Stocks slumped on Friday closing out a second week of losses for equities as traders grapple with… a stronger than expected economy and a reluctant-to-loosen-up Fed. But beware, according to University of Michigan Sentiment, confidence is slowly waning portending weaker growth.

What lies beneath the shiny glass. Have you been to New York City? If you haven’t, at least you have seen it portrayed in movies and in pictures. I can tell you that it is even more awe-inspiring if you witness it in person. With its rows of behemoth structures, one larger than the next, it is hard to believe that such feats of engineering are possible, especially in the tight footprints allotted to developers. The new breed of building is taller and shinier than the prior, all covered in a skin of reflective glass. You can’t see inside those buildings, but surely you have wondered what goes on inside… if anything is even going on inside.

If you thought that occupancy is low, well you are partially right, especially when it comes to commercial office space. You have probably also heard that commercial real estate is under a bit of pressure, and that pressure is not necessarily coming from lower occupancy as much as it is coming from higher interest rates. Think about this basic math question. If you invest $5 in your friend’s lemonade stand and she pays you $1 a year in interest, you are doing pretty nicely with a 20% return on your investment. Let’s say that you borrowed $2.50 of that investment from your cousin Morty. Now with your out-of-pocket investment of $2.50, that $1 return become 40%. WOW, do I have your attention now? Are you thinking to yourself, “Marko, you left out the cost of borrowing from cousin Morty.” If you did, you are correct. You see, Morty is a fair man and only charges you 10% a year to borrow the $2.50. So, the real math looks like this: net return = $1 return from the lemonade stand – the $0.25 you owe Morty = $0.75. That $0.75, while less than the full $1, still gives you a yield of 30%, which gives +50% greater than if you didn’t borrow from Morty. That’s it! That’s how you make money with leveraged finance. BUT HOLD ON, of course it’s not that simple.

I mentioned before that Morty was fair. He may be, but he is not stupid. He was only willing to extend those 10% terms for 3 years, after which you must pay him back the $2.50. When you initially borrowed the money, you thought that you could do 2 things after 3 years. You could either turn around and sell your shares in the lemonade stand for something greater than the initial $5, or you could refinance with either Morty or another cousin, and hopefully even get a lower interest rate than 10%. That all seems as easy as taking candy from a baby.

That, story on a very, very basic level is how real estate developers built all those shiny buildings and made so much money after 2009. Low and lower rates made leverage and refinancing over and over a money machine for all parties involved. Going back to our lemonade stand. There is one scenario that could throw a spanner into the works (a spanner is a wrench 😉🔧). What if after 3 years, Morty will only refinance the original loan with a 25% interest rate, because interest rates went higher. In fact, you heard from Morty’s sister Ida, that Morty borrowed the $2.50 from his local bank and paid 5% interest, netting him a cool 5%. If the Fed raised interest rates in the 3-year period, Morty would have to pay more to borrow from the bank, say, at least 15%, which is why he is now asking you for 25% interest. If you agree to those terms, you will now only make 15% on your investment. While that seems like a lot, it is not only significantly less than the original 30% yield, but it is on par with boring bank interest rates. You would not be beating the market. Ohhhh boy.

But wait, it gets worse. Let’s say that the lemonade stand’s main customers were folks who commuted every day. Most of them have switched to a 3-day workweek / hybrid commute / WFH. Because of this, the lemonade stand is making -40% less income, and because of this your friend can only pay you $0.60 return a year. Ouch, that leaves you with a LOSS! Nobody wants to lose money, so you try to sell your shares in the lemonade stand and you find out that your share is only worth $2 because the stand is getting old and sales are down. What can you do? You have no choice but to default on your loan to Morty and hand him over your share of the lemonade stand. BUT Morty doesn’t win, because he owed money to the bank and is losing money as well, so he is faced with the same dilemma as you and he defaults to the bank and turns over the shares of the lemonade stand. Now the bank is stuck with the shares in a lemonade stand, and the closest experience the bank has with lemonade stands goes back to the 1970s when they used to hand out lollipops to their customers’ kids (come on, you remember those days 😉).

In 2024, almost $1 trillion in commercial real estate loans are going to mature, and owners are going to have to call their banks and their private equity investors and have a very, very hard conversation. Some lenders may extend the loans FOR A STEEP FEE, while other lenders will have very little choice but to accept keys as property owners default. This is a very real possibility for 2024 as many loans coming due have already been extended. And the one potential savior for this would have been aggressive Fed rate cuts, which are looking more and more unlikely. Pay close attention to banks which are holding lots of CRE loans on their books. Also note how most of those banks have been selling their CRE debt to private equity investors at deep discounts. You can bet that cousin Morty and his bank will be paying very close attention to this week’s FOMC meeting.

LEMONS AND LEMONADE IN THE PREMARKET

Alphabet Inc (GOOGL/GOOG) shares are higher by +5.6% in the premarket after Bloomberg News reported that Apple is in talks to use Alphabet’s generative AI Gemini in iPhones. While this can be a win for Alphabet and iPhone users, it shows that Apple is getting aggressive to keep up with AI’s rapid growth. Potential average analyst target upside: +17.3%.

PepsiCo Inc (PEP) shares are higher by +1.76% in the premarket after Morgan Stanley raised its rating to OVERWEIGHT from EQUAL-WEIGHT. The company’s forward PE of 20.17x is cheaper than the 22.29x median forward PE of its peer group. Dividend yield: 3.07%. Potential average analyst target upside: +13.7%.

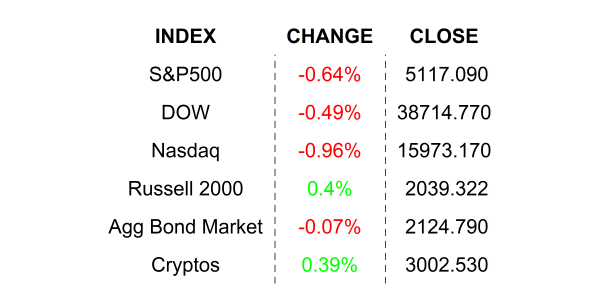

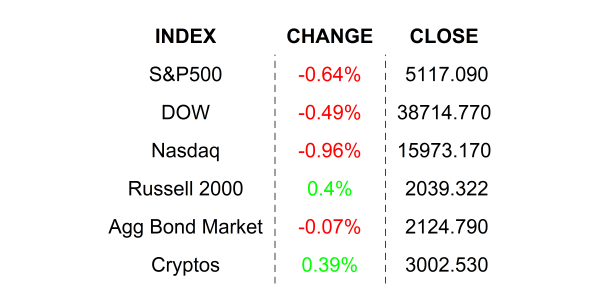

FRIDAY’S MARKETS

NEXT UP

- NAHB Housing Market Index (March) is expected to have remained flat at 48 for the month.

- Later this week: lots of housing numbers, Leading Economic Index, and the showstopper will be the Fed’s FOMC meeting which will conclude on Wednesday. Download the week’s economic calendar for times and details and don’t forget to have a look at my daily chartbook. I create it for you daily (as its name suggests) so that you can be in the know.

.png)