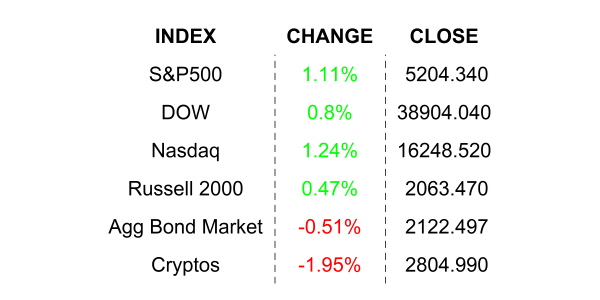

Stocks rallied on Friday as investors decided that a good economy is good for… everyone. Payrolls topped analyst expectations and the unemployment rate dipped.

A divine sign. Have you been to New York’s Metropolitan Museum of Art? It has been around since the 1870s. It sits prominently on 5th Avenue and its rear is nestled right in beautiful Central Park. Just passing it and taking in the building’s interesting façade and sheer size would, in of itself, arouse the senses. If you were one of the 6 million or so visitors to the museum last year, you might have browsed its complete Egyptian temple or one of the other 2 million pieces of art housed under its roof… er, roofs. Even non art fans can find something of interest in the sprawling New York City icon. One of my favorites is a 1498 woodcut print by Albrecht Dürer called The Four Horsemen, from “The Apocalypse”, or as I learned it in my youth Die apokaliptischen Reiter. You don’t need to be a biblical scholar to understand the content. You can quite literally stare at the small print for hours appreciating the detail of the print and its warning message.

Whether you buy into the message or not, you couldn’t help but wonder if New York was in receipt of a similar divine message on Friday as a rare earthquake shook the city and surrounding area. That alone should have piqued the interest of the paranoid (most New Yorkers are naturally paranoid anyway 😉). Today, New York will be treated to a once-in-a-century solar eclipse. That’s right, Wall Street will be in almost total darkness right before the market closes this afternoon 🌕☀️.

First an earthquake, now an eclipse? What else can happen? On Friday, the Bureau of Labor Statistics released its monthly job report for March, the number of newly created jobs came in significantly higher than even the most bullish analyst was expecting. When I saw the number cross the tape, I thought that it could be a sign that great pain was coming to stocks. According to the infamous Phillips Curve, which I have covered many times as being a playbook favorite of the Fed, labor market strength leads to inflation. That means the Fed should dislike a strong signal from the labor market… WAIT JUST A MINUTE. Isn’t 50% of the Fed’s dual mandate to ensure a strong labor market. So, would Friday’s release leave the Fed happy or unhappy?

Perhaps, the question should be, “did Friday’s release leave the stock market happy or unhappy?” Well, we already have that answer, and it is “happy.” A strong labor market means that the economy is strong, more importantly, that companies are healthy and expecting upside. Last Wednesday I tortured you with math in order to explain why your favorite stocks get beat up when Treasury yields rise ( https://www.siebert.com/blog/2024/04/03/did-you-pay-attention-in-arithmetic-class/ ). I gave that lecture, partially tongue-in-cheek, because while I certainly subscribe to the math, I believe that traders are sometimes a bit too sensitive to it… the theoretical value of a stock, that is. But let’s assume that you are a true believer in the math. A strong sign from the labor market means that companies are expecting great growth in the future. So, based on the math, even if rates stay unchanged but growth (g in my equation) goes up… well, so does the theoretical, intrinsic value of stock.

So, while floods, pandemics, earthquakes, and eclipses may send eerie signs to some believers, the market, on Friday at least, took the labor market print as a sign that things are going to be good for stocks. Or maybe, traders were too busy talking about the earthquake to panic about the Fed’s delayed rate cutting. Or maybe someone looked at the NPV equation and thought, it’s just math, stupid.

DIVINE SIGNS IN THE PREMARKET

Ulta Beauty Inc (ULTA) shares are higher by +2.05% in the premarket after Loop Capital’s Anthony Chukumba raised the company’s rating to a BUY from a HOLD citing overdone selling in the wake of the company lowering its current quarter guidance last week. In the past 30 days, 15 analysts have raised their price targets while 3 lowered them. Potential average analyst target upside: +27.8%.

The Kroger Company (KR) shares are lower by -1.33% in the premarket after BNP Paribas Exane downgraded the stock to UNDERPERFORM citing challenging conditions for US grocers in coming quarters. 34.8% of analysts who cover the stock rate it the equivalent of a BUY, while the majority of them (52.2%) rate it a HOLD. Dividend yield: 2.02%. Potential average analyst target upside: +1.6%.

FRIDAY’S MARKETS

NEXT UP

- No economic releases today, but later this week we will get Consumer Price Index / CPI, Producer Price Index / PPI, FOMC Meeting Minutes, University of Michigan Sentiment, and the start of earnings season. Download the attached earnings and economic calendars for details.

- Fed speakers today Goolsbee and Kashkari.

.png)