Stocks danced around in yesterday’s session, ultimately closing slightly positive amidst no real news. Today will indeed bring some real news to feed hungry markets.

What is really important? If you a regular reader and you just skim through my daily notes… just skim… you would get the theme of my messages which would be 1: Interest rates are important, BUT 2: stock traders are overly sensitive to them, 3: the Fed is in no rush to appease sensitive stock traders, and 4: the Fed will lower rates this year, so CHILL OUT. DO 5: pay lots of attention to the health of the companies that you are invested in, and 6: pay close attention to the economic numbers, especially the ones that are current and forward looking. That’s it. Have a nice day 😊.

Just kidding, you know I would not let you off that easy, but those are 6 important points to consider before getting yourself all worked up and grab for the Alka Seltzer if you are old school, or Brioschi, if you are really old school. This week, though it may not appear so on the surface, touches on most of those 6 points above. Today, we will get to read the minutes from the last FOMC meeting. Traders are champing on the bit to get a glimpse into any info that would hint at the Fed’s timing on rate cuts – expect volatility. This morning, we will get Consumer Price Index / CPI, which will give us a read of consumer inflation in March. I know that it is somewhat backward looking, but it is the best we have short of your own assessment at your local grocery store. CPI will give us a mixed bag, but what economists will look at most closely are the monthly and annual core numbers which remove energy and food costs (which is silly, but it is what it is). Those numbers are expected to have moderated slightly. Any large deviations from those will cause volatility.

So, if you are guilty of ignoring points 2 and 3, and you don’t agree with point 4, today will be your day to be caught up in all sorts of messy theories. Now, I want to be clear that if we really, really learn something new and altogether different from today’s numbers, it would be prudent to re-check your investment thesis. But, once again, only if we learn something NEW.

Tomorrow, we will get Producer Price Index / PPI, which would give us a little bit more to chew on. You see, PPI has more potential to predict the future as it tracks costs to producers and retailers. So, if you believe that companies are rational (I do), then it is correct to assume that if their costs are going up, prices to you and me will not be going down in the future. That would fall under point 6. Another great point 6 release will come out this Friday when University of Michigan releases its sentiment number for April. Yes, this month! It is based on surveys of real people, and they do a preliminary survey and final survey each month. They also break down information on the timing of sentiment and inflation expectations. Don’t miss that one.

Finally, on Friday, we can dive into point 5 as quarterly earnings season begins in earnest with the big financials. Now pay attention. I am not saying that whether rate cuts happen in June or September will not impact JPMorgan Chase, but I would strongly encourage you to pay closer attention to the company’s earnings announcement, particularly the commentary and any future guidance. Point 5! The next several weeks will be packed full of items from points 5 and 6. There will also be much conjecture around point 2 and 3 as well. Just please remember that long-term investing success IS dependent on a strong economy and strong corporate performance ABOVE ALL. Do you get my point… er, points?

WHAT’S HAPPENING BEFORE THE BELL

Albemarle Corp (ALB) shares are higher by +2.01% after BofA raised the lithium provider to a BUY on hopes of chemical price stabilization and demand. The company’s forward PE of 32.42x is higher than the 16.73 PE of its peer group. Dividend yield: 1.32%. Potential average analyst target upside potential: +15.9%.

Delta Air Lines Inc (DAL) shares are higher by +3.95% in the premarket after it announced that it beat EPS and Revenue estimates by +23.71% and +0.47% respectively. The company raised its current quarter guidance above analysts’ expectations and stated that strong demand is expected to continue, and that growth is normalizing. In the past 30 days, 8 analysts have increased their price targets while none have lowered them. Dividend yield: 0.84%. Potential average analyst target upside potential: +15.7%.

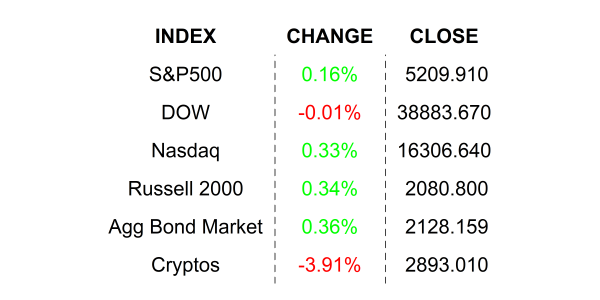

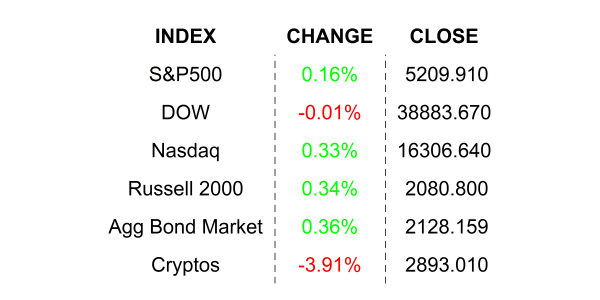

YESTERDAY’S MARKETS

NEXT UP

- Consumer Price Index / CPI Excluding Food and Energy (March) may have moderated to +3.7% from +3.8%.

- The Fed will release minutes from its March 20th FOMC meeting this afternoon at 14:00 Wall Street Time. Everyone wants to know when the Central Bank is going to cut interest rates and the minutes may provide some clues.

- Fed Governor Michelle Boman and Chicago Fed President Austan Goolsbee will speak today.

.png)