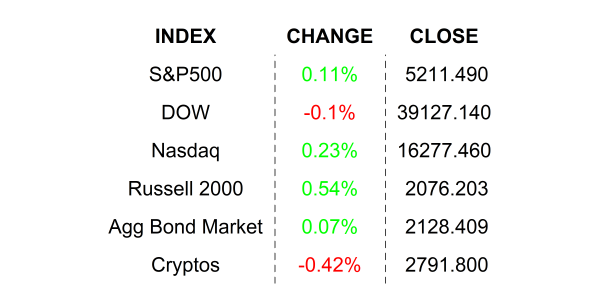

Stocks gained yesterday, helped along by market-friendly comments by Fed Chair Jay Powell. ISM Services Index unexpectedly slipped in March with its Prices Paid sub-index posting a notable decline.

On the bias. Academics recognize that bias exists everywhere. I was actually speaking with two esteemed academics just last night, and both of them, more than a few times, invoked a bias disclaimer. The conversation we were having was centered on management decision bias. For example, if a CEO feels personally passionate about the environment, he or she may push for larger ESG investments, despite their having negative implications on the company’s financial performance. That kind of bias. Are you biased? Of course, you are, we all have a private agenda. Hopefully, your private agenda serves the greater good of society… or at least doesn’t take away from the greater good.

Ok, before I spiral too far into the obscure, I will get to the point. Did you ever wonder if the Fed’s FOMC members have private political agendas? Remember, these FOMC members are at the controls of the US economy. They are solely in charge of the mechanism that makes pain or pleasure in your retirement portfolio. Go on, read that again 🔁. That’s right, they can all vote to lower interest rates to 0% next month if they wanted to. The Fed Chair reports to… no one when it comes to policy decisions, so what’s to stop him from guiding his FOMC to raise or lower interest rates to gag or goose the US economy to either make the current administration look bad or look good?

It is well established that presiding economic conditions influence elections. You can search around the Web for FOMC members’ political affiliations if you like. We know that Jerome Powell is a Republican and was nominated by President Trump. So, is it possible that Powell may opt for stricter monetary policy to squelch any economic gains for President Biden?

This is obviously a highly charged question. There are piles of academic papers on the topic and if you do search the Web, you will find that it is a highly polarized topic with competing political thinktanks publishing papers in support of their political agendas. I did come across one paper that analyzed all the declared political affiliations of Fed economists that showed an overwhelming high ratio of democrat:republican. So, I go back to the burning question, is it possible that these economists would allow bias to enter their forecasts in order to influence the FOMC members who vote on policy with the ultimate goal of getting a democratic president re-elected?

This question is, of course, elevated at the moment because not only are we in an election year, but also the US economy is at a critical inflection point. That means the next few moves by the Fed can determine if the economy rockets forward or stalls into a recession. While the Fed has solidly pivoted at this point, it has only done so in spirit. It has not yet sealed the deal with dovish rate cuts, and there is a chance that we can get 2 cuts leading up to November’s election. Talk about timing.

Have I gotten you all nervous yet? Don’t be, I am here to assure you that the Fed is politically independent. I want to remind you that Powell has a long history of publicly ignoring the jabs of the guy who nominated him, often reminding him that the Fed is independent. So much so that President Trump has already announced that if he is re-elected, he would replace Powell, a fellow republican, whom he nominated to the position. Why am I so confident that political bias will not impact rates? Because most of the folks at the Fed come from academia, where academic integrity is of paramount importance. Do they have private agendas? Of course, they do. Does bias exist? Every one of them, just like my friends from last night, is well-aware of bias, which makes them less likely to make decisions based on it. If you listened to Chairman Powell’s speech yesterday, you would have noticed that he paid a significant amount of attention to highlighting the Fed’s independence. That was him signaling to the public that whatever the Fed does in the month’s leading up to elections will be data dependent… without bias.

WHAT’S POLARIZED IN THIS MORNING’S PREMARKET

Conagra Brands Inc (CAG) shares are higher by +6.16% after it announced that it beat EPS and Revenue estimates last quarter. The company also reaffirmed its full-year guidance, which is on the higher side of analysts’ expectations. Conagra’s forward EPS of 11.16x is lower than the 17.07x EPS of its peers. Dividend yield: 4.81%. Potential average analyst target upside: +2.3%.

Cryptos are higher early this morning with biggest gains in Binance Coin and Bitcoin Cash.

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (March 30) is expected to come in at 214k, up slightly from last week’s 210k claims.

- Today’s Fed speakers: Harker, Barkin, Goolsbee, Mester, Kashkari, Musalem, and Kugler.

.png)