Stocks had a mixed close yesterday, at the mercy of minor numbers ahead of tomorrow’s big inflation figure. Consumer Confidence is waning with investors concerned about the present and future.

Mercy. I am going to dig into my Wall Street Book of Odd Sayings and thumb to a very, very worn page. Hang on, give me a second. Aha, here it is, it reads “DON’T FIGHT THE FED!” Go on, read it again. I have reminded you of this many times on our journey together, and I have to, occasionally, even remind myself. Traders, sometimes, feel like they are in control of the markets, with thumb on the mouse-wheel and index finger on the BUY button. If you have been successful as a trader with your whipping (with emphasis on the silent ‘h’) and driving… sorry superstar, it has been at the pleasure of the gods of luck. Alas, your future is in the hands of the Almighty… Fed.

Don’t believe me? Just take a look at the chart at the end of this passage. It shows how traders, sometime in mid-January of this year were expecting 6.5 quarter point rate cuts by the end of the year. That’s right, -1.5% of cuts! In fairness, there was a legitimate thesis for cuts with inflation on shrink and Fed members appearing less belligerent. Cuts, perhaps, but maybe not 6.5. And I know that’s easy to say now, but in fact, it is easier than you may think. The Fed today is not the Fed of years past. Members are no longer the staid, pinstriped, button-down, demure bankers locked away in their offices of oak and steel. No, today, you can’t get them to shut up when there is a hot mic or live camera. They even go as far as publishing their individual projections on where they see rates and the economy over the next 3 years. They are humans, like me and (presumably) you, so you can take their 3-year projections with a grain of salt, but maybe, not so much their predictions over the next 6 – 12 months. Those projections, if you recall, were far less aggressive than what traders were betting on. Further, those hot mics and live cameras captured those very same VOTING bankers telling traders that they were wrong. Now, I am not saying that the bankers are not listening to what the markets were expecting however, it was pretty clear that markets were, perhaps, a bit unrealistic. However, traders were persistent, hoping, in some way to jawbone the Fed into doing their bidding. Presidents, in the past, have tried that tactic as well, and they have been unsuccessful.

February has been a month of back to reality for traders, however. You can see by the chart that traders have finally capitulated, recognizing that a more realistic 2 to 3 quarter basis-point cut may be in the offing. If you were a fly on the wall in one of those traders’ offices, you would surely find on their desks an opened jar of antacid tablets, and a book of Wall Street sayings, opened to a page that reads “DON’T FIGHT THE FED!”

THIS MORNING’S GOINGS ON

First Solar Inc (FSLR) shares are higher by +6.21% after the company announced that it beat EPS estimates. The company also guided positively for the year. Solar companies have been under pressure by lower demand, higher interest rates, and changes in state regulations. In the past month, 2 analysts have raised their price targets while 5 have lowered them. Potential average analyst target upside: +55.3%.

eBay Inc (EBAY) shares are higher by +5.20% in the premarket after the company announced that it beat EPS and Revenue estimates by +4.17% and +1.9% respectively. The company provided positive forward guidance reflecting a focus on increasing margins which was well received by analysts. The company’s board of directors also approved a stock buyback plan, which investors always appreciate. Dividend yield: 2.25%. Potential average analyst upside potential: +8.3%.

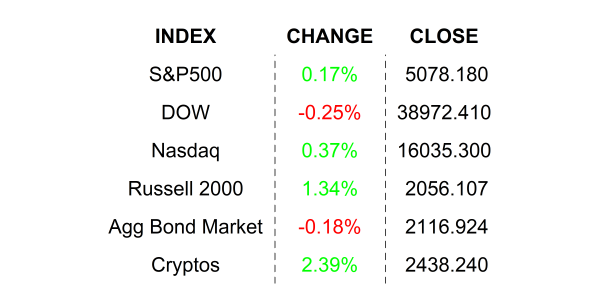

YESTERDAY’S MARKETS

NEXT UP

- Quarterly Annualized GDP (Q4) is expected to come in at +3.3% in line with the prior estimate.

- Fed speakers today: Bostic, Collins, and Williams.

- After the closing bell earnings: Nutanix, Okta, Paramount Global, AMC Entertainment, Duolingo, Snowflake, C3.ai, Salesforce, HP, Chemours, Sarepta, Monster Beverage, and Jazz Pharmaceuticals.

.png)