Stocks slipped yesterday as bond traders cried “is the 10-year yield an April fool’s joke or something” – it was no joke. Manufacturing had a good month and spooked investors into believing that the Fed will never, ever cut rates again… ever 🥵.

One thing leads to another. If you watched MTV in the 80s and you are now humming that 1982 song 🎶 by the Fixx, great, because the 80s were awesome… at least I remember them as being so. BUT that is not the point of this morning’s market note – I digressed. I watched a lot of my colleagues show up to the office yesterday and shoot an aghast look as they took their coats off and glanced at the screens across the trading floor. They were expecting markets to be higher. As they turned on their computer screens the confusion began to build when they spotted 10-year Treasury Note yields near recent highs around 4.31%… when they were at least -10 basis points lower just last week and appeared to be heading to 4.00%. No one said it, but they were all thinking “that’s not supposed to happen on a Monday morning after a holiday with no real economic releases.” But alas, it did. Here is what happened.

The Institute for Supply Management released its monthly ISM Manufacturing PMI. “PMI” stands for Purchasing Managers Index. My regular readers know that I love PMIs because they represent the opinions of the folks who have boots on the ground. You know, the guys and gals responsible for purchasing raw materials, shipping products, hiring and firing… the real guts of business. Absent are the thick-specs-donning, academic economists, replaced by jeans and sneakers wearing folks who make things go. Do you want to know what those good folks thought last month? Just look at this chart and keep reading.

Indeed, as you will note from the chart, ISM Manufacturing popped above 50 for the first time since 2022. In PMIs, readings above 50 represent expansion, while numbers below characterize contraction. So, the message is: manufacturing is back. Ok, can we get breakfast now? Sorry, not quite.

You see, it was a long weekend for Wall Street as markets were closed on Friday for… Good Friday. That gave traders a chance to collect their thoughts about the past quarter which also happened to end over the weekend. The smarter ones sharpened their pencils, caught up on reading THIS NOTE, and hopefully, spent time with loved ones. Others probably fell for the oldest trick in the Wall Street book. They looked at their performance in Q1 and multiplied it by 4 to project the great returns they now expected to make for the year and they ordered a round of drinks for the whole bar room. Pro-tip: that is dangerous math… don’t do that!

Imagine finding out that manufacturing had a good month in March after hearing a month’s-worth of anti-rate-cutting rhetoric from the Fed, after logging a better-than-hoped-for quarter in stocks. What is the first thing that comes to mind? No foul language please, I like to keep this PG-rated. Take a look at this chart and keep reading.

There you go. On this chart, you can see that, based on Fed Funds futures, the probability of a -25 basis-point rate cut in June went from 57%, where it was last Thursday, to below 50% yesterday morning. On Wall Street, less than 50% means “ain’t gonna’ happen, bro!”

Now, if I wanted to make your life miserable, I would post 2 more charts, but I respect your patience with me, so I will just say that the other 2 charts I want you to know about are as follows. First, there is an intraday chart of 10-year Note yields that shows them spike nearly +12 basis points in response to the release. And second, a chart that you probably were actually looking at yesterday morning that showed stock index futures tank before the open. At that point, you might have changed the channel on your TV or switched over to your Instagram app to look at cute puppy pictures.

If you did, it was probably the right thing to do, because ultimately the situation improved somewhat throughout the session. Yesterday’s news was nothing really… um, new. Last Friday, while markets were closed, the PCE Deflator came out with expected, unremarkable results on inflation. Manufacturing has indeed been on the mend, and as you can see by the first, colorful chart, has done better in the past… even when markets were going higher. Traders came around to remember that a healthy manufacturing economy is good, and that yesterday’s number very likely didn’t even budge the needle for the Fed’s rate cutting plan for this year. The Fed is in no rush to cut rates. Got it? Now can we get back to focusing on companies and their prospects for earnings going forward?

WHAT ABOUT THIS MORNING?

Humana Inc (HUM)shares are lower by -9.55% in the premarket in response to Centers for Medicare and Medicaid (CMS) announcing a lower than expected increase in payments to Medicare advantage plans. The announcement impacted other providers as well, including CVS Healthcare, UnitedHealth, and Elevance Health all down, and topping the S&P500’s premarket losers. Dividend yield: 1.00%. Potential average analyst target upside: +16.4%.

The Estee Lauder Cos Inc (EL) shares are higher by +2.22% in the premarket after Citi lifted its rating to BUY from HOLD and raised its price target citing improving topline growth. The company’s 67.6x forward PE is greater than the 21.89x PE of its peers. Dividend yield: 1.73%. Potential average analyst target upside: +5.4%.

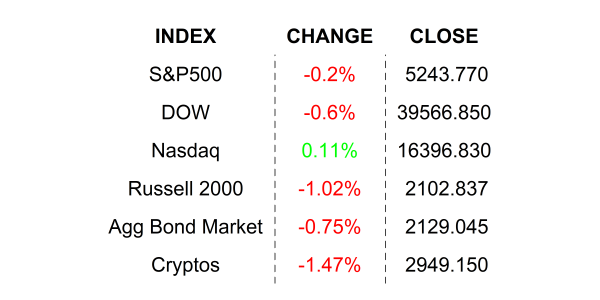

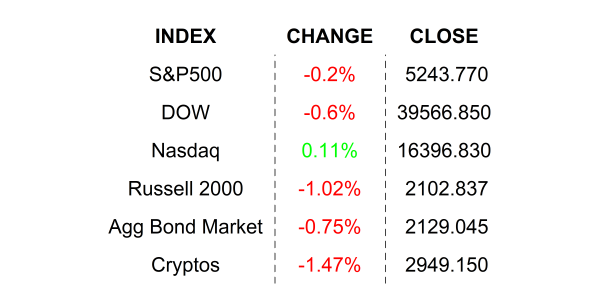

YESTERDAY’S MARKETS

NEXT UP

- JOLTS Job Openings (Feb) probably declined to 8.73 million from 8.863 million vacancies from a month earlier.

- Factory Orders (Feb) are expected to have gained +1.0 after slipping by -3.6% in January.

- Fed speakers today: Bowman, Williams, Mester, and Daly.

.png)