Stocks had another rough session yesterday declining under the weight of higher bond yields. Retail Sales came in hot adding to the angst of yield-scared investors.

Add to cart. Bond yields are higher and fearful stock investors are using it as an excuse to unload. I am pretty sure most of them don’t even know the equation that ties stocks to bond yields, but YOU DO, my faithful, loyal, and highly cherished readers. Why? Because I so often refer to it in my writings. Whether you believe in it or not, let us take a second to figure out what is affecting the root cause of all this noise. That root cause, of course, are bond yields. They are higher across the curve, but let’s just focus on the shorter maturities, because they are closely tied to Fed policy.

For example, 2-year Treasury Note yields started the year off around 4.25% but currently sit around 4.95%, having added some +44 basis points since the beginning of April. The large uptick in yields reflect the changing expectations for Fed rate cuts over the next 2 years, and clearly those expectations are diminishing. They are declining largely due to the recent spate of strong economic figures. Remember the term “soft landing?” Well, now the term of the day is “no landing,” meaning the economy is just going to continue to fly high despite the Fed’s best efforts to bring it to ground. And, indeed, the economy is certainly holding its own. Employment is currently quite healthy, and consumers continue to… CONSUME. More on that in a few sentences. All this combined with the fact that inflation has still not receded to the Fed’s highly publicized +2% target has put the Fed in a position where it is in no hurry to lower interest rates… and most of its member-bankers have said as much, in so many ways, on so many occasions. With all that, rate cut expectations are being adjusted lower, and with them, bond yields are climbing. Now back to consumption.

Yesterday’s Retail Sales figure came in higher than expectations, and with it, an upward revision of last month’s figure. When people hear that Retail Sales are hot, the first thing that comes to mind is… INFLATION, which, in this period of time, means selling bonds AND stocks for weak-handed investors. In all OTHER times, one might be happy that consumers are keeping the economy moving forward. Let’s get a few things straight. First, healthy consumption is ALWAYS good for the economy. Without a strong economy, we CANNOT have a strong stock market. Second, let us define what we mean by “hot” Retail Sales. Better yet, why don’t I just show you a chart of Retail Sales. Check it out and then follow me to the close.

Now, without even looking at the numbers on the y-axis, you should clearly see that the trend Retail Sales is healthy, and in no way, out of control. Did economists get it wrong in their estimates? Yes, they did, as they have been assuming that higher interest rates would have stymied consumption. But to be clear, they were off by 0.3%. Finally, what was the biggest contributor to the monthly number? Well, it was 2 things. Gasoline and online retail. Before you rush to judgement, you must know that big ticket, interest rate sensitive items were actually a drag on the monthly number, as they declined. So, indeed, the Fed’s tight policy remains effective. Yes, consumers are consuming, but only on essentials. You be the judge. Does yesterday’s figure portend 2022-style inflation? I thought you might say that 😉.

WHAT’S ON THE MOVE THIS MORNING

Live Nation Entertainment Inc (LYV) shares are lower by -9.54% after Bloomberg reported the Department of Justice was preparing to launch an antitrust complaint against the company. The company is expected to announce earnings in early May. I would compare the company’s forward PE to its competitors, but alas it doesn’t have many 😉. Potential average analyst target upside: +17.9%.

UnitedHealth Group Inc (UNH) shares are higher by +7.27% after the company announced that it beat EPS and Revenue estimates by +4.87% and +0.59% respectively. The company re-affirmed its full-year guidance. In the past 30 days, 16 analysts have lowered their price targets while none has raised them. Dividend yield: 1.69%. Potential average analyst target upside: +26.7%.

Also, this morning: BofA, Morgan Stanley, and Bank of New York / Mellon all beat on EPS and Revenues, while J&J and PNC Financial came up short on Sales.

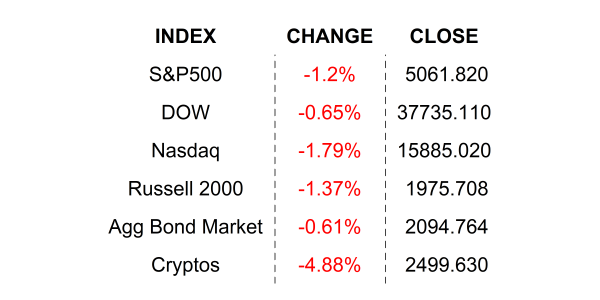

YESTERDAY’S MARKETS

NEXT UP

- Housing Starts (March) are expected to have fallen by -2.4% after gaining +10.7% in February.

- Building Permits (March) may have slipped by -0.9% after climbing +2.4% in the prior period.

- Industrial Production (March) is expected to come in with a +0.4% increase after inching up by +0.1% in the prior month.

- Fed speakers today: Jefferson, Williams, Barkin, and Colins. Chairman Powell will speak at 13:15 Wall Street Time.

.png)