Stocks took one straight on the chin yesterday dragged down by all-popular Apple’s China slip. ISM’s Services Index underwhelmed, but unfortunately, it doesn’t cover the portion of services that are causing inflation to be sticky… housing.

Current currency. I finally put my computer to bed at 21:30 last night and had all intentions set on writing about yesterday’s market slide and Apple, but I had to change course this morning when I read about Egypt’s devaluation of its currency the Egyptian Pound. It’s not just the Pound that has my mind racing but also Bitcoin, which continues to hold up right below $70,000 and is this morning once again trading right at the recent highs it logged 2 days ago (bumping up against its all-time highs from 2021). I feel strongly compelled to mention both, so bear with me as I try to sew together these 2 somewhat similar topics. Now, pay attention.

Let’s start with the Egyptian Pound and the country’s devaluation. You may be wondering, “why would a country want to devalue its currency?” It has such a negative sound to it, doesn’t it. The truth is, there is no mystery to it; a devaluation is a literal devaluation, or loss of value relative to other currencies. Ok, so the question still remains; why? Well, the complete answer is too complex to lay out in a few paragraphs, so I will stay high level. Egypt is a producer of energy products (oil and gas) as well as fertilizer, amongst other things. It is not strictly a net exporter per se, but it does produce products that are fit to be exported. In that case a weaker currency makes its products cheaper to foreign countries seeking its products. As we all know by now, lower prices usually increase demand, which in this case would have a positive impact on the Egyptian economy. Regarding that, the country has had its challenges. After a +6.7% GDP increase in 2022, last year saw a slowdown to +3.8 with economists expecting a similar increase in 2024. Unemployment is relatively low and stable, but inflation is through the roof growing by +33.8% in 2023. So, the challenge for Egypt is not necessarily to spur its economy but rather to fight sky high inflation. In recent days, the country raised its key lending rate by +600 basis points and its central bankers hope that the devaluation will help as well. In that case, a devalued currency would make foreign imports more expensive and possibly lower demand, which would ultimately help curb inflation. Egypt is currently in talks with the IMF to raise critical funds, which is likely contingent on the country’s taming its inflation problem. The central bank has essentially thrown the kitchen sink at the problem with hopes that it will help. Unfortunately, devaluation is typically inflationary 😟.

Pay attention now, here comes the forced segue into Bitcoin ₿₿₿. The stark overnight exchange rate change in Egypt ultimately begs the question: what is a currency really worth? It’s not like a stock that comes with cash flows and assets, or a commodity futures contract that entitles you to pork bellies (which you can presumably turn into food) or crude oil (which you can presumably turn into all sorts of stuff). So, what is it really worth? This takes us to Bitcoin. Bitcoin is a digital currency, nothing more. You can use it to purchase things that are valuable to you in your everyday life, like food, services, and even shiny things like televisions and cars. So, indeed there is some value to possessing these things. But, as you know, there are other ways to pay for those things, like greenbacks, or dollars. What is a dollar worth? It used to be backed by gold, which you could request, if you were patient enough and felt like carrying around bricks of the stuff, although I am pretty sure that Walmart does not accept it as a form of payment. No, the US Dollar is a fiat currency, backed only by the good name of the United States Government, the US economy, and all of those aircraft carriers floating on the seven seas. That’s gotta’ be worth something, and it is. That is why most transactions the world over are conducted using US Dollars.

Bitcoin is also a fiat currency of sorts. The difference is that it is not backed by any implied promise, and it certainly does not command a fleet of nuclear-powered attack submarines. It does not pay dividends. It does not make any promises of future cash flows. You do not get the right to take delivery of frozen orange juice concentrate at some future date. You can’t even video tape yourself burning it to gain internet notoriety. Pro tip: don’t burn currency, it’s illegal… and um, stupid. No, Bitcoin is nothing more than an alternative currency that exists in a digital world managed by a secure blockchain. A blockchain is nothing more than a way of accounting for who owns what. Have people figured out how to steal some now and again? Yes, but let it be known that some crazy folks still rob banks to steal cash… the old kind. At the end of the day, Bitcoin has matured into a viable currency.

That being said, when you stick that $100 bill you got from the tooth fairy in your piggy bank, it does not increase in value by +60% in 3 months. That’s right you can buy +60% more stuff with it this morning than you could on December 31st of last year! Now, that has gotten a lot of people excited and even more people nervous. Now, let’s get something straight. In January of 2021, a 1951 Mickey Mantle baseball card sold for $5.2 million! The card does not pay dividends though you can use it to play flip with your friends, and it can do a good enough job at scratching an itch in a hard-to-reach spot on the back of your neck. But do you need to pay $5.2 million for that. The answer is YES, if you want to use famous Yankee Mickey Mantle to get the job done. Folks, all joking aside, it comes down to supply and demand. In the case of Bitcoin, it HAS PROVEN TO BE A VIABLE FORM OF CURRENCY, establishing basic value. Now, the cool thing about Bitcoin is that it is limited and not easily created. It takes time, money, and lots of resources to mine it. To make things even more interesting, it halves every 4 years, meaning it gets +50% more expensive to mine a block, making it more valuable yet, and a halving is coming up on April 19th. So, you got it, supply is limited like the Mickey Mantle card. Now let’s go to demand. Not everyone is ready to start paying for their shoes with Bitcoin, HOWEVER an increasing number of folks are interested in investing in the cryptocurrency. Forget about the reason why they want to invest, but the fact is that they do. On January 10th of this year the SEC approved the launch of several Bitcoin ETFs opening the door to any investor wishing to invest in Bitcoin. There are no digital wallets to deal with, no secret passwords… no, just plain old ETFs like the ones we love to invest in day in and day out… mainstream. When you buy a Bitcoin ETF, the manager of the ETF will ultimately have to purchase Bitcoin itself. So, demand for the ETF spurs demand for Bitcoin… WHICH MAKES BITCOIN GO HIGHER, thus accentuating the growth associated with limited supply. SO, what is Bitcoin worth? Just ask the market! Why is it going higher? Supply and demand, or to put it in old tongue-in-cheek Wall Street terms: more buyers than sellers.

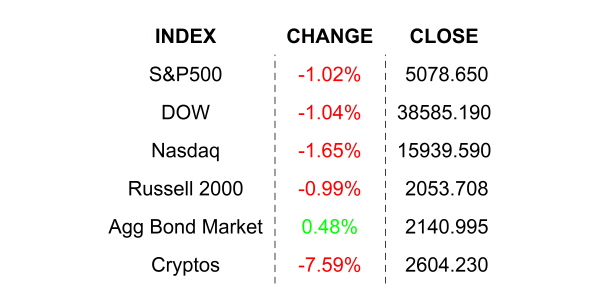

YESTERDAY’S MARKETS

NEXT UP

- ADP Employment Change (Feb) may show that 150k new jobs were added for the month after 107k were added in January.

- JOLTS Job Openings (Jan) is expected to show 8.850 million vacancies, slightly less than the last print of 9.026 million openings.

- Fed Beige Book will be released this afternoon cataloging anecdotal information on economic conditions across all the Fed regions.

- Fed speakers today: Powell (THIS IS A BIG ONE), Daly, and Kashkari.

.png)