Stocks swooned yesterday as traders got the jitters ahead of slugger NVIDIA’s earnings, out this afternoon. Interesting earnings and a few eyebrow raising deals added to mixed tape… and volatility.

I own you. Have you ever been in a crowd of random people, say family members or close friends, and what starts out as a healthy conversation about… the state of things, slowly starts to lose altitude? It takes one person to say something just slightly provocative and then it starts. If you look around the room you can see the players all with that look as if they are searching their internal Googles for some facts that they picked up that would support the case the country is heading to… um, [fill in your favorite 4-letter word].

“Did you see what so and so did?” “That dirty this or that!” “I heard that you-know-who is really a bla-bla-bla.” Then it comes out, “you know, so-and-so country owns the US anyway.” I generally ignore all the other stuff, but this one always gets me. I am a financial guy, so that means everyone usually stares at me after that statement is thrown out there. My immediate first thought is that, even though Standard & Poor’s and now, late-to-the-game Fitch downgraded US debt, the US is the safest place in the world to invest your money. The US sports the largest economy in the world, it has a stable legal system, low corruption (relative to everywhere else), the strongest military in the world, a solid, liquid currency, vast natural resources, an endless supply of entrepreneurs, and the New York Yankees (sorry, haters I am from NY). I am sure that nay-sayers can produce instances where things are imperfect, but when it comes down to it… I mean really down to it; the US is the safest place to put your money. Even the person from above who spewed the “owns us” comment agrees with this, and their thesis is that some foreign evil government is hording all US Treasuries in a basement somewhere, waiting to sell them all in order to destroy the US. Gosh, I just realized how dark this is all sounding, but I am getting to my point.

So, I hope you agree that the US does represent a safe investment for anyone wishing to keep their assets safe in all weather conditions. But who really is the US’ biggest banker? Go on say it… it’s OK, because you are incorrect! There, does that make you feel better? Check out this awesome chart from my friends over at Bloomberg. You can get all the details by reading through The Treasury Bulletin, issued quarterly. What you are seeking is in TABLE OFS-2 — Estimated Ownership of US Treasury Securities. The chart is the best way to consume it though. Check it out, and then we can wrap this up.

What makes this chart interesting is that you can see how foreign ownership, the red line (I didn’t pick that color 😉), has slowly increased since 2028, but not by much. The purple-blue line represents the Federal Reserve. Remember that in Quantitative Easing (QE) from the pandemic, the Fed bought lots of securities in the open market. You can see the initial jump and then increase to a peak in early 2022 at which the inflation-fighting Fed started to “shrink its balance sheet” in Quantitative Tightening (QT). But, alas, we care about the yellow line which represents you, me, mutual funds, pension funds… not those evil foreign governments. You can see those holdings swelled rapidly beginning in the pandemic, even prior to yields ratcheting higher in 2022. Go on, look at the chart again and commit it to memory. This way the next time you find yourself in one of those awkward conversations, you can just quash the notion and follow it with facts about why everyone, especially non-foreign entities want to own US Treasuries. You can change out The Yankees thing with your favorite team ⚾.

WHO OWNS WHAT IN THIS MORNING’S PREGAME

Palo Alto Networks (PANW) shares are down by -23.52% after the company announced EPS and Revenue beats for last quarter but cut full-year and current quarter revenue and billing guidance to well below analysts’ forecasts prompting several analysts to bench the company with downgrades. This may have an affect on all related cyber-security stocks today, so keep a look out. In the past month, 18 analysts have raised their price targets while 9 have lowered them. Potential average analyst target upside: -6.9%. WHY IS THIS NEGATIVE? Because the current share price is above the median analyst target. While this can be viewed as the stock being expensive, it does not mean it will not continue to climb.

Amazon.com Inc (AMZN) shares are higher by +0.82% in the premarket on news that it will be added to the Dow Jones Industrial Average, replacing Walgreens (down -2.69% in early trade). Amazon already announced its results earlier in the month with solid beats on EPS and Revenue. Potential average analyst target upside: +24.0%.

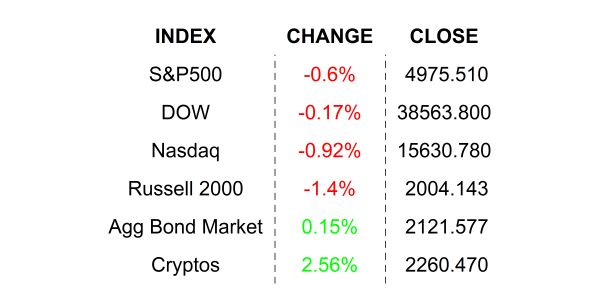

YESTERDAY’S MARKETS

NEXT UP

- FOMC meeting minutes from its Jan 31 meeting will be released this afternoon at 14:00 Wall Street Time. This is guaranteed to be a market mover as everyone wants to know what the group of powerful bankers is thinking on rate cuts. Many expect that the discussion will point to rate cuts in the second half of the year, but you can see for yourself later today.

- Mortgage Applications (Feb 16) took a -10.6% dip for the week after sliding by -3.3% in the prior week. Looking back at the history, applications appear to be trending down recently showing that rate hikes do eventually have impact.

- Fed speakers: Bostic, Barkin, and Collins.

- Earnings after the closing bell: Marathon Oil, Sunrun, Lucid Group, Rivian, Mosaic, NVIDIA, Synopsys, and Etsy.

.png)