Stocks rocketed to fresh highs yesterday propelled by NVIDIAs moonshot earnings 🚀. Services PMIs lagged economists’ estimates which may be a glimmer of hope for the still-angry Fed.

Digging in the dirt. Ok, humor me. Do you remember when you thought that Apple’s iPhone was silly? Who would want to carry around a bulky email device without a keyboard? And use it as a phone as well? No way. Going back to the 1980s, do you remember when you thought that personal computers, spreadsheets, and word processors were all for basement hobbyists? How about Myspace, Facebook, LinkedIn, and Twitter? Those were just things to keep kids busy, right? OBVIOUSLY, we know today that those things are a part of all our lives, and not in a small way, but in a very critical way. Not only are all those things critical to navigate through our days, but they have also made us more productive than ever.

How do you think Gross Domestic Product (GDP) grows? I know, I know, that is a very complex question. But at a high level, imagine if an economy only produced 1 good, say gold. The more gold we discover, the greater our GDP. Once we discover the gold, it has to be mined. If we can mine a certain amount of gold per year using our hands, we could double our output if we used shovels. Ok, smarty pants, I know that we could just hire more and more workers, but ultimately there would be no room and their marginal productivity would diminish. Practically, you can only fit so many miners in a mine. Ah, but if we introduced a steam shovel, we could multiply our output by tenfold without having to crowd our mines. Ultimately, we would plateau unless we discovered new sources of gold. Let’s say we discovered all the gold in our abstracted, fake, 1-good country, we would never be able to grow our GDP again. UNLESS, we discover a way to make our workers even more productive. Perhaps if we started using dynamite to blast away rock, we would need less hands, shovels, and steam shovels. Now, 1 laborer could move more dirt than 1000 workers when we founded our country.

Can you see the theme here? It’s all about becoming more productive given limited resources. This same concept can be applied to a more real, modern world. Imagine if we went back to a time where we had to handwrite everything, crunch away on a mechanical adding machine, phone the operator to connect to colleagues and customers. Do you remember carbon paper? Mimeographs? Those were good times, but not very productive. The only way to increase productivity was to work more hours. So, is that it then? Just increase the workday to 12 hours and move the bathrooms closer to the workers’ desks? Yep, that’s it. Tapped out. No more GDP growth, UNLESS we discover a way to make ourselves more productive. That is where personal computers, spreadsheets, mobile devices, and social media come in. We can all now put 36 hours of work into just 10… and we can do it from anywhere… we don’t even have to move the bathrooms 😉. I am not going to post a chart of US GDP since the advent of all these things, but suffice it to say, technology has had a major hand in getting the US economy to where it is today.

So, now that we have all reaped the benefit of technology, where to next? Have you ever seen someone on a train shuffling between multiple smartphones while balancing an open laptop on their lap? We only have 2 hands and one lap! No, what we need is a new, new technology to make us even more productive. That, my friends is where AI comes in. If used properly it has the ability to make us all more productive. Instead of searching through user manuals, AI can help us solve problems more quickly and so on. AI won’t do your work for you, but it can help you work more productively, and we are just at the beginning of that cycle.

Do you remember Visi-Calc by Visi-Corp? How about Lotus 123 by Lotus Development Corp. Those are the predecessors to Microsoft’s Excel. I remember articles talking about how those tools were supposed to completely eliminate whole sectors of the economy. There were also naysayers who laughed at the idea of a personal computer. Obviously both sides were wrong. Those computers and spreadsheets made us more productive, and perhaps the only group/industry to suffer was the typewriter manufacturers, though many of them pivoted into developing printers. So, if you are wondering why AI is a hot topic nowadays, you have your answer. Microsoft has 80,305,052 subscribers to its Office 365 software. Imagine how much output those 80 million folks can produce compared to the same number of workers in 1972. One final note. I can remember when many people believed that Microsoft and Apple were overvalued… back in 1988. These are exciting times, but a word of caution is warranted. Not all companies are the same; just ask VisiCorp, AOL, and Blackberry.

WHAT’S HOT AND WHAT’S NOT BEFORE THE BELL

Booking Holdings Inc (BKNG) shares are lower by -8.38% in the premarket after the company announced that it beat EPS and Revenues last quarter. The company offered a disappointing forward look based on reduced reservations, but it did initiate a new dividend. In the past month, 8 analysts have increased their price targets while 5 have lowered them. Potential average analyst target upside: -1.2%. WHY IS THIS NEGATIVE? Because the current share price is above the median analyst target. While this can be viewed as the stock being expensive, it does not mean it will not continue to climb.

Live Nation Entertainment (LYV) shares are higher in the premarket after it announced an EPS miss with a strong beat on Revenue. In the past month 10 analysts have raised their target prices while none have lowered them. With a forward PE of 47.7x, the company is rich compared to the 25.64x of its peers. Potential average analyst target upside: 85.7%.

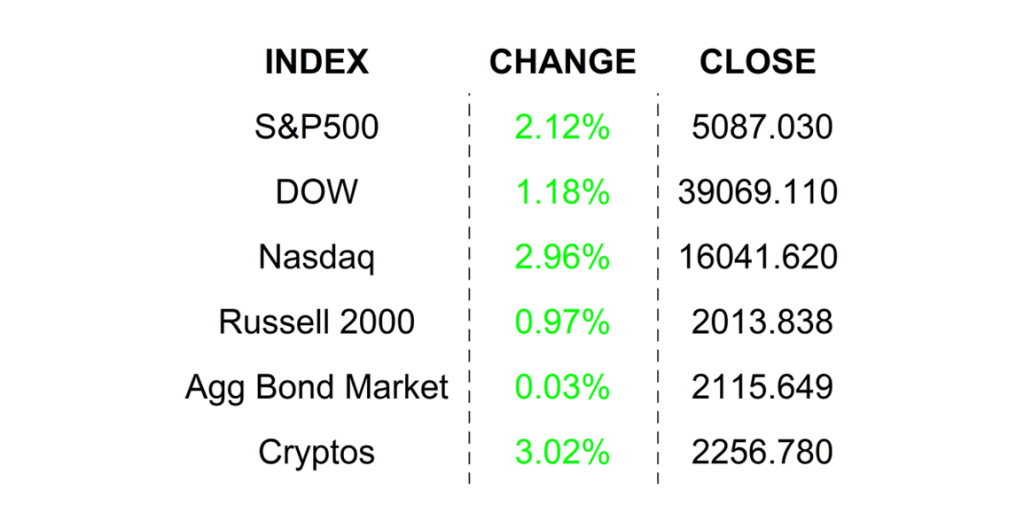

YESTERDAY’S MARKETS

NEXT UP

- No major economic releases today. Next week, there are still important earnings releases teed up in addition to housing numbers, Durable Goods Orders, Consumer Confidence, GDP, Personal Income, Personal Spending, PCE Deflator, and more PMIs. Check back in on Monday for calendars and details. Don’t forget to give my daily chartbook a look (ATTACHED AND HANDCRAFTED EVERY DAY); no telling what you might glean from them.

.png)