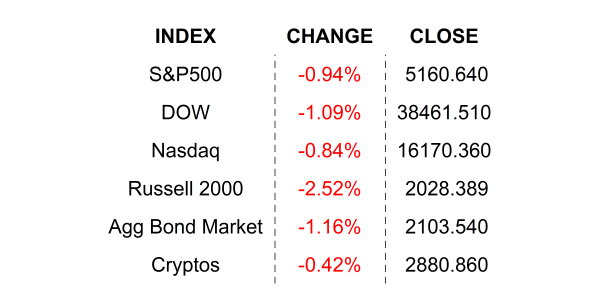

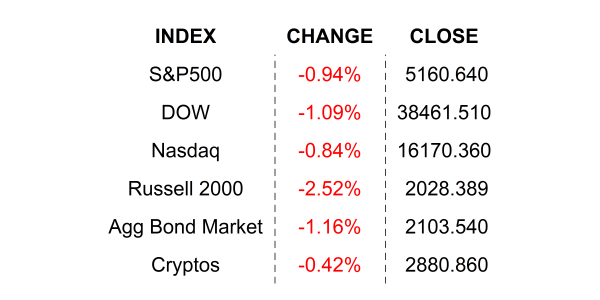

Stocks were trounced yesterday as traders unloaded stocks in response to a hotter-than-expected inflation figure. Fed minutes suggest that all members are in agreement that rates needed to be cut this year – just how much and when is still a big mystery.

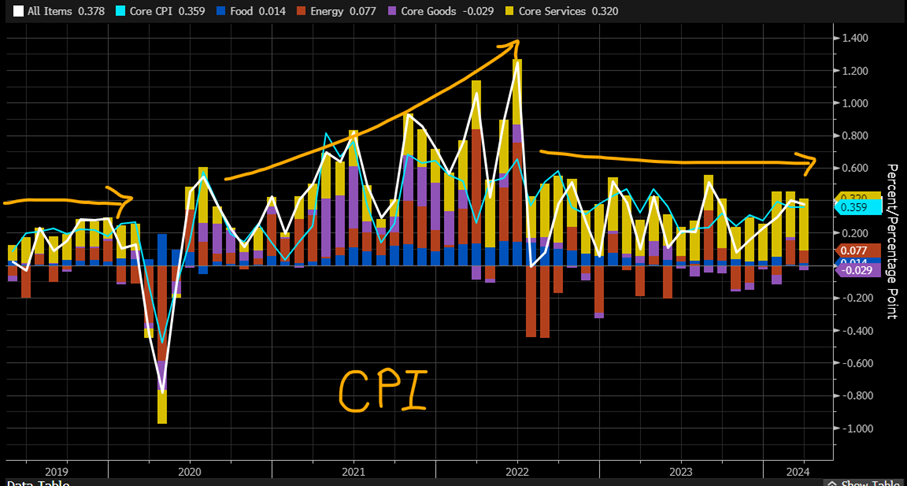

Reality check. Was yesterday’s inflation number and subsequent market reaction a reality check for bulls? Let’s get some actual intel on this matter. Here is the headline. Topline Consumer Price Index / CPI rose by +0.4% in March for a second straight month. Economists were expecting a +0.3%. If you look at the index on an annual basis it came in at +3.5% when economists were expecting +3.4%. That only really means we still have a way to go to get to the Fed’s +2.0% target. Take a look at the following chart. Don’t get too deep into it; I am interested in your getting a high-level visual impression.

Got it? Good, now let’s delve in. What I wanted you to notice was how aggressively inflation picked up in 2021 and for the first half of 2022, and how it abruptly dropped by the end of 2022. So far, so good. The clear problem is the part of the chart after the decline. You can see that the monthly trend is pretty much sideways. The Fed, as you might suspect, would like to see that trending down and ultimately match the magnitude of the bars in 2019. That clearly has not happened, but I do want you to notice that it is a) not very far off, and b) slightly more volatile than it was back in 2019, but c) in general, the monthly numbers are ALWAYS volatile, so if you are trying to get an idea of a trend you have to look at it at a very high level, akin to my roughly drawn orange arrows. Looking at those alone, you would probably not panic about inflation and understand that while we are not back to “normal” yet, whatever normal even is (inflation ran at +3% on average for the better part of the past 100 years, 2% is kind of a new-ish thing), we are probably out of the unarguably bad place we were in during 2021 and 2022.

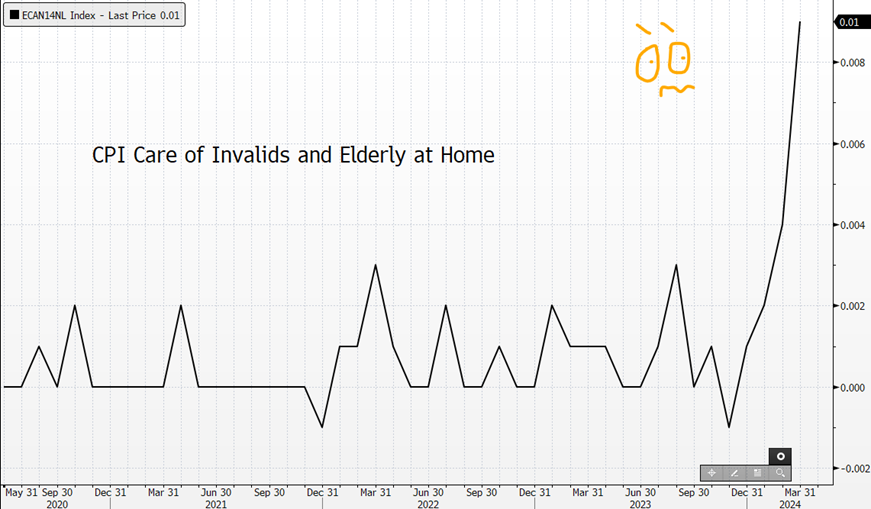

Now, let’s scratch one layer below the surface and find the culprit for this “unthinkable” (I say that tongue-in-cheek) print. Food inflation is under control, Energy inflation was lower for the month, Goods (the STUFF we buy) dis-inflated, and Services… AHHH service, inflated more than the prior month. Are you surprised? This seems like a bad broken record, doesn’t it? Let’s see which subgroup was responsible. Shelter was hot BUT less hot than in February, so it wasn’t the usual suspect shelter. It turns out that the perpetrator was Medical Care Services which grew significantly more than in the prior month. One level further down reveals Hospital and Related Services as the biggest gainer. We have come so far, may as well keep going. Ah, there it is. The category of Care Of Invalids and Elderly At Home gets the hot print award. See the chart at the end of the section.

Now, I am not sure what is going on in that category. I know that it is a big problem for many folks, but I am not convinced that the Fed is ready to make rate decisions based on a hot print in Care Of Invalids and Elderly At Home. I am sure that markets can’t always only go up and that an occasional correction is healthy. You can use any excuse you like for the pullback, but please, please make sure you get all your facts right.

WHAT’S HOT OR NOT THIS MORNING

CarMax Inc (KMX) shares are lower by -7.57% in the premarket after the company missed both EPS and Revenue estimates last quarter. In the past month 5 analysts raised their price targets while none have lowered them. Potential average analyst target upside: +10.1%.

Constellation Brands Inc (STZ)shares are higher by +1.93% after the company announced that it beat EPS and Revenue estimates last quarter. The company provided full-year guidance that exceeded analysts’ expectations. Dividend yield: 1.34%. Potential average analyst target upside: +12.1%.

YESTERDAY’S MARKETS

NEXT UP

- Producer Price Index / PPI (March) is expected to have gained +0.3% for the month, lower than the February’s +0.6% advance.

- Initial Jobless Claims (April 6) is expected to come in 215k, slightly lower than last week’s 221k claims.

- Fed speakers today: Williams, Barkin, Collins, and Bostic.

.png)