Stocks got hammered yesterday late in the session, shredding earlier gains, teamed up on by Fed talk and middle east tough talk. Traders were on edge looking for excuses to unload stocks ahead of today’s big employment number.

WHILE YOU SLEPT! My regular readers know that this is one of my favorite lines. It has so many meanings to me, and I use it in so many different places. It is true that I start my writing process every morning at 04:00 Wall Street time. It is also true that I spend most nights between 20:00 and 23:00 in my office working. Presumably, those are the times when most normal people are sleeping, exercising, nodding off on the couch with family, etc. The markets are technically open from 09:30 through 16:00, but clearly the world of finance does not get much rest, save for maybe happy hour in New York, Tokyo, or London. Wait, wait, don’t get yourself all up in a tizzy. You keep doing what you are doing and stop worrying – you have me! I can’t possibly catch everything, but I can assure you that if you read this note somewhat regularly, you will have a really good clue about what is happening in the world of your portfolio.

It’s Friday, and I try… TRY to keep it light on Friday, but yesterday’s market action requires a bit of attention… sorry. One simply cannot avoid addressing the stock market’s weakness over the past several sessions. So, what happened WHILE WE SLEPT? In this case, I use the statement to refer to the fact that most people were just not paying attention to the market this week as it is a vacation week for kids and grandkids, and we are all still riding high after last quarter’s superlative market performance. After a few days of tension in the market, yesterdays AM session seemed to produce the tonic needed for salvation. Finally, a strong morning. But it was not meant to be. At some point during the day Neel Kashkari, Minneapolis Fed President, who was part of a packed procession of Fed speakers, uttered the UNTHINKABLE. He said that there was a possibility of NO FED RATE CUTS THIS YEAR. Can you imagine? Of course, you can, and it makes the hairs on the back of your neck stick up 😨.

First of all, thanks Neel! We know you are a super-hawk and that you have a flair for drama. We also know, based on last month’s infamous dot plot, that at least 2 FOMC members expect the same. Thanks for revealing the fact that you are 1 of the 2; we are not surprised. Are we impressed? Well, we shouldn’t be, because 17 other FOMC members think that rates will be lower by the end of the year. In fact, the median expectation is ¾ of point lower, or 3 cuts, put another way. Oh, and Neel, we need to mention that your opinion in this case doesn’t matter because you are not a voting member this time round. So… no we are not impressed. But something spooked the markets yesterday, and though Neel may have been the initial catalyst, there was something else.

Remember crude oil? Do you remember how it spiked in early 2022 after Russia invaded Ukraine sending fuel prices on a rocket ride that landed right in your wallet as prices at the pump exploded upward? That was credited as one of the straws that broke the inflation camel’s back. With inflation now on the ebb, we are all full up on Crude talk and more focused on what AI can do for our 401k and when Neel Kashkari might relent on rate cuts. So, in essence, when it comes to crude oil prices, YOU WERE PROBABLY SLEEPING. Check out this chart. Just humor me and look at it closely for 20 seconds then follow me to the close.

I know it’s kind of a busy chart for a Friday, but it tells an important story. Since the start of the year, crude oil future prices are up by +22%! That’s right. They were climbing slowly under your radar and in the past few days as tensions between Israel and Iran escalated, crude prices ratcheted higher to JUST BELOW 2022’s highs. The recent climb was due to lower supply and higher demand helped along by frictions in Red Sea shipping, among other things. You see, crude oil prices are still important, and we know that sharp rises can find their way into broader inflation figures. Not exactly news we want to hear when markets are already on edge about rate cuts and in the midst of media-grabbing sound bites by some hawk from Minneapolis. I guess it’s time to wake up ☕☕😃.

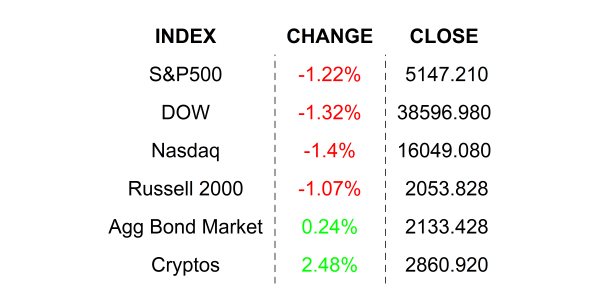

YESTERDAY’S MARKETS

NEXT UP

- Change in Nonfarm Payrolls (March) is expected to show that +214k new jobs were created, lower than February’s +275k new hires.

- Unemployment rate (March) may have slipped to 3.8% from the prior month’s 3.9%.

- Fed speakers today: Collins, Barkin, Logan, and Bowman. They may be boring, but as we learned yesterday, they can move markets, so be on the lookout for soundbites.

- Next week we get Consumer Price Index / CPI, Producer Price Index / PPI, FOMC Meeting Minutes, and University of Michigan Sentiment. That should be enough to keep you awake, so check in on Monday for calendars and details.

.png)