Stocks closed out the quarter on a high note last Thursday after a quarter filled with reality checks on rates and surprise gifts from the strong US economy. Inflation cooled last month according to a Good Friday inflation number, delivered while markets rested.

Done and dusted: Q1. If you weren’t around for last Thursday’s market close, you might have missed the collective e x h a l e by traders as quarter 1 slipped passed the finish line. Coming into 2024 there were no guarantees. Markets were overworked but pumped. The economy was looking strong but there was still doubt about corporate health. Geopolitical turmoil continued to burn below the surface. Finally, the markets and the Fed were in a pitch battle over where interest rates would end up in 2024. Weird, considering that it is the Fed which makes that decision, but heck, you can’t get if you don’t ask. In any case, it was clear as the calendar turned, that one of the two opponents was going to have to tap out of that conflict. What was also clear was that there could only be 1 winner, and if it was the Fed, the market was likely to be stuck with the butcher’s bill. We managed to pull off a greater-than-average year in the S&P500 which clocked in a +24.23% gain.

So, in the blink of an eye, here we are at the end of quarter 1… well, technically at the beginning of quarter 2, this morning at least. The S&P500 turned in a solid +11.24% gain. Geopolitics continues to burn like a dangerous dumpster fire threatening to rage out of control. The economy delivered a solid quarter of numbers with inflation remaining somewhat stalled just north of the Fed’s target, thanks to high rents. Blue-chip economists lowered expectations of a recession, and we learned a week before the quarter end that the Fed’s powerful economists upped their expectations for economic growth this year.

Oh, and in that grappling match between traders and the Fed, it was the traders who ultimately tapped out, relenting to the reality that we may only be treated to 3 interest rate cuts this year… if we are lucky. The Fed’s messaging has been clear that it is in no rush to lower rates, as long as the economy continues to post positive results. The good news in all that is that the equity markets remained positive even as expectations changed on interest rates. Perhaps it was helped along by the positive news from the broader economy, but in reality, Artificial Intelligence, or rather the prospects of AI, did quite a bit of heavy lifting.

Technology-driven sectors topped the leaderboard of the quarter with communication services delivering +15.82% and information technology yielding +12.69%. Consumer discretionary and utilities took the bottom 2 slots returning +4.98% and +4.57% respectively. Scratching one layer below that surface was the semiconductor industry group, returning a solid +39.46%; it is part of the information technology sector. That industry group is necessary for just about everything that requires electricity, but specifically… um, artificial intelligence.

So, what will dominate Q2? Now that the Fed has proven that only it can decide where interest rates will be, the market is likely to be more focused on FOMC meetings. We have one in May and one in June, with little hope of any cuts until June. In between we have lots of FOMC member talk to keep the markets in check. I am sorry to have to bring this up, but it is also an election year, and the rhetoric will start to intensify this quarter which has the possibility of spilling over into the markets.

On the corporate front, all eyes will be on the banks, wondering if the massive amount of real estate debt coming due this year will cause more failures. Will tech continue to post good enough results to keep the AI narrative going? That will be on every trader’s mind throughout the quarter. We are also likely to see more up-and-comers come to the equity markets with IPOs in the wake of Reddit’s recent successful debut combined with market strength.

Finally, we cannot ignore the importance of all the economic releases in the months ahead. Lots of focus will continue to be placed on inflation figures and employment numbers, because those are the ones that drive the Fed. Leading indicators like consumer confidence and purchasing managers indexes will give us clues on the current health of the economy. All in all, both the equity and fixed income markets are both starting the quarter on their front feet, but the climb is still quite steep… and the journey far from over.

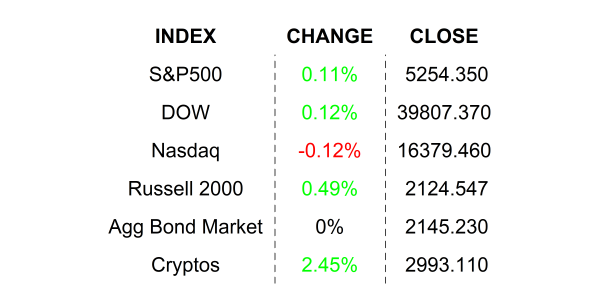

THURSDAY’S MARKETS

NEXT UP

- Construction Spending (Feb) is expected to have climbed by +0.7% after slipping by -0.2% in January.

- ISM Manufacturing (March) may have increased to 48.4 from 47.8.

- Coming up: JOLTS Job Openings, Factory Orders, Durable Goods Orders, and the monthly employment situation. Download the attached economic calendar for times and details.

- Fed Governor Lisa Cook will speak today.

.png)