t paying attention. The Magnificent Seven is kind of the iPhone 15 to the FANGS iPhone 10. The group includes Apple, Alphabet, Microsoft, Amazon, Tesla, Meta, and NVIDIA. Indeed, those stocks have enjoyed some rich gains in recent quarters, which may be why those big bank, so-called quants made such claims and rang the warning bell. I want us to think about that for a moment.

You may not be a qualified quant, but I am, and you can follow me, but before we proceed, it is important to recognize that ordinary, everyday stock traders are far more sophisticated than ever. The internet with its rich set of research materials has a lot to do with it. Advanced, broadly available, software is also to blame for retail investors making smart decisions. And for everything else… you have my daily note, so focus for a moment 😉.

Let’s think back to the dotcom bubble. Let’s zero in on that period from 1998 to 2000. What was your computer setup at the time? Did you even have one? Did you have a smartphone? How about fiberoptic internet access. If you had a stock portfolio, do you remember how you made trades? Sure, you called your broker hoping that HE was not at lunch. If HE wasn’t, he would most likely have given you some unwanted advice before placing your trade and charging you a $42 commission. If you did have a broker, did he ever go over the ins and outs of stock valuation? No? Nothing about the discounted cash flow models and their reliance on bond yields, weighted average cost of capital, terminal values? How about multiple analysis? Ok, that last one is a maybe, but still most decisions back then were likely the result of something you read about in a newsletter, the newspaper, or something you heard on CNBC. Do you remember Louis Rukeyser’s famous “Wall Street Week,” which aired each Friday on PBS? Looking back on those times it is easy to see how we might have been influenced to buy a stock with not much more substance than the “.com” suffix. There you go, now you remember pets.com, eToys.com, kosmo.com, boo.com, etc… .com! Thinking back, knowing what we know today, it is no wonder that the bubble burst giving birth to the term “dot-bomb.”

Turning the clock forward to today. Just a few short years ago in the midst of the pandemic, investors became much smarter, realizing that a company’s value is tied to earnings and the prospects for future earnings growth. Even during a pandemic, it became clear that some stocks would not only remain healthy at the time but prosper in the period beyond.

Speaking of “beyond,” investors took a further step in sophistication in late 2021 and 2022 when they learned that interest rates and bond yields also had something to do with stock valuations. I know that I explained it to you many times in this very note. I usually did it with tongue-in-cheek, because I knew that its impact was mostly due to the arcane way in which we assign intrinsic values to stocks. Don’t get me wrong, I use those very equations every day, but what was interesting was that everyday investors began to use it as an excuse to sell stocks when interest rates began to rise. Stocks which still had great prospects fell… like it was 1999. Wait, why did pets.com fail again? Oh, because they spent too much money, had a losing business model, no growth prospects, and people finally realized their investment dollars were being spent on expensive Herman Miller chairs rather than solid cash-generating ventures. Ok, so investors, now familiar with the iconic discounted cash flow (DCF) models, are clearly, far more educated today than they were back then.

If you agree, and you do understand the model, then you should very much understand why companies like Microsoft, NVIDIA, etc. have had a wild run, and more importantly, why that run may, indeed be justified. What’s more, the only similarity that the magnificent seven has to the dotcom bubble is that their multiple valuations are high relative to other stocks. Those hotshot quant-jocks over at that big bank should check their models… or maybe they should call up their clients and ask THEM for advice… because it is likely that they know better. Do you believe that Microsoft, Apple, NVIDIA, Alphabet and similar companies have strong growth prospects for the future? Do you believe that AI is not just a passing fad? Do those companies have strong balance sheets and stable cash flows? Do they have good leadership and practice commendable corporate governance? How about interest rates and bond yields? Are they going to be higher or lower in the months and years ahead. Folks, I think you have the answers you seek. If you want to know more about how interest rates influenced your stocks, read my newsletter from September, 2022 here for a primer.

WHAT’S BUBBLING THIS MORNING

United Parcel Service Inc (UPS) shares are lower by -6.88% in the premarket after it announced that it narrowly beat EPS on a Revenue miss in Q4. The company gave 2024 guidance that was below the median analyst target. The company did raise its quarterly dividend by $0.01 per share, but that was not enough for disappointed investors. UPS’s forward PE of 16.73x is higher than competitor FEDEX’s 14.05x and investors have to decide if the premium is justified… or if FEDEX is cheap. Dividend yield: 4.12%. Potential average analyst target upside: +7.0%.

F5 Inc (FFIV) shares are higher by +8.83% in the premarket after it announced that its beat EPS and Revenue estimates by +13.09% and +1.13% respectively. In the past month 11 analysts have raised their price targets while none have lowered them. Potential average analyst target upside: +4.5%.

Also, this morning: Danaher, GM, JetBlue, Marathon Petroleum, and HCA Healthcare all beat on EPS and Revenues while Polaris, Pulte Group, Pfizer, Johnson Controls, and Corning came up short of their marks.

YESTERDAY’S MARKETS

NEXT UP

- FHFA House Price Index (Nov) is expected to have grown by +0.3%, level with the prior month.

- Conference Board Consumer Confidence (Jan) may have risen to 114.5 from 110.7.

- JOLTS Job Openings (Dec) is expected to show a minor decrease to 8.75 million from 8.78 million vacancies.

- Earnings after the closing bell: Juniper Networks, Skyworks, AMD, Microsoft, Electronic Arts, Alphabet, Match Group, Starbucks, Stryker, Mondelez, and Teradyne.

.png)