Stocks rallied yesterday because Chairman Powell decided not to upset the rally – thanks Jay. The trade deficit got bigger in January because happy Americans are buying foreign goods, which is a sign of economic health, in case you wanted to know.

Can’t we just be happy? What are you waiting for? Are you one of those people who is hoping for an absolutely pig of an economic release with hopes that the Fed will be scared out of its bed and forced to lower rates? It’s ok if you are, you are not alone. Let’s go with that. What if that happens? Today’s monthly job number comes in and shows that not a single new job was created last month and suddenly the Fed decides to cut the Fed Funds Rate on March 20th, though Fed Funds Futures predict only a 5% chance of it. So, what then? On March 21st, will your life somehow get transformed materially? Will the cost of eggs and beef and rent suddenly go down? Most importantly, will you finally be able to find something worth binge-watching on Netflix? But, really, will your NVIDIA or Apple stock suddenly have a better chance at long-term success? No, nope, nada, nichts, [fill in your favorite negative].

So then, what’s all the fuss with these rates? I should think that we would all want to celebrate if the US Economy added more jobs than expected. A healthy labor market is critical to economic growth. Job security leads to consumer confidence which leads to consumption. Consumption, an obsession of mine, makes up 2/3 of GDP. Aha, I get it, you are worried about inflation. You suddenly remember how fast the prices of EVERYTHING rose in 2022 and the hairs on the back of your neck begin to rise. STOP! That inflation was caused by a supply shock combined with a stimulus-driven demand shock. Both are now gone. I realize that there are still some costs that are growing at an alarming rate. But wait, what does that have to do with NVIDIA or Apple?

No, we need to be rooting for a strong economy were there are lots of jobs, where wages are growing in parity with inflation. Inflation was at +3.1% in January and economists expect that it remained there in February (and we will find out if it did next week). I know that the Fed would like to get it to +2%, and I would too, but if you took the average inflation since, say 1926, you would find that it is around +3.1% 🤓.

Now, I will concede that if you are a highly leveraged real estate investor that needs to refinance a loan this year, a Fed rate cut can mean the difference between bankruptcy and success. Commercial real estate investors typically borrow on rates based on SOFR (Secured Overnight Financing Rate), which is causally influenced by the Fed Funds Rate. In the case of borrowing, lower is better. One wonders if commercial real estate investors get a break in their financing costs that landlords might pass on some savings onto renters 😕. I will pause and let you finish laughing. Are you good? Let’s keep moving. If you are invested in REITS or real estate heavy companies, I forgive you for rooting for a bad print this morning.

What is the point of this diatribe? I want to remind you that regardless of what the Fed may or may not do, none of us, regardless of our portfolio’s makeups, wins if the economy is in bad shape. It starts there… it ends there. So, for a change, let’s not get so hung up on what and exactly when the Fed will lower rates and by how much. Chairman Powell made it clear in his two days of testimony this past week that rate cuts at this point “would be appropriate.” They are coming. I will end with this. If you are invested in a company with bad management and poor prospects for revenue growth, neither strong economic growth, nor lower Fed Funds rates are going to help you. And finally, you can always rewatch the entire 6 seasons of The Sopranos… it got a 92% Rotten Tomatoes rating.

WHAT TO ROOT FOR THIS MORNING

Biogen Inc (BIIB) shares are higher by +3.93% in the premarket after competitor Eli Lilly announced that the FDA is delaying its decision on their competing Alzheimer’s disease drug donanemab (did I get that spelling right 😉). In the past month 20 analysts have lowered their price target while only 1 has raised it. Potential average analyst target upside: +34.9%.

Textron Inc (TXT) shares are higher by +1.55% in the premarket after Bank of America raised its rating to BUY from NEUTRAL. Of the analysts that cover Textron, 61% rate it a BUY, 33% rate it a HOLD, and the remaining 6% rate it a SELL. The company will announce its earnings next month. Dividend yield: 0.08%. Potential average analyst target upside: +23.7%.

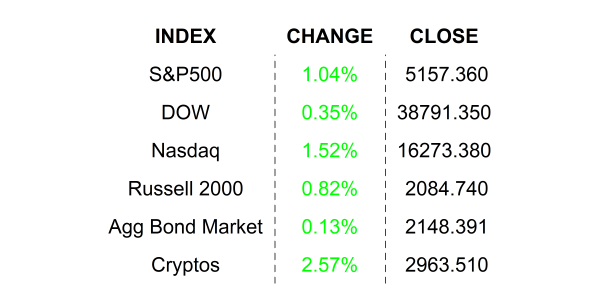

YESTERAY’S MARKETS

NEXT UP

- Change in Nonfarm Payrolls (Feb) is expected to come in at 200k lower than January’s hot print of 353k.

- Unemployment Rate (Feb) may remain unchanged at 3.7%.

- New York Fed President John Williams will speak today.

- Next week: Consumer Price Index / CPI, Producer Price Index / PPI, Retail Sales, Industrial Production, and University of Michigan Sentiment. Check back in on Monday for calendars and details.

.png)