Stocks found new highs with a push from the Fed and Boss Jerome Powell. Rate policy remained the same, but Powell’s unexpectedly not-hawkish demeaner won the hearts of bulls, who ignored hidden warnings.

Oh no he didn’t. No, he didn’t lower the Fed Funds Rate… but he also didn’t raise the Fed Funds Rate. You shouldn’t be surprised if you have been reading my notes even semi-regularly. Even as I slurped down espresso #1 yesterday morning, my local news station told viewers not to expect any rate cuts and then moved on to something about a rat infestation. The reality is that there is a bit of tension in the markets right now. For quite some time, futures traders have been betting that the guys and gals with their hands on the hammers and feathers would be opting for feathers, lots of feathers. The problem is that policy makers made it clear that they were not ready for the aggressive rate cutting. After months of disagreement, another hashmark was added to the highly worn page of my Wall Street Sayings Book emblazoned with the words “don’t fight the Fed!” Traders recently capitulated, bringing expectations more closely in line with the Fed’s December dot plot and forecast. With stocks at all-time highs and recently rising Treasury yields, it is clear that the markets were looking to the Fed for some direction.

That direction would come from a freshly updated dot plot and forecast. Would there be revisions? Would they be up or down? Up would be terrible, down would be great, and unchanged would simply add to the tension. So, what did we get? Take a look at the following, admittedly busy dot plot chart from Bloomberg. Then read on for the interpretation.

First things first. Turn your attention to the left-hand side of the chart. The Mustard colored dots are yesterday’s projections for yearend and the grey dots are December’s projections for yearend. The individual dots represent individual FOMC members’ projections. We take a median of the projections to get an overall projection, and you can see that the median is unchanged from December, implying 3 rate cuts of -25 basis points before yearend. That’s the big news. But there was more hidden on the side of the chart that no one BUT US NERDS look at. The “longer term” projection on the right-hand side of the chart. I circled it so you can zero in on it and notice that the median rose ever so slightly, possibly even unnoticeably. But wait, now that we are willing to look beyond 2024, we notice that the median is bumped up by +25 basis points in 2025 and 2026! Wait, how could this have occurred? Is the Fed backtracking? Is it re-pivoting to hawkishness?

Perhaps we should look at the numbers behind the dots. You know, the actual forecast release. Aha, there it is! FOMC members upped their projections for GDP growth in 2024, 2025, and 2026. Wow, that is positive, showing more confidence in a soft landing. Moving down the forecast table, we see that FOMC members upped their yearend Core PCE projections (inflation) but kept future projections level with December. This is where things get somewhat confusing. The Fed upped its growth estimates, inflation estimates, and lowered its unemployment projections for 2024 and yet it did not change its rate expectations. That can only mean that the Fed is very confident that inflation is on the way out. In other words, it is not concerned, and it plans to stick to its current rate-cutting path. That is still confusing but slightly positive. AND who doesn’t think higher GDP and lower Unemployment is great. Now onto the nerdy stuff.

The true pocket-protector-wearing, slide-rule-sliding, HP-12C-calculator-poking economists will point out that the upward revision of the longer run Funds Rate is anomalous. You see, even the ALL-KNOWING FED ECONOMISTS know that “in the long run we are all dead,” according to economics high priest John Maynard Keynes. Who could possibly know where everything will be in 2027 and beyond? If you are thinking “nobody,” you are correct. So, the smart economists over at the Fed typically pencil in what is known as r*, or r-star. That is the technical term for the Fed Funds Rate at which policy is neither restrictive nor stimulative. It’s like neutral in your car. Now, to be clear, we are deeply in Theoryland, and r-star is a hotly debated topic… in Theoryland. Yesterday’s forecast shows us that the consensus at the Fed thinks that r-star is slightly higher than it thought it was in December. Are you impressed? Do you even care? Oh, and I forgot to mention that r-star is not a constant, it can change, and it has. If you look back at all my daily notes, which I keep posted so you can keep me honest, you will find my missives on r-star being around 2% and slowly rising to 2.5%. Yesterday, the Fed proclaimed that r-star is probably around 2.6%. So why the slight increase? That could only mean that the Fed is expecting the economy to be healthy going forward, which means keeping to its +2% inflation target will be more challenging than in the past, however it still expects inflation to be on target… according to the same forecast.

How did the market interpret this? Well, stocks agreed and interpreted it as being positive… or, not negative, with the Fed’s hopes for a soft landing increasing. Stocks rallied. Short-maturity Treasury Note yields declined now that the Fed restated its rate cutting path for 2024, though traders ignored 2025 and 2026 projections. Longer-maturity yields declined only slightly because the message received was the potential for higher long-term inflation, and long-term bond investors need more yield to compensate for higher inflation. So, the yield curve shifted lower, and it steepened. This morning, the interpretations are all in the “goldilocks” theory camp. Economy will be healthier than previously thought, rates are still on track to move down by ¾ of a point by yearend. All that stuff about r-star and the long run is cool, but, as we are all dead in the long run, traders are opting for the YOLO trade and mashing down on the buy button.

WHAT’S HAPPENING IN THE PREMARKET

Micron Technology Inc (MU) shares are higher by +16.74% after it announced that it beat EPS and Revenue estimates last quarter. The company gave guidance for the current quarter that far exceeded analysts’ estimates. In the past month, 24 analysts have upped their targets while none have lowered them. Dividend yield: 0.47%. Potential average analyst target upside: +30.6%.

Darden Restaurants Inc (DRI) shares are lower by -6.69% after it announced that it missed EPS and Revenue estimates. The company cut its full-year same store revenue growth estimates to below analysts’ estimates. Of the analysts that cover the company, 65.5% rate it a BUY, 31.0% rate it a HOLD, and the remaining 3.4% rate it a SELL. Dividend yield: 3.00%. Potential average analyst target upside: +3.2%.

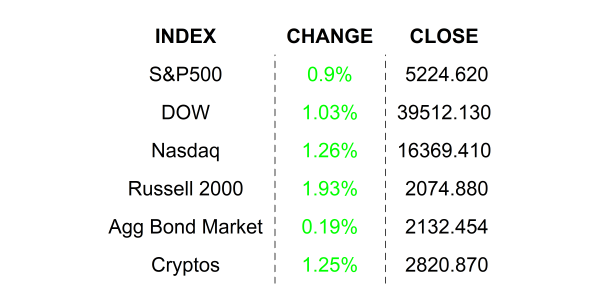

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (March) is expected to come in at 213k, slightly higher than last week’s 209k claims.

- S&P Global Flash Manufacturing PMI (March) is expected to have slipped to 51.8 from 52.2, while the Services index may have slipped to 52.0 from 52.3.

- Leading Economic Index (Feb) is expected to have declined by -0.1% after falling by -0.4% in January.

- Existing Home Sales (Feb) probably fell by -1.3% after climbing +3.1% in the prior period.

- NIKE and FedEx are expected to announce earnings after the closing bell.

.png)