Southwest applies the airbrakes causing a loss in price altitude, blaming Boeing

Stocks opened the session in the red and desperately clawed its way higher, ultimately falling short of gains. Worries about today’s inflation figure kept the bulls on the sidelines opening the field for a rare outperformance of value stocks.

Under the influence. Have you been paying attention to bond yields lately? Of course, you haven’t been because stocks are just so much more fun to talk about. Artificial Intelligence, weight loss miracles, Bitcoin, salacious executive behavior… really, how can one resist? It’s Ok, I am not offended if bonds are your second thought, though I caution you not to ignore them completely. We all know that stocks have had an interesting year so far, clocking a few solid months before pulling back over the last few weeks, but bonds have had an interesting ride as well. Let’s take a quick look at a chart and see if we can get up to speed on what is happening in not-so-exciting-to-rave-about-at-the-bar bonds. Let’s start… with chart (I’m such a poet 🤣).

This chart shows yields of both 2-year Treasury Notes (blue line) and 10-year Treasury Notes (green line). Both started the year off lower with the 2-year around 4.25% and the 10-year around 3.87%. They have since both trended higher but have recently pulled back with the 2-year closing yesterday at 4.52% and the 10-year at 4.08%. So, what is this all telling us? I KNOW YOU WOULD RATHER KNOW ABOUT STOCKS, BUT please bear with me. Though many folks think that 2’s and 10’s trade together, they don’t, and they are influenced by 2 completely different things.

The 2-year note is highly influenced by Fed Policy. Where do you expect overnight rates (essentially Fed Funds) to be in 2 years? Of course, you have to get some term premium for parting with your principal for 2-years. Even the Fed will tell you where it thinks yields will be in 2-years and, yes, the market has its own spin on that. Going into the new year, investors were much more aggressive in their hopes for sooner and larger rates, and as we have seen in recent weeks, those high hopes have been lowered. Not only have FOMC members done their best to dash hopes of aggressive cuts, but the stronger than expected economic numbers and a slight inflation uptick in January have supported that guidance. That is why we saw 2-year yields rise since the beginning of the year.

By eyeballing the chart, you might think that the 10-year yield is moving in lockstep with the 2-year. It is, but for a completely different reason. If I asked you what you expect Fed Funds to be in 10-years and you answered with a number, I would probably struggle to hold back laughter. According to a very famous quote from a very famous economist, “we are all dead in the long run,” and 10-years is, kind of, the long run. But still, you surely have an opinion on which way things may be going in the future. More precisely, compared to the end of last year, have you revised your opinion on how well the economy will be doing in the future? Read the question again and think about it. Of course you have! The economic numbers we have been receiving more recently have been quite unexpectedly, healthy. Stronger employment, better-than-expected earnings, a less-dysfunctional Congress, a strong stock market… all, of these things point to better days ahead with the likelihood, IN YOUR MIND, AT LEAST, of a recession, well… receding. What happens when an economy is stronger? That’s right, you guessed it, inflation. Inflation not in the near-term, but the longer-term. If you are going to tie your money up in a 10-year Treasury Note with a fixed coupon, you would want to make sure that future inflation would not eat into your yield, lowering your purchase power. This is embodied in your real yield, which factors in inflation. That is why yields go higher when bond traders are expecting a stronger economy in the future. Of course, we have to mention that the opposite occurs, and longer-maturity yields fall when traders see stormy clouds on the horizon. Additionally, we can’ t ignore that 10-years IS, indeed a mighty long time from now, so opinions can swing wildly from day to day as investors change their minds. Finally, we can’t ignore that market supply and demand effect prices and yield of bonds. Supply and demand in this case means buyers and sellers as in traders with short-term goals of making trading profits. Traders who bought 10-year Notes around 4.30% in February have made a profit with notes trading at 4.08%. They are possibly hoping for yields to go back below 4% before they sell and take profit. That selling pressure may push those yields higher once again.

In captive 2-year notes, with the Fed in charge at the moment, next week’s FOMC forecast release will certainly have an influence on those. HOWEVER, with that meeting still a week away, today’s Consumer Price Index / CPI release could still add some volatility to the equation. See, bonds are not so boring after all. If you are still seeking interesting stories, you can take a look at corporate bonds which are tied to Treasury yields but have all the fun stories, successes, and (hopefully not) failures of their corporate issuers.

WHAT’S HAPPENING WITH STOCKS THIS MORNING

Southwest Airlines Inc (LUV) shares are lower by -7.4% in the premarket after it announced that it was cutting back on capacity in the second half of the year, partially in response to Boeing’s recent aircraft delivery schedules. American Airlines, Delta, and United are all down in the premarket after Southwest’s admission. The company won’t release earnings until late next month at which time it is expected to revise guidance. Dividend yield: 2.13%. Potential average analyst target upside: -8.4%. WHY IS THIS NEGATIVE? Because the current share price is above the median analyst target. While this can be viewed as the stock being expensive, it does not mean it will not continue to climb.

Oracle Corp (ORCL) shares are higher by +13.26% in the premarket after it announced that it beat EPS and Revenues estimates last quarter. Analysts have zeroed in on strong bookings reflecting strong AI demand as being a positive for the company. In the past month 15 analysts have increased their price targets while 1 has lowered them. Dividend yield: 1.40%. Potential average analyst target upside: +17.5%.

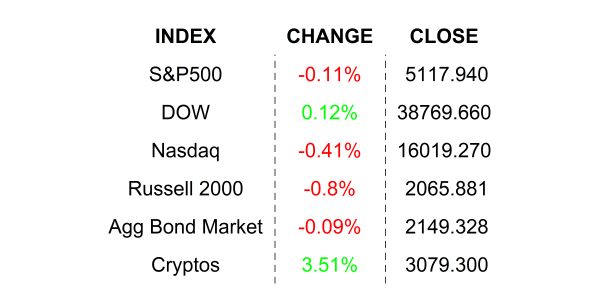

YESTERDAY’S MARKETS

NEXT UP

- Consumer Price Index / CPI (Feb) is expected to have increased to +0.4% from +0.3% for the month. Ex Food and energy, it is expected to have dropped to +0.3% from +0.4%. All eyes will be here this morning!

- NFIB Small Business Optimism (Feb) came in lower than expected at 89.4, down from last month’s 89.9 read.

.png)