Stocks rallied yesterday with nothing to constrain the bulls from crashing new gates. Earnings in the US on track to outpace overseas rivals leaves traders wondering if TINA (there is no alternative) will return.

Bulls, bears, and Dragons. Wall Street loves its history. We collect things and put them in a big bin, and we pull them out, WHEN CONVENIENT, to describe a course of events. Basically, there is some sort of answer for everything, because on Wall Street, there is only one thing better than knowing the future, and that is a complete explanation of the current.

Some of the earliest relics in Wall Street’s bin are our iconic spirit animals the Bull and the Bear. There are lots of stories, none of them definitive, about the origins of these animals, but we find references to them in literature as far back as the 18th century. Are you a bull? Of course, you are, because you like to earn BIG returns with your stock portfolio. It is said that the use of the bull to describe a rising market was derived from the way in which the animal attacks with his horns, thrusting them in an upward direction. Sidenote, because it is Friday. Have you seen the charging bull at New York City’s Bowling Green? It is a must see. There is always a line of tourists waiting to get a picture with this unofficial New York mascot. If you make your way to the rear of the bull, you will notice that it is… um, anatomically correct 🙄. You will also notice that it’s bull-specific anatomy is highly polished relative to the rest of his anatomy. That is compliments of the throngs of visitors who have heard the urban legend that… well, I won’t get into the details, but many dreams of great market success were bread from that interesting ritual.

As far as I can tell there are no big bronze bears in New York city, though there are plenty of locals who will happily growl at tourists for standing in the middle of the sidewalk staring up at the tops of our awesome steel and glass skyscrapers. I am sure that there are true bears out there in the world, but most of us are either bulls or… nervous bulls. Use of the animal bear to represent a declining market is said to date back to bear-skin jobbers who used to sell bear skins without actually having them, hoping that the prices would come down at which time they could purchase them at lower prices and deliver them. It is like short-selling stock… don’t do that. An easier explanation is how the bear attacks by swiping its paws in a downward motion.

Yesterday, the S&P500 briefly rose above 5000, though it closed slightly below it, still at another fresh all-time high. Wall Street also loves round numbers, and 5000 is an important psychological level. But, how on earth did we get here? There were no important economic releases this week, and earnings have been solid, but not exactly earth-shattering. There is nothing new from lawmakers. Political rhetoric is increasing as election season picks up, and if you look closely at it, there are no clear strategies to take advantage of a win by either candidate. There are at least 2 major ongoing military conflicts, and another one brewing. None of these is cause for panic, but neither are they cause for a celebration. Well, I suppose the fact that the US economy just continues to perform well despite the finest economic minds’ doubts. Thanks to consumers who will simply not give up, despite high interest rates, despite deadly viruses, despite ridiculously high NEW YORK CITY APPARTMENT RENTS, despite ridiculous purchases of things you saw on Instagram… it keeps going, but I have to stop, or I’ll miss my morning train. Though layoffs are happening, there are still plenty of job vacancies to be filled. The Fed with its most powerful economist-bankers in the world is also vexed by this. Things are going well, and the Fed can simply not explain why.

I was mulling over this very challenge this early morning, and then it came to me. It came in a flash of fire and smoke. I realized that tomorrow is Chinese New Year and that 2024 is the Year of the Dragon! It only happens every 12 years! The dragon represents power, luck, and success. There are five types of dragons, and this year, the Wood Dragon is up. The last wood dragon year was 1964. Wood dragons represent growth (like trees) and the S&P500 definitely grew in 1964, up by almost +13%. US GDP topped +6.4% that year and the unemployment rate was around 5%, which is slightly higher than it is today, but still quite low by historical standards. Hmm, are you thinking what I’m thinking? I say we give it a test. Going forward, let us see if we can classify this market as a dragon market, which is kind-of a bull market on steroids. A word of caution though, if you spot any dragons, I would not have a go at its… well, you know… for good luck. Happy Chinese New Year 恭喜发财.

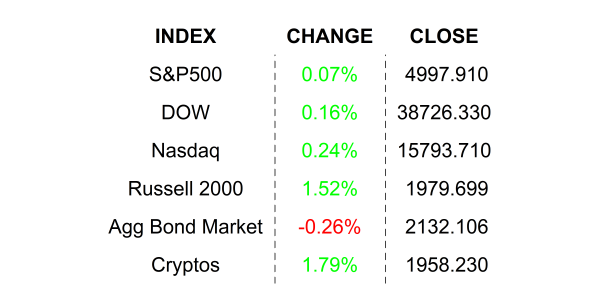

YESTERDAY’S MARKETS

NEXT UP

- CPI Revisions are due today. They can be revised as far back as 5 years… go figure. Anyway, it may seem trivial, but the Fed watches this closely and a big revision can move the markets.

- Next week we will get more earnings along with Consumer Price Index / CPI, Producer Price Index / PPI, Retail Sales, Industrial Production, housing numbers, and University of Michigan Sentiment. Check back in on Monday for calendars and details.

.png)