Stocks rallied yesterday after a wet noodle of a start as relieved Fed officials took to the airwaves. The earnings parade continues, and it hasn’t been as bad as many expected.

Hoo, who? I feel blessed to have an active stretch of wood behind my suburban garden. It is not very big, and admittedly, I can just make out a neighbor’s house on the other side when the winter-bare trees allow it. But that does not stop all manner of fauna from distracting me long enough to keep myself grounded. There are squirrels, lots of deer, rabbits, foxes, many regal hawks, abundant crows (especially in winter), and one of my favorites, owls. Hearing an owl’s hoot in the dead of night is really inspiring, even if you are not a fan of birds. Just this morning… early, early morning, WHILE YOU SLEPT, I let the dog out for her morning inspection and one of the local great horned owls made his presence known. Eloise wasn’t having it as she cocked her head to try and locate the source of the “hoo-hoo-hoooo.” Unable and frustrated, my furry friend responded with a couple of sharp barks to make HER presence known. I grew nervous as I was sure the neighbors, not likely nature lovers, wouldn’t appreciate this sonic display at 3:58 AM. More importantly, I didn’t want my visiting grand dog to scare away any of my feathered friends.

Turning back to yesterday’s session. Stocks appeared to be lost in the early hours, searching for a reason to rally. Every turn was met with resistance, and it seemed futile, but then came an unlikely lifeline from Treasury traders. The Treasury auctioned off a bunch of 3-year notes and, based on the results, bidders were eager to snap them up. Why would we care? Remember from my last 2 submissions, that the shorter maturities are under the spell of the Fed with the 3-year being, kind of, the farthest one out. The strong bidding at around 4.2% indicated that Treasury traders are expecting yields to come down in the near future. You get it? Even all of the negative rhetoric from Powell in the past week couldn’t scare bond traders.

That optimism gave stock traders a dose of courage, which was only underscored by dovish Fed speak. Ultimately that courage allowed stock traders to break through and pull-off a much-needed strong close for stocks.

After downing 2 tasty espressos made from some super-fresh coffee beans that my coworker brought from Jamaica for me, I dropped the dog off with my wife for some extra snuggles. But I was not quite ready to fire up my Bloomberg and start writing. You see, there was a gnawing pang of worry about my garden’s owl. So, I turned off all the lights, opened my back door and crept out onto my patio. It was a glorious, clear, and chilly morning. I cocked my head and listened as the cold air awoke my still-sleepy lungs. And there it was, my owl, confident and wise as ever, undaunted by the taunts of an overconfident and eager puppy. Never underestimate the wise bond market. It is always filled with wisdom… you just have to listen.

There is a big 10-year Treasury auction today… you may want to pay attention.

WHAT TO GIVE A HOOT ABOUT THIS MORNING

VF Corp (VFC) shares are lower by -11.80% in the premarket after the company announced disappointing Q4 EPS and Revenue results. Analysts were expecting a weak result, but the magnitude of the miss was not unnoticed. The company pointed to weaker-than-expected demand from its North Face brand as the culprit. The company is currently reevaluating its brand portfolio. Dividend yield: 2.12%. Potential average analyst target upside: +12.1%.

Fortinet Inc (FTNT) shares are higher by +9.14% in the premarket after it announced that it beat EPS and Revenues by +17.84% and +0.24% respectively. The company’s Q4 billings had exceeded analysts’ models and the company provided conservative, but strong, current quarter and full-year guidance. Potential average analyst target upside: +11.0%.

Also, this morning: Carlyle Group, Ares Capital, Bunge, CVS, Emerson Electric, and Uber all beat on EPS and Revenues, while Hilton Worldwide, Yum! Brands, and CDW disappointed.

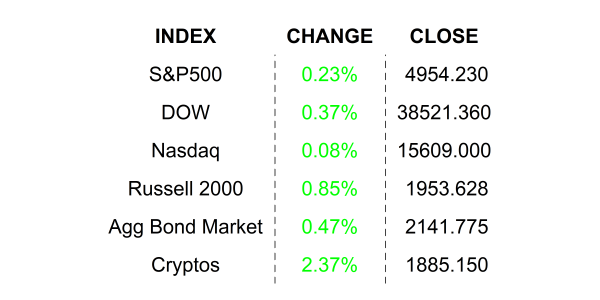

YESTERDAY’S MARKETS

NEXT UP

- The Treasury will auction off $42 billion 10-Year Notes at 13:00 Wall Street Time. That is a bit auction and traders will be eager to see if demand will be strong enough for a successful auction.

🦉

- Earnings after the closing bell: McKesson, O-Reilly Automotive, Disney, PayPal, Monolithic Power Systems, Annaly, Wynn Resorts, Spirit Airlines, Mattel, Allstate, and Coty.

.png)