Stocks rallied yesterday on news that inflation, still not gone… could have been worse 🤔. Tech stocks helped push the S&P500 to a fresh, all-time high.

Stuck in the mud. Yesterday, the Consumer Price Index / CPI came in a bit hotter than expected. By now, it’s old news (I wrote in the headline) that the markets reacted to the news positively. Well, to be clear, no one was celebrating hotter-than-expected inflation numbers, but leading up to the release, traders had likely prepared themselves mentally for a far more painful surprise. After all, economic numbers have been generally positive lately, the markets have been holding up, so, naturally traders are waiting for the other shoe to drop, and CPI is a… um, shoo-in for the role of that shoe. That said, things were not as bad as traders were privately expecting. Publicly, the numbers were slightly higher than economists were expecting.

The Fed is like a once vicious dog, now napping between traders and a big, fluffy cake, leaving traders trying to figure out how to tiptoe around the beast without disturbing it. That very Fed focuses a bit more on the Personal Consumption Expenditure (PCE) Deflator as its principal means of measuring inflation. Both indicators measure inflation but utilize different methodologies. We will get that number later this month, and economists have already begun to estimate what it will show based on yesterday’s CPI release. The good news is that it appears that it is pointing to a more market-friendly number. IF THOSE ECONOMISTS ARE CORRECT, of course.

For now, let’s take a quick look at the components of yesterday’s number. The annual figure came in at +3.2% while economists were expecting +3.1%, and the core index came in at +3.8% with economists expecting +3.7%. That was the headline. Now let’s take a closer look. The stuff we most often associate with inflation… literally, stuff, or more technically expressed as Core Goods actually DEFLATED from a year ago by -0.76%. Energy, once a big problem, also deflated by -0.30%. Food, another problem in the past, grew by +0.3%, which is very much in line with where it was before inflation kicked in. Alas, we arrive at the problem… and that is… once again, Core Services, which grew by +3.057% from a year ago. Tickets to see Taylor Swift or the Yankees may be expensive, but they will only cost you +0.05% more than a year ago. No, that’s not the problem. Health Insurance also costs what seems to be a small fortune is actually cheaper by -0.237% from a year ago. That brings us to the real culprit of higher-than-Fed-target inflation. Drumroll, please… Rent of Shelter, which is +3.375% more costly than a year ago. That is, my friends, the WHOLE story of inflation, and for my regular readers, not at all surprising. Now, I have read in a number of places that Fed members expect rents to come down in coming months, but I cannot find any direct quotes or citations, so let’s just leave it at that. Inflation is still higher than the Fed would like it to be and the sticky part of it is Rent.

Do you own a home? Do you, like most people, have a mortgage? If you do, it is likely that your mortgage rate is significantly lower than today’s prevailing rates. SO, you, like almost all other mortgaged homeowners, would not consider selling your house and trading up… until rates moderate. It’s OK, you are not alone. However, that has caused home prices to stay high due to a lack of supply. That may change once rates let up a bit. In the meantime, you may think you are escaping the pain felt by renters, but you aren’t because your Water, Sewage, and Trash Collection Services will cost you +5.319% more than a year ago. Gardening and Lawncare is sometimes reported, but not in this latest release. I can fill in the missing number based on my personal experience, and that will cost you more as well. Start saving because Spring is in the air and my gardener is at home right now polishing his trucks.

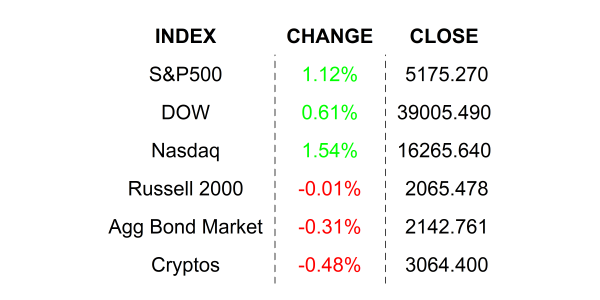

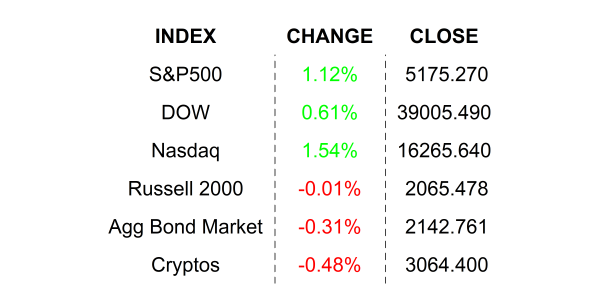

YESTERDAY’S MARKETS

NEXT UP

- Crude Oil Inventories (March 8) are expected to have drawn down to 306.67 k barrels from 1.367 million barrels.

- The Treasury will auction off $22 billion 30-year notes.

.png)