Stocks rallied to new heights on Friday because everyone wants in on the action. Sentiment indicators and PMIs came in softer than expected but that did not stop jubilant traders.

What do you think it’s worth. Did you ever wonder how big-name investment banks come up with their index targets for the year? I spent a good amount of time with some exceptionally bright folks this past weekend and wouldn’t you know it, this very topic came up. We wondered collectively if the stock market is in some sort of a bubble. There are many ways to define a bubble and I won’t get into them in my limited time with you this morning, but I am sure that you have noticed that the financial press has no qualms about using the eye-grabbing moniker to… well, grab your eyes. My longtime readers may recall that I introduced the Minsky Moment to you way back in 2018. In fact, I did a search of my posts during 2018 and I found that I featured discussions about bubbles and Minsky three times during that year, so something must have triggered that. We’ll get back to that in a moment.

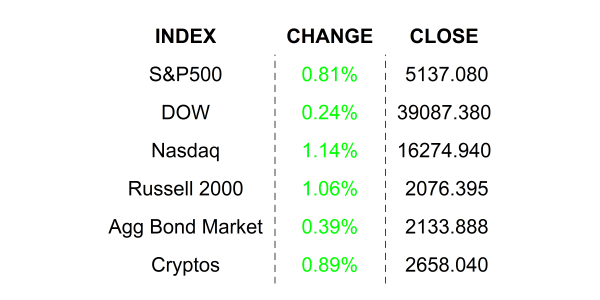

The discussion was still fresh in my mind when I started my morning research WHILE YOU SLEPT at 4:00 AM. And there it was. Bank of America and Goldman Sachs both on the tape opining on the market. BofA ratcheted up its S&P500 target to 5,400 and Goldman Sachs said that the Magnificent 7’s high valuations are supported by fundamentals. Go ahead, you can read that sentence again. The S&P500 closed at 5,137 on Friday at a fresh all-time high. Just a few weeks back we collectively cheered that the S&P500 rose above 5,000. Oh, and for some reference, the index closed out 2023 at 4,769. Stop, don’t do the math, just realize that the S&P is clearly higher year to date. All this amidst deteriorating expectations about Fed rate cuts and respectable but not crazy-good earnings.

Let’s start with Goldman’s admission about the Magnificent 7. NVIDIA, as you know, is a proud member of this gang of winners and I am zeroing in on it just because everyone wants to know: what is it worth? Well, Goldman thinks it can get to $875 within the next 12 months (it closed at $822 on Friday). Now, these analysts conduct very thorough analyses on the companies they cover, and they don’t easily change ratings or targets without strong conviction. Knowing this, let’s take a look at Goldman’s view on NVIDIA over, say the last year or so. Last February, Goldman raised NVDIA to a BUY from neutral. You may recall that this was just as Microsoft introduced AI to the stock market. So, that was a good call on the part of Goldman, knowing how critical NVIDIA’s chips are to AI. Do you know what Goldman’s target was for the company at the time? I’ll tell you; it was $275! So, I guess the analyst was kind-of right considering that the stock is now trading at $837 in the premarket. You might be wondering if the analyst still thinks that the stock is worth $275. Of course, he doesn’t, he would look foolish if he did. He has since raised his target for the stock… SIX TIMES since that BUY recommendation, in May 23, July 23, August 23, November 23, and 2 times last month alone. What would cause all those hikes? Well, it is true that the prospects for the company have risen rapidly in these past 12 months as companies all scramble to be part of the AI revolution which rely heavily on NVIDIA’s products. AND it is also true that the company has grown its EPS by some +390% in 2024. Regardless of all that, the market has decided that the stock is worth, well $837 last I checked. With all these increases one wonders if these levels can hold and whether there will be more upgrades if the stock continues to climb… with fundamental justification, of course.

Finally, let’s get back to BofA’s bold call. Do you know what its target was for the S&P500 prior to this morning’s hike? It was 5,000. With the index around 5,137, a new target of 5,400 seems reasonable, wouldn’t you say? What’s the point of all this. Forecasting exact price and index target levels is a tricky business, and if you follow the process closely, you may notice that it is not very accurate, and possibly a bit more art than science. Don’t get me wrong, the information is useful, but at the end of the day, it is you that must make the decision of what you think NVIDIA is worth, and it is up to you to decide if the market is in a bubble and whether another Minsky Moment is just around the corner. I first wrote about Hyman Minsky in August of 2018 (you can go back and read it here: https://www.siebert.com/blog/2018/08/15/bubble-trouble/). I am pretty sure I mentioned something about Bitcoin and the FANGS (the predecessor) to the Magnificent 7. Since I wrote that, the NYSE FANG+ index rose by +255% and Bitcoin has increased by +969%. HOWEVER, neither ascended in a straight line… and I probably changed my feelings on the matter several times along the way. Stay focused and do your homework!

FRIDAY’S MARKETS

NEXT UP

- No releases today but Philly Fed President Patrick Harker is scheduled to speak today.

- The week ahead is jampacked with released including PMIs, JOLTS Job Openings, Factory Orders, Durable Goods Orders, ADP Employment Changes, and the all-important monthly employment numbers. Additionally, there are still some important earnings announcements. Download the attached economics and earnings calendars for times and details in the week ahead. Don’t forget to look at my daily chartbooks for some insights.

.png)