Stocks closed in the green after spending the morning under water as Producer Price Index figures offered some positive news on the inflation front. Central bankers cannot ignore the recent spate of strong inflation and economic numbers, but they know the path forward requires… looking forward.

Eyes on the road ahead. Do you remember your first driving lesson? I remember mine. I am pretty sure that my father would have listed that as one of his crowning life achievements, as it likely took every cell in his body to remain patient with me as I drove up the curve multiple times, knocked over garbage cans, and even lost my temper with my father’s constant “guidance”. Thankfully, all of this took place in front of my house and my mother was able to rush down from the stoop and throw in the towel at a point where I was surely about to receive capital punishment for my foul language. It got better after that inaugural event, and I still remember some of the important lessons learned. The most important one is keeping your eyes on the road… that is, the road in front of you… especially when the car is in drive.

I talk a lot about economic releases. I post them in the WHAT’S NEXT section every morning, I attach calendars every Monday, and I even highlight the ones you should watch. My regular readers know that all numbers are not created equal. While all are important, most of them are backward looking, while others are forward looking. Clearly, we should place more import on the forward-looking ones. When making an investment decision, wouldn’t you want to know how well the economy will be doing in the future versus what it was doing last year? Of course, you would. When we invest in a stock, we are investing in all of its potential, in perpetuity. Perpetuity is an extreme form of the future… as in, forever… and ever. Sure, a stock’s past record is important, but it is the future that will make or break our portfolio returns.

In recent weeks we have been treated to a number of economic figures which came in higher than expected. Notably, employment figures were strong for last month. Under normal circumstances, strong employment would be unequivocally labeled as “good” for the economy. But our fascination with the exact date of rate cuts throws the strong showing into ambiguity. Will a strong labor market lead to higher demand for goods and services leading to higher inflation and the Fed’s abandoning its dovish mood? A few days ago, the Consumer Price Index / CPI came in higher than expected. In that case, higher is never a good thing. That release gave the bears a rare chance to come out of their caves and maul the markets. But what does the CPI for last month really mean for the economy and your stocks? If you read my note from yesterday, you should have come away with a “that’s what everyone is worried about???” kind of feeling. Yesterday’s Producer Price Index / PPI came in lower than economists’ estimates. Even though it was based on last month’s numbers, it is considered a leading inflation indicator because producer and retailer costs ultimately impact what consumers end up paying. Immediately after the release investors shrugged off the positive news. Later in the day, it finally sunk in that the PPI news was good and that the prior days’ selling was probably an opportunity to buy the dip.

The Fed has a tough job. It has to make policy decisions for events that may or may not happen in 6 to 18 months from now. Sure, they are “experts” at forecasting and prediction, but if you look at their track record, you would probably be pretty shocked at how poor it was, especially in longer run projections… you know, the important ones. Anyway, suffice it to say that FOMC members surely cannot ignore sticky inflation and the strong labor market, but they know that the longer that rates remain restrictive (as they are today), the more likely the economy will stall, and at that point, even sending rates to 0% won’t stop the economy from contracting. So, they have to be impractically forward-looking, meaning they may still cut rates amidst hotter inflation numbers in anticipation of what might be later this year and next.

As I put the final touches on this note, several of the big banks have already hit the tape with their earnings, officially kicking off earnings season. As I do every quarter, I am going to remind you not to forget to focus on future guidance, because that is what will really determine what a stock is worth. Think about driving down your street looking out the back window of your car only. Scary thought isn’t it. Hands at 11 o’clock and 2 o’clock, seatbelts buckled… EYES STRAIGHT FORWARD.

WHAT’S CAUGHT IN TRAFFIC IN THE PREMARKET

JPMorgan Chase & Co (JPM) shares are lower by -3.09% after it announced that it beat EPS and Revenue estimates by +11.12% and +2.18%. The company reaffirmed guidance but reported Net Interest Income (NII) on the lower side, which is the likely cause for the selling pressure. Dividend yield: 2.35%. Potential average analyst target estimate: +6.1%.

BlackRock Inc (BLK) shares are higher by +2.42% in the premarket after it announced that it beat EPS and Revenue targets by +5.04% and +1.05% respectively. The company announced AUM figures in line with analysts’ expectations. In the past 30 days, 8 analysts have increased their price targets while 2 have lowered them. Dividend yield: 2.59%. Potential average analyst target estimate: +15.5%.

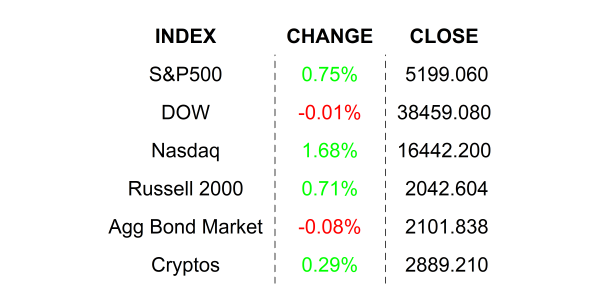

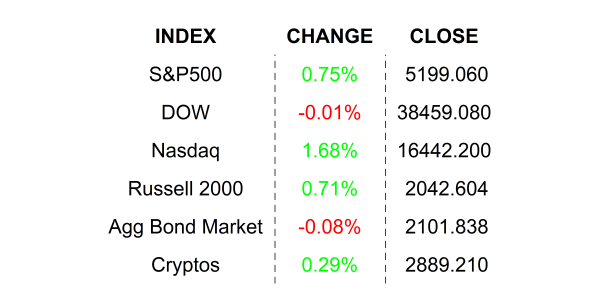

YESTERDAY’S MARKETS

NEXT UP

- University of Michigan Sentiment (April) may have slipped to 79.0 from 79.4. Inflation expectations are expected to remain unchanged.

- Fed speakers today: Collins, Schmid, Bostic, and Daly.

- Next week: Earnings, earnings, earnings, and regional Fed reports, housing numbers, Industrial Production, Fed Beige Book, and Leading Economic Index. Check in on Monday to get your hands on economic and earnings calendars for times and details.

.png)