Stocks gained on Friday on a stronger-than-expected economy and on the back of social media giant Meta… er, Facebook… you know 👍👍👍. Companies went gangbusters in hiring last month… not bad for a “faltering” economy.

Racking in the likes. Friday was somewhat of a confusing session to some. The day started out with a grand slam employment number. Let me clarify that for a second. In order to have a strong economy, you need to have a healthy labor market. Working begets wages and wages pay for “stuff” and that consumption is the biggest part of GDP, by far. Make sense? Of course, it does. Economists were expecting a +170k new nonfarm job adds in January, but instead +317k new jobs were filled and December’s number was revised upward from +216k to +333k. Sidenote: economists are not too great at forecasting… it’s nothing personal, it’s just a fact. I won’t get further into that; it will make for an interesting topic in another note. For now, let’s agree that those numbers are a thumbs up for the economy. So, if you are hoping for a strong economy… AND YOU SHOULD BE IF YOU ARE A LONG-TERM STOCK OWNER, you should be quite pleased. If you are still fixated on which exact day the Fed will lower the Fed Funds rate, you might have been disturbed by Friday’s strong print.

If you are that person, the second one, you may also be worried that interest rates coming down in March versus May or June may ruin your favorite stocks hopes for future success. That would be unfounded. On Friday, and contrary to what you might think, stocks rallied. Meta found its way out of the Metaverse and has turned its focus back on money-making activities and did really well last quarter. So well, that it decided to start paying a dividend, which is rare for a growth company. Indeed, the entire stock universe, except for small caps, threw a big party for Meta on Friday.

As you might have guessed, bond traders… miserable bond traders, were thoroughly unimpressed with the strong economic number. 10-year Treasury Note yields jumped by some +13 basis points! Why? When an economy is strong, it is reasonable to expect higher inflation, because all those newly employed people are going to increase demand for goods and services, pressuring prices higher. If you are going to lock your money into a 10-year note, you will require more yield to compensate for higher inflation expectations. THAT IS WHY LONGER MATURITY NOTES FELL ON FRIDAY, trust me. Many folks incorrectly may have assumed that it was because hopes for a rate cut in March were diminished by the strong economic number. Nope, it had everything to do with a stronger economy and inflation expectations.

On the other end of the rainbow… the front end of the yield curve, where short maturities live, that is where Fed expectations are played out. The 2-year note is the shortest maturity note that is influenced by Fed policy, and it gained +16 basis points in Friday’s session. Guess what, the pain didn’t end with Friday’s closing bell.

Fed Chair and chief mouthpiece Jerome Powell got gussied up for a 60-Minutes interview on Sunday night. While actual rockstars were walking the carpet at the Grammy Awards, J-Pow was strutting his stuff in prime-time, and trust me, he is the only rockstar you need to know about if you have financial investments. What, you missed it? Don’t you want to know what he had to say about rate cuts? What, you would rather watch Taylor Swift than hear about the Taylor Rule? You watched rockstars instead of hearing the Fed Chief talk about r-star (r*)? That’s ok, all you have to do is look at how 2-year futures traded last night through this morning. Wouldn’t you know it, they are down. Why, because Powell went out of his way to make it clear that rates are not likely to be cut in March. Hopefully, you already knew that, but if you didn’t, he reminded America of it in primetime last night. This morning , 2-year yields are down by another -8 basis points. Talk about a hangover.🤘👩🎤👨🎤🤘

WHAT’S ROCKIN’ AND ROLLIN’ THIS MORNING

The Estee Lauder Cos Inc (EL) shares are higher by +15.2% in the premarket after the company announced strong beats on both EPS and Revenues. The company also announced a restructuring which will include layoffs of 3-5% of its workforce. The company also raised its full-year guidance, though it is still below analyst estimates. Dividend yield: 2.96%. Potential average analyst target upside: +5.6%.

Air Products and Chemicals Inc (APD) shares are lower by -8.35% after it announced that it missed EPS and Revenues by -6.25% and -6.36% respectively. The company also lowered its full-year guidance below analysts’ estimates. Execs blamed poor performance in China and lower demand for Helium. On a sidenote, it’s not just for balloons! Helium is used in semiconductor manufacturing and other manufacturing instances. Dividend yield: 2.74%. Potential average analyst target upside: +20.3%.

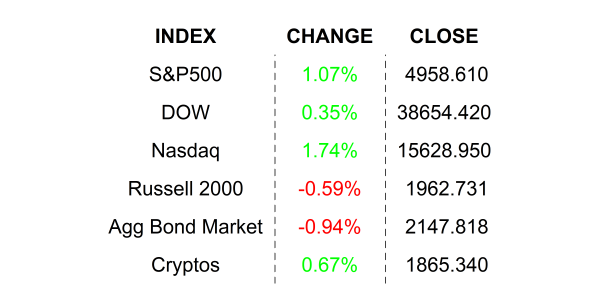

FRIDAY’S MARKETS

NEXT UP

- ISM Services Index (Jan) may have increased to 52.0 from 50.5.

- S&P Global US Services PMI (Jan) is expected to come in at 52.9 in line with earlier, flash estimates.

- The week ahead features a light economic release schedule but a fool earnings schedule. Download the attached economic and earnings calendars for times and details.

.png)