Stocks dipped yesterday after Fed Chair said he did not expect to cut rates in March – no one was surprised, but everyone was unhappy ☹. Yesterday morning’s ADP report was largely overshadowed by the Fed, but it showed a marked slowdown in hiring.

Reality check, please. What happened yesterday? Honestly, really, nothing. If you looked at the intraday chart of the S&P500 yesterday, you likely felt a pang of anxiety once or twice. It’s OK, no one likes to see sharp drops in the world’s leading stock index. I have been at this for well over 30 years and I still find myself resorting to thoughtful breathing exercises from time to time, but it is usually not the breathing that gets me through. More on what does in a moment. For now, let’s quickly unpack yesterday’s Fed shakedown.

Rates remain unchanged. You were not surprised because even if you don’t read my note every day 🧐, it is likely that your local news station had the guy on the right read something to that effect off a teleprompter. After all, it has become big news to the broader audience, who has likely now grown to expect higher mortgage rates and higher prices. Neither are good. Further, I suppose that the “broader” audience should be happy to have learned that the Fed was not likely to raise rates yesterday. Ok, now the gal on the left has moved on and she is reading a story about flooding in the subways. You, my friends, are not the broader audience and you know better. You were not expecting any rate hikes yesterday. What’s more, YOU were not expecting rate cuts either! Please don’t tell me that I wasn’t quite clear in a special, ambiguous way that I have perfected over the years.

Figuring out what Chairman Powell might say after the announcement is a bit trickier. Based on recent economic data it seemed unlikely that he would march up to the podium wearing a party hat with spinning bowtie and declare “let the party begin!” Would he commit to ending rate cuts to the gaggle of pressing financial reporter superstars? Of course not, the Fed is never black and white, but he did get pretty close to the edge by implying strongly that “restrictive policy has probably peaked.” That means no more rate hikes. No surprises yet, right? Now things get tricky. What about rate CUTS? Rate cuts to the market are like fluffy, cream-topped cupcakes. The more the better, even if you don’t like cupcakes… and even if too many of them can be unhealthy. So when and how many cupcakes will J-Pow serve up? As I mentioned yesterday and so many times before, the market is hoping for a plateful by the end of the year. The bond markets are hoping for a few, and the Fed… well, the Fed would hope to serve as few as possible, so that it can continue the party into 2025. Oh, and so they can avoid giving the economy a stomachache.

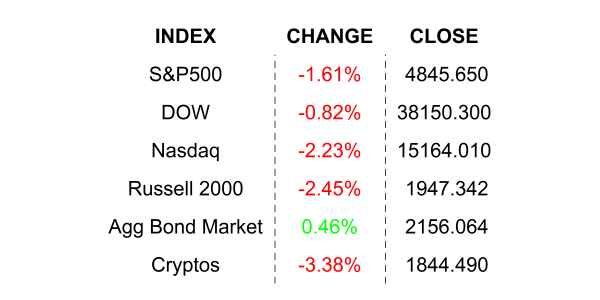

I am not going to go through all the quotes and dissect their hidden meanings. What is clear from yesterday’s presser is that the pivot is real. The Fed will stop feeding us mush (as in the mush hated by the kids in The Little Rascals). HOWEVER, we are going to have to wait for the cupcakes, lollypops, and candy buttons, because Powell was pretty clear that a rate cut will not be coming in the Fed’s March meeting. Uh oh, but as of yesterday morning, Fed Funds futures were predicting a 43% chance of a March cut. No guarantees, but 43% means “not improbable” for Wall Street. So how did markets react to the news? You can just lower your gaze to the YESTERDAY’S MARKETS section and see all the red to get your answer. What about those soothsaying futures traders? They have surely abandoned all hopes for a rate cut in March. Um… not really. To be fair, the probability of a March cut fell to 35%. Sure, that means that they believe it is less probable, but a 35% chance is still noteworthy. All in all, the markets threw a temper tantrum, not because they did not get what they were expecting, but because they did not get the surprise they were secretly hoping for. Is that worth having anxiety over?

Now on to how I deal with those things. Yes, I breathe in once or twice, but then I step back and engage my brain. I ask myself the most important question for a long-term investor, one which I have repeatedly asked you in the past few weeks. Are rates going to be higher or lower by the end of the year? Are rates going to be higher and lower next year? If “lower” and “lower” are your answers, then yesterday was nothing but folly. PLEASE focus on the forward guidance provided by your portfolio companies, that is a far better predictor of what you will be eating at the end of 2024 and in 2025. Stay focused… eat healthy 🥦🥦🥦🧁.

WHO IS SERVING MUSH IN THE PREMARKET

Align Technology Inc (ALGN) shares are higher by +12.79% in the premarket after the company announced that it beat on EPS and Revenues in Q4. The company provided Q1 revenue guidance that exceeded analysts’ expectations. The healthy serving of cupcakes caused analysts to cheer and some to raise their targets. Potential average analyst target upside: +13.9%.

CH Robinson Worldwide Inc (CHRW) served up a bowl of cold mush missing EPS and Revenue estimates by -37.72% and -2.76% respectively. To quote the CEO, “Weak freight demand in an elongated market trough, combined with excess carrier capacity, continued to result in a very competitive market.” Thanks for the color, Dave. Over capacity is the result of poor planning. Competition is to be expected in a commodity like freight. The part about weak demand is of concern and should evoke broader macro questions. Dividend yield: 2.9%. Potential average analyst target upside: -1.5%. WHY IS THIS NEGATIVE? Because the current share price is above the median analyst target. While this can be viewed as the stock being expensive, it does not mean it will not continue to climb.

Also, this morning, Parker-Hannifin, Enterprise Products Partners, Cardinal Health, Eaton, Merck, and Lazard all beat on EPS and Revenues (cupcakes) while Ball Corp, Sirius XM, Stanley Black & Decker, Peloton, Honeywell, Brunswick, Royal Caribbean, Becton Dickinson, and WEC Energy Group came up short (mush).

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (Jan 27) is expected to come in at 212k, slightly lower than last week’s 214k claims.

- ISM Manufacturing (Jan) may have slipped to 47.2 from 47.4.

- After the bell earnings: LPL Financial, Skechers, US Steel, Meta, Microchip Technology, Amazon, Deckers Outdoor, Eastman Chemical, Apple, and Clorox.

.png)