Stocks had a mixed close yesterday as traders with Super Bowl hangover fought their way through a volatile session. Nothing doing meant speculating on today’s big inflation number.

What does it all really mean? Yet another day, yet another discussion about interest rates and some bureaucratic central banker named Jerome, Jay… whatever. If that is what you are thinking, you are right… kind of. You are probably looking at your stock portfolio, which has done fairly well in recent weeks. You probably think bonds are boring, but you have been told that yields are high, which means you can get a good return on T-bills or even your money market. While you are probably more interested in stocks, you at least know that you can get a good yield if you absolutely, positively MUST buy a bond of sorts. Things seem to be going OK with the economy, gas prices are below $4 a gallon and you heard that inflation is coming down. So why does anyone even care what the Fed is up to?

Oh, oh, now you remember that mortgage rates are really high, like 7% or something. BUT YOU DON’T REALLY CARE! You are thinking about it, and you remember back to when you bought your house in 1998 and your mortgage rate was around… um… um, 7%. Wow, what a coincidence. But you still don’t care, because you refinanced at least twice since buying you home, once in the early aughts near 5% and once again in the mid-teens for less than 5% and you took out some equity because your home value was going up again. I know at least 5 people who claim to have locked in the lowest mortgage rate ever in the early days of the pandemic – WOW are they proud of themselves. What is my point here? Think about it. Everyone you know has pretty much locked in lower mortgage rates for a long time, so unless they are desperate to move and buy a new home with a new mortgage, current rates are of very little concern to them. They can just sit tight and wait for mortgage rates to come down again and then put their homes on the market. So, once again, what’s the big deal with these higher rates?

Well, these higher rates are affecting some parts of the economy that you may not think about often. Think about banks. You may think that they like higher interest rates because they can make more money on their lending. The problem is that banks don’t necessarily like higher rates, but rather, a steep yield curve where they can make big spreads borrowing in short maturities and lending in longer maturities. With the yield curve inverted for an almost all-time record of over 400 days, banks are struggling to earn loan margins. Have you heard? Of course, you have.

Banks have other worries on their hands. Commercial real estate loans are not typically long maturities, mostly under 5 years. Therefore, a real estate developer who took out a low interest loan 3 or 4 years ago… and bragged about how low the rate was at the club… is now going to have to pay back the principal within a year. But don’t worry, real estate investors typically refinance before their loans mature. Are you with me? With rates much higher today than they were 4 years ago, borrowers will have to make higher debt service payments on their refinanced debt. You know what that means for real estate people? Lower returns, or worse yet… bankruptcy. You see, a lot of commercial real estate is so highly leveraged, that small jumps in expenses can put a property under water. Not to mention lower occupancy and falling values. This can leave a bank with a box full of keys as investors simply abandon their properties.

Finally, think about corporate borrowers who also relied heavily on the low interest rate environment in the decade prior to 2022’s Great Hike. I am not talking about high quality borrowers here. Most of them were smart enough to borrow lots of money with long maturities in 2020 and 2021. We need to worry about the ones that are below investment grade who need access to debt markets to stay afloat. If their loans are coming due, there is a higher probability that those companies will simply be forced to default. That is why we see all the ratings agencies forecasting higher default rates ahead, even though things seem like they are going well.

Now, I am not trying to ring any alarm bells here, but if all these worst-case scenarios play out, they will certainly affect the overall equity markets, and if it is severe enough, they could lead to a recession, which would not be appreciated by the equity markets. No amount of AI technology offerings helps a company’s stock go up when a recession hits. So, is the Fed under pressure to call it right and let up on the brakes before it is too late? YOU BET, given its track record of causing recessions by being too aggressive… or raising rates too late and allowing inflation to get out of hand. Me? I am always keeping a close eye on those boring central bankers. Why? Because my stock portfolios depend on it.

WHATS SHAKIN’ IN THE PREMARKET

Hasbro Inc (HAS) shares are lower by -9.09% in the premarket after the company announced that it missed EPS and Revenue targets by -41.05% and -5.05% respectively. You read those correctly. The company also gave guidance that was shy of analysts’ targets. The company also raised its dividend and claims to be focused on… refocusing its efforts on profitability, rightly so. Dividend yield: 5.45%. Potential average analyst target upside: +20.6%.

The Coca-Cola Co (KO) shares are marginally higher by +0.27% after it announced that it beat on EPS and Revenue estimates. The company also issued full year guidance that beat median analyst targets. Notably, the stock just formed what is known as a golden cross where its 50-day simple moving average crosses over its 200-day simple moving average. Technical analysts view that as being positive… at least in the near-term… if the cross holds 😉. . Dividend yield: 3.08%. Potential average analyst target upside: +9.8%.

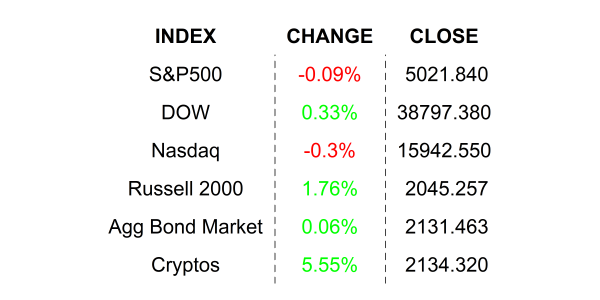

YESTERDAY’S MARKETS

NEXT UP

- Consumer Price Index / CPI (January) is expected to come in at +2.9% after printing +3.4% in the prior period. Core CPI is also expected to show disinflation falling to +3.7% from +3.9%.

- Snow is falling on Wall Street today which surprisingly, can affect volumes. Sorry detractors, Wall Street is still the center of the financial universe🌌.

- After the closing bell earnings: Robinhood, GoDaddy, AIG, MGM Resorts, Entegris, Zillow, Lyft, Airbnb, and Akamai.

.png)