Stocks gained yesterday driven higher by AI-rooted tech shares. Homebuilder sentiment is building… slowly, coming in higher than expected with still a long row to hoe to get back to pre-pandemic levels.

Intelligence test. Yesterday’s market action offered us a throwback view to last year. Ugh… that weird environment where everyone is scratching their heads, afraid to be happy. “Tell me more Mark,” you exclaim. Have you seen bond yields lately? Of course, you have, you read my daily market note and I often refer to them. If you missed those, I would remind you that yields have ratchetted to the top of their recent ranges rather quickly… rather recently. The move in yields is largely due to a recent run of solid economic data and investors giving up hope that the Fed is going to aggressively cut interest rates within the first half of the year. You probably know that. Knowing that yields are at November 2023 levels, you would probably assume that stocks have sold off to 2023 levels as well. Relax, relax, that isn’t the case. In fact, the S&P500 is +12.74% higher than back on November 30th. This, despite the fact that the market has had a rate-cut reality check in the interim along with some interesting, negative earnings revelations. What gives?

Remember that the S&P500 is a capitalization weighted index. That means the biggest stocks in the index have the most influence on its direction. Do you want to know the biggest stocks to which I refer? Sure, you do, if you don’t already know. They are in order Microsoft, Apple, NVIDIA, Amazon, Meta, Alphabet A and C, Berkshire Hathaway, Eli Lilly, and Broadcom. That’s 9 companies and 10 stocks, which make up around 32.5% of the indexes weight. Of those 9 companies, only 2 are not tech-oriented, and 1 of those manufactures Mounjaro. The 1 outsider is Berkshire Hathaway… whose single biggest holding is… Apple. Are we on to something, yet?

Do I have to go through each of those stocks to show you which ones have pulled the most in recent months? I am sure that one of them is at the tip of your tongue. If you are thinking NVIDIA, well you are probably correct. We all know by now what drove NVIDIA to these levels so fast. Of course, that would be Artificial Intelligence. How about Microsoft? Yes, AI, as well. In fact, you may recall that it was Microsoft that awoke the markets early last year with its AI success. Alphabet too has had some AI wind in its sails in recent months, though it is a bit behind OpenAI’s GPT-powered Microsoft. Apple has been left flailing in the wind with no real AI solution yet and softening iPhone sales in China. Of course, NVIDIA which sells the shovels to the gold miners is making money on anything that happens in the AI world. Amazon does more than make you happy to see boxes on your front porch. They are a premier cloud computing service provider. Do you know what happens in those clouds these days? I’ll give you a hint… it is 2 words, and they start with an A and an I… oops, I gave it away. You are getting the gist of it by now. Yesterday, the AI world got a big boost, which threw it into overdrive. First, NVIDIA announced its next generation AI chip… and we were probably already pretty impressed with its current generation. But tech investors love progress, and NVIDIA’s announcement simply cemented what the markets already knew. NVIDIA is real. The most interesting news came before the market opened, and I spelled it out for you in yesterday’s WHAT’S HAPPENING section. Apple and Alphabet, both members of the top 10 S&P stocks club, are in talks which would have Apple using Alphabet’s Gen AI solution Gemini in its products. WOW, that is a huge win for both companies if it comes to fruition. Those 2 companies are long-time rivals, so if they decide to collaborate somehow in AI, it shows how critical they both feel it is to remain competitive in the space.

So, I am sure that you didn’t need me to tell you that AI is big and that it is driving the markets higher. In fairness, there are another roughly 490 stocks in the S&P500 that deserve some credit for doing the other 67.5% of the pulling. An interesting way to get an idea of that magnitude is to compare the S&P500 to its half sibling, the S&P500 Equal Weighted Index, where all stocks are treated equally. We have covered it here several times and you have probably seen it on TV or read about it. That index has gained +11.93% since last November. Indeed, it has underperformed the cap-weighted index, and we know why. It is up to you to decide if that bit of intelligence is real or artificial, or, more importantly, how long the allure of AI will last.

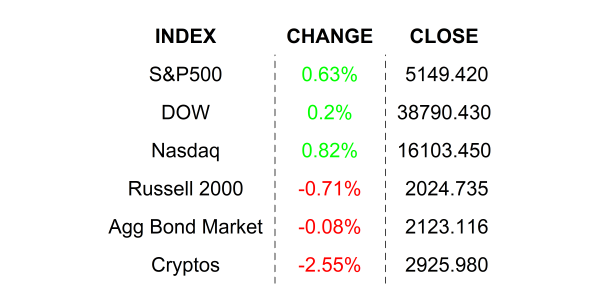

YESTERDAY’S MARKETS

NEXT UP

- Housing Starts (Feb) are expected to have gained +8.2% after declining by -14.8% in the prior month.

- Building Permits (Feb) may have advanced by +0.5% after slipping by -0.3% in January.

- The FOMC starts its 2-day confab today leaving investors on the edges of their seats. They will have to wait until tomorrow to hear the results.

.png)