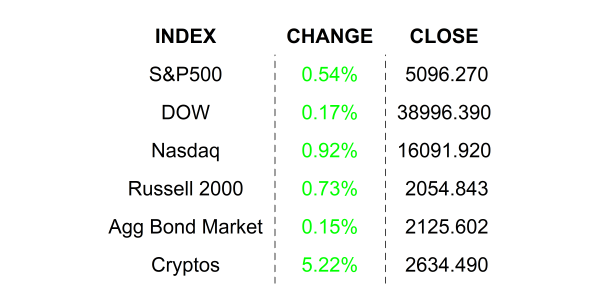

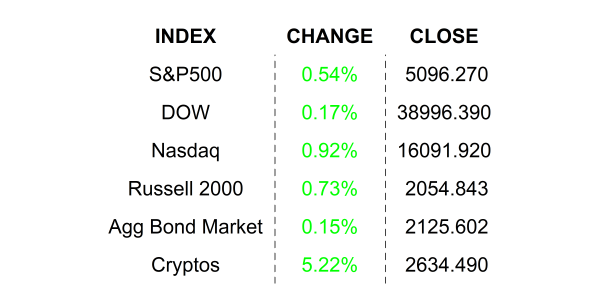

Stocks rallied yesterday with the Nasdaq finding a fresh high on high volume. Inflation figures were slightly higher than in the prior month, but progress was still made.

Out like a… cheetah. If you are like me, you are counting the days down to the vernal equinox, a.k.a. the official start to spring. That said, I take even the slightest glimmer of it as a win. For instance, today is the first day of meteorological spring. I am not a meteorologist, but I do watch the weekend weather quite closely 😉 and I am somewhat obsessed with direction of the wind, a throwback to my sailing days. Anyway, friends, spring is nigh, and I am feeling rather like I have a spring in my step. Likewise, the market too leapt into March with a bit of vim and vigor.

The Nasdaq composite hit another all time high despite many news outlets attempting to derail the rally with headlines like “inflation highest in months” and “inflation worse than expected.” To these I say: true, but check the details and false, check your sources. I get that it is hard to grab the eye of a reader or a viewer with yet another report about boring inflation, so adding a bit of doom to the headline, though it may be a stretch, is understandable. Today, I am going to talk to you about boring inflation again, but I am going to show you what yesterday’s report was all about, and possibly why the markets rallied into the close.

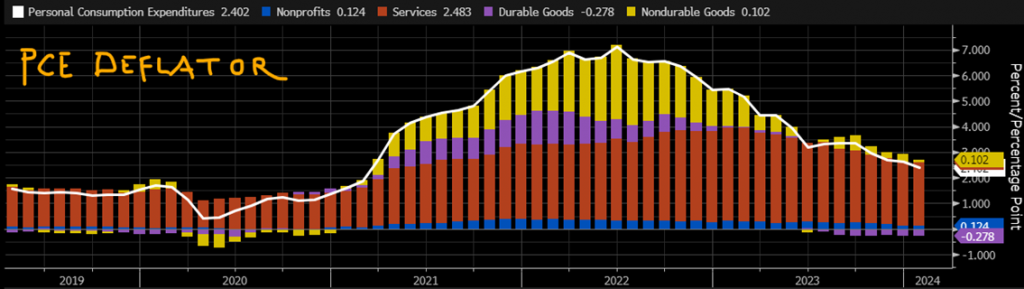

First, I want to start with my favorite Bloomberg chart. It is so on-point that it is not worth my reproducing, and I am happy to give my friends at Bloomberg credit. Check it out and then keep reading for a brief description.

This is a chart of the PCE Deflator and its key components. Before we start, I want to remind you that the Fed uses this indicator when it is talking about inflation. This chart shows change in prices from a year ago. We commonly think of inflation in annual terms, and when the Fed talks about its inflation target of +2% it is referring to this very figure. That number, delineated by the white line on the chart is at +2.42%. You will note that last month it was higher, so just using visuals alone, you can see that it is improving and converging on the Fed’s magical number. You may also notice that the white line was as high as +7% in 2022. That was bad, the Fed was sweating bullets, and it was worthy of a doom-ridden headline, but, as a very wise man tells me often, “we are here now.” And where we are is pretty good.

When we talk about inflation, we are often envisioning those crazy days in the late pandemic where things like cars, TVs, dishwashers, and food were all hard to get and their prices were out of control. Remember those days? Of those three examples, TVs was the only one I was not forced to buy. Not fun, indeed. All those items fit into durable and non-durable goods categories. Those are the gold and purple bars. You can see that prior to the pandemic, they were rarely positive and how during the pandemic they surged. If you look carefully at the chart, it is safe to say that those have gotten back to normal. What has not gotten back to normal are the rust-colored bars, services.

It may be hard to notice visually, but the rust bar for January was ever so slightly higher than the one in December, +2.483 versus +2.453, to be exact. The increase is not notable, but what is, is that they are not following the same pattern as the “goods” categories. They appear to be sticky. Now, I am going to dive really, really deep and tell you the two biggest culprits: Rent and Hospitals. I have mentioned rent many times in my inflation discussions and it continues to be a thorn in the side of inflation, the Fed… and both my kids’ budgets.

A key driver of rent rates is interest rates. Most residential rentals are leveraged and higher cost of debt forces landlords to seek higher rents. Will lower rates expected later this year help? Probably not, but possibly in the future as owners refinance at lower rates when their loans come due. Of course, demand can have an influence too. A sharp rise in unemployment or a recession will certainly force landlords to lower rents. Neither of those appear to be on the immediate horizon, so it looks like we are just going to have to deal with it… for now.

I recently worked on a project where I took the simple average of inflation from 1926 through current. Do you want to know what that number was? Of course, you do, it was +3%. So, technically we are already better off than we have been… on average… historically. The Fed only officially started referring to +2% as a target rate in 2012. Prior to that, economists and Fed officials would often look at the “long running average level of inflation” as a guide. Now you know what that number is. Can you please be positive now? Spring is coming.

WHAT’S HOT AND WHAT’S NOT THIS MORNING

Hewlett Packard Enterprise (HPE) shares are lower by -5.58% in the premarket after the company announced that it missed Revenue targets in Q4. The company lowered its full year guidance, which is still in range of estimates, while current quarter guidance is below. The company attributes the weakness to soft demand for network products and lack of GPU chips for manufacturing AI-focused servers. Hint: that means strong demand for chips by NVIDIA and AMD 😉. The announcement drew a downgrade to EQUALWEIGHT from Wells Fargo. Dividend yield: 3.21%. Potential average analyst target upside: +11.7%.

NetApp Inc (NTAP) shares are higher by +17.43% in the premarket after it announced that it beat EPS and Revenue estimates by +15.57% and +0.94% respectively. The company raised its full-year guidance to well above average analysts’ estimates. In the past month, 9 analysts have increased their prices while only 1 has lowered them. Dividend yield: 2.42%. Potential average analyst target upside: +11.0%.

YESTERDAY’S MARKETS

NEXT UP

- ISM Manufacturing (Feb) may have increased to 49.5 from 49.1.

- Fed speakers today: Barkin, Goolsbee, Waller, Bostic, Daly, and Kugler.

- Next week: still more earnings along with Factory Orders, Durable Goods Orders, The Fed Beige Book, and the monthly employment report. Check back in on Monday for calendars and details.

.png)