Stocks slipped yesterday closing above daily lows as anxious investors await today’s critical inflation figures. The Fed too, is looking for direction from the numbers, and it is getting none.

Take your time, guys. I always love getting GDP numbers. Not unlike some items left in the back of my refrigerator, I must first check the expiration date before I consume. Yesterday we got the second reading of 4Q23 GDP. Yes, all the stuff that happened in the US economy starting last October through New Years. Can you even remember what you wore on New Years Eve? Anyway, if you want to know how well the US economy did last year, you can be confident that Government economists have checked their numbers at least twice before telling us… yesterday. Oh, and just to be safe, the economists will check their work a third time and let us know the number at the end of next month… before starting to calculate what is happening this quarter and giving us their first guess on that at the end of April 🤦♂️.

Yesterday’s release showed a downward revision from the original print from last month. Your first thought may be that a downward revision of GDP is a negative data point for the economy. And at a high level… it is, though in this case I use “high level” in a negative sense. My regular readers know that I often ignore the high-level view and go right to the fine print, because that’s where one finds the juicy stuff. So, was there any, so-called, “juicy stuff” in yesterday’s release? Well, most of the headlines will point to a reduction in inventories as the cause for the downward revision. This is not surprising given that inventories were somewhat bloated in Q3 last year and we are hearing lots about inventory reductions in this almost-over earnings season. But still, remember that this is a second estimate on what happened last year. In any case, I am glad the economists got that right, but what I really wanted to look at was one key component of the number. Can you guess what number that is? Come on, you know… CONSUMPTION.

One of my favorite indicators of economic health. Cars, garden hoses, Twinkies, haircuts, Taylor Swift tickets, it’s all there. The more of that stuff we buy, the more the economy expands. And, because it makes up around 2/3 of GDP, it has a big impact. If for any reason we stop buying stuff, well my friends, that portends trouble, real trouble. But don’t worry yourself because consumerism is alive and well. We know this because the Personal Consumption component of GDP was revised upward. Interestingly, economists were anticipating a downward revision.

So, on the surface, the downward revision may seem like a negative, but based on what we have learned from what was happening below the surface, the number was quite positive. Bloated inventories were less bloated than originally expected and consumers consumed more than originally expected. Go figure! What are the implications of this revelation? Surely, the Fed would like to see consumption moderate because consumption drives demand which drives inflation. But wait, all this was happening last year. Getting back to the refrigerator. If you found a hunk of your favorite cheese in the back of your fridge and looked at the “best if eaten by” date and noticed that it had already expired, but someone crossed out the date and wrote in a more recent, but still passed date, would you eat it? Perhaps, if you give it the smell test… well, maybe not 🧀.

WHAT SMELLS LIKE WHAT THIS MORNING

Monster Beverage Corp (MNST) shares are higher by +5.64% in the premarket after the company missed EPS and Revenue estimates in Q4. The gains are likely due to significant growth in QoQ sales and significantly higher margins, both of which were praised by analysts who cover the company. Potential average analyst target upside: +15.2%.

HP Inc (HPQ) shares are lower by -2.51% in the premarket after the company announced that it missed EPS and Revenue estimates last quarter. The release showed a decrease in personal and commercial computer sales, though units rose. That means price points were lower (it’s just math, stupid 😉), which the Fed will appreciate, but not so much, shareholders. The company also reaffirmed its full-year guidance, indicating that these results are only a temporary setback. Dividend yield: 3.83%. Potential average analyst target upside: +9.4%.

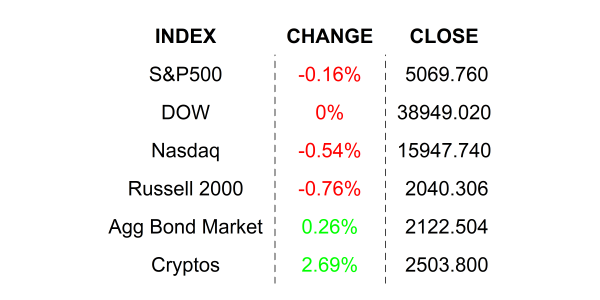

YESTERDAY’S MARKETS

NEXT UP

- Personal Income (Jan) is expected to have risen by +0.4% after climbing by +0.3% in December.

- Personal Spending (Jan) may have advanced by +0.2% after jumping by +0.7% in the prior month.

- PCE Deflator (Jan) is expected to have declined to +2.4% from +2.6%, while the Core Deflator may have decreased to +2.8% from +2.9%.

- Initial Jobless Claims (Feb 24) is expected to come in at 210k, slightly higher than last week’s 201k claims.

- Pending Home Sales (Jan) may have added +1.5% after gaining by +8.3% in December.

- Fed Speakers: Bostic, Goolsbee, Mester, and Williams

- After the closing bell earnings: Veeva Systems, Autodesk, Zscaler, Sweetgreen, Dell Technologies, Hewlett Packard Enterprise, Fisker, and Ginko Bioworks.

.png)