Stocks rallied yesterday on a weaker than expected retail sales figure. Americans bought less in January, but Fed speakers are in no rush to make things easier.

You bought what? I pretty much use all my weekly spending money on getting to work and Starbucks, to stay awake… at work (because, you know, I get up WHILE YOU’RE STILL SLEEPING to write this). Of course, we have lots of expenses to run our household. Any large discretionary items like TVs, computers, new iPhones, etc. are all thoroughly vetted out in discussion, lots of discussion. Some things make it into an Amazon shopping basket… only to sit there for a month… until I have to reorder something like vitamins or cleaning supplies, at which time that big, non-necessity item gets deleted. There is always plenty of spending on holiday gifts and birthday celebrations for kids, family, and friends… those seem to come at the worst times. Where does that leave me… always spending… which is why I am… er, always working. Does this sound familiar? Of course, it does.

It all comes down to needs and wants, doesn’t it? Yesterday, the US Census Bureau released its monthly Retail Sales figure, and it showed that expenditures declined by -0.8%, which was bigger than expected. That means we cut back more than economists were anticipating. Though you probably don’t hear about this number often, it is up there in importance with inflation figures, because spending leads to inflation. Got it? So, let’s dig in and see what we increased our spending on last month and where we cut back. In December, big increases came in Motor Vehicle and Parts, Clothing, General Merchandise Stores, and Nonstore Retailers (online shopping). All that makes sense given the holidays… maybe not the auto thing, though. Interestingly, Health Personal Care Stores saw a big cutback in December. I guess we were too busy partying to tend to our health. Sadly, that also makes sense. And then came January.

January is that month where New Year’s resolutions take effect, most of which include spending less, drinking less, etc. Motor Vehicles and Parts saw the biggest cut back, followed by Building Materials, Nonstore Retailers, and Miscellaneous Store Retailers. Ok, that makes sense. Tightening the belt, so to speak. But wait, we spent more on Food and Beverage Stores, specifically, Grocery Stores. Following our theme of wants and needs, Groceries are needs, so can we deduce that consumers forewent wants for needs? Seems reasonable… until we notice that Food Service and Drinking Places took the top spot in gains. One last word on this. You are probably thinking that this is normal behavior for January. Last January, Retail Sales increased by +3.7%, so no, it’s not seasonal.

The takeaway here is that consumers appear to be adjusting their spending habits. It’s too early to say if a trend is emerging, but the beginnings of one are certainly present. That may prove helpful in further reducing inflation in coming months, but it certainly won’t help the case for a soft landing. I have to end here, because my Starbucks order is ready.

HOT AND NOT IN THE PREMARKET

Applied Materials Inc (AMAT) shares are higher by +11.84% in the premarket after the company announced that it beat on EPS and Revenues by +11.64% and +3.57% respectively. The company also gave current quarter guidance that was above analysts’ expectations. In the past month, 10 analysts have increased their price targets while none lowered them. Dividend yield: 0.68%. Potential average analyst target upside: +8.2%.

NIKE Inc (NKE) shares are lower by -0.96% in the premarket after the Oppenheimer cut its rating to MARKET PERFORM from OUTPERFORM. Soft demand and lack of innovation top that analyst’s list for reasons to cut. NIKE also announced a -2% cut in its workforce. Dividend yield: 1.39%. Potential average analyst target upside: +15.4%.

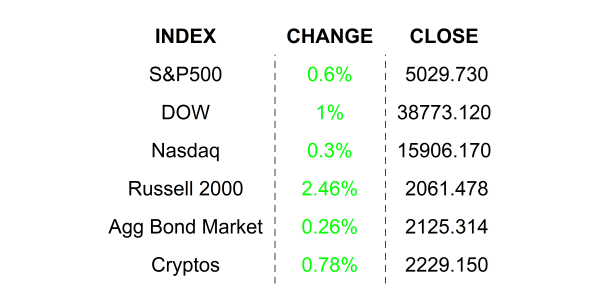

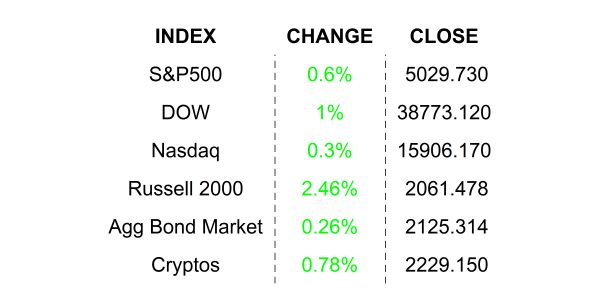

YESTERDAY’S MARKETS

NEXT UP

- Housing Starts (Jan) were probably flat after declining by -4.3% in December.

- Building Permits (Jan) may have gained by +1.3% following a +1.8% increase in the prior period.

- Producer Price Index / PPI (Jan) is expected to come in at +0.6% after climbing by +1.0% in the prior month.

- University of Michigan Sentiment (February) may have inched up to 80.0 from 79.0.

- The market is closed on Monday for what the NYSE calls George Washington’s Birthday, but most of us know it as President’s Day. BTW, a large bronze statue of Washington presides over the entrance to the stock exchange. He was sworn in as the first US President on the balcony of Federal Hall, right there on Wall Street… in case you were wondering.

- We still have earnings releases and numbers next week, so check in on Tuesday for your weekly calendars.

.png)