Stocks rallied on Friday, ushered higher by the high priests of AI growth Microsoft and Alphabet. Inflation numbers came in higher than expected, confirming what the markets already expected.

What do you say? Last Friday’s inflation number came in on the higher end of economists’ estimates. If you polled them over the watercooler, they would most likely have expected it to come in on the higher side. On Wall Street, we call this a whisper number. Look, a lot goes into developing those economic models, and often the complicated ones don’t agree with the really simple ones, and only the smart analysts don’t discount the simpler ones. I showed you in a series of simple charts a high-level forecasting method for inflation which quite clearly showed that we can expect it to bump up a bit before most likely receding into the close of the year. If you missed it, you could check it out here: https://www.siebert.com/blog/2024/04/22/what-to-expect-when-you-are-reflecting/ .

Economists do, in fact use forecasting tools like the ones I showed you in the post, but they also use bottom-up methodologies in which they decompose the economic number to the same elements that the government agency measures in order to provide us with the topline numbers we are so obsessed with. They then attempt to forecast each of those elements separately. This process of decomposition allows the analyst to get a better understanding of the driving forces behind the ultimate indicator. It also makes for an easier process. For example, it would be easier for you to answer the question “do you think that musical instrument prices will rise next month, and if so by how much,” then “how much do you think annual inflation will increase next month?” Follow me? Now, you can call musical instrument companies and speak to your grandkid’s trombone teacher, which is a good start, but more than likely, you will look at the recent trend and try and determine if it will continue or if there are any seasonal components that need to be factored in. You may formulate a thesis as to why a trend may shift from growing to slowing, and it may even be obvious by looking at the chart. I know you don’t have time for that, but economists do… it’s their job. That is how they come up with those numbers.

Now, let’s move on to what the markets would like and, more importantly, what it all means for your portfolio. Clearly, the market, and just about everyone else would like to see inflation go back to where it was before the pandemic. Nobody likes inflation, but really, nobody like high interest rates. Even banks don’t like this type of high interest rates. But let’s stick to the stock market, which clearly doesn’t like high interest rates. It is none other than the Fed that plies at the levers of interest rates… and your stock portfolio. The folks who work for that venerable agency have been saying that inflation needs to get back to +2.0% for them to adjust those levers to lower interest rates. AND the fact of the matter is that inflation has, indeed, not yet gotten to that target. In fact, it seems to be heading in the wrong direction recently.

So, I am going to ask you the question? Do you think inflation is going to ease at some point soon so that the Fed can actually lower interest rates and cure your portfolio of interest-rate-fear-ides? If you have been paying attention, you might retort back to me a question like “in Friday’s numbers, what caused them to turn up instead of down?” If you are a regular reader, you probably have already guessed the answer, and it is not musical instruments. Inflation stickiness remains in services, specifically housing and healthcare. Digging one level further, the culprits appear to be rent and hospital services. Now, I can ask you a question which is easier to answer? Do you think rent inflation is going to slow down any time soon? What about healthcare costs, specifically those from hospital care? I thought you would say that 😉.

Well, here comes the tough question. Do you think that keeping interest rates higher will cause hospitals to slow down the increases in their charges? Probably not. And finally, do you think that higher interest rates are going to cause landlords to stop raising rents? SURELY NOT, in fact, higher interest rates will only serve to cause landlords to keep rents high in order to cover their high borrowing costs. But really, the most important question is what does the Fed think about all this? Well, we are going to have to wait and see later this week when the FOMC meets, and Fed Head Jay Powell gives us his thoughts on the matter. Indeed, your portfolio is definitively in his hands right now.

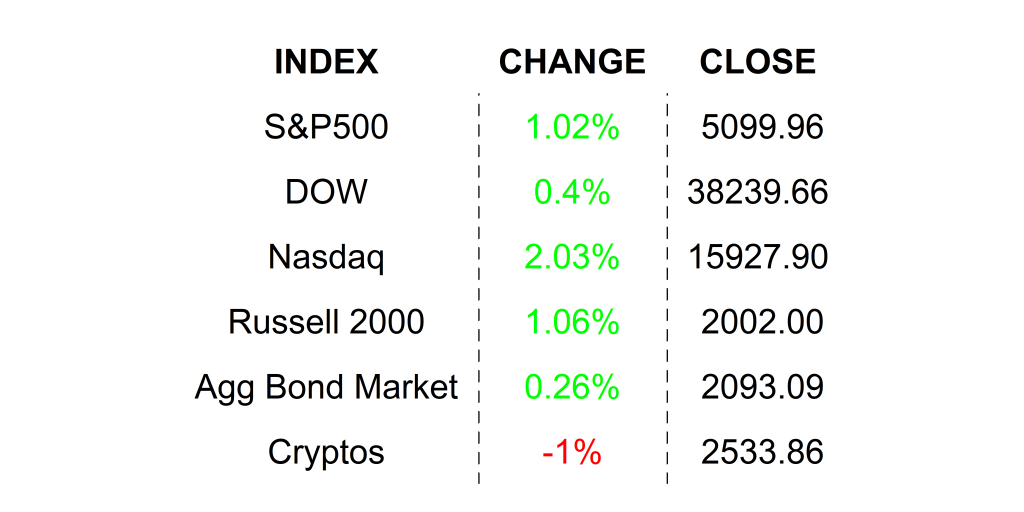

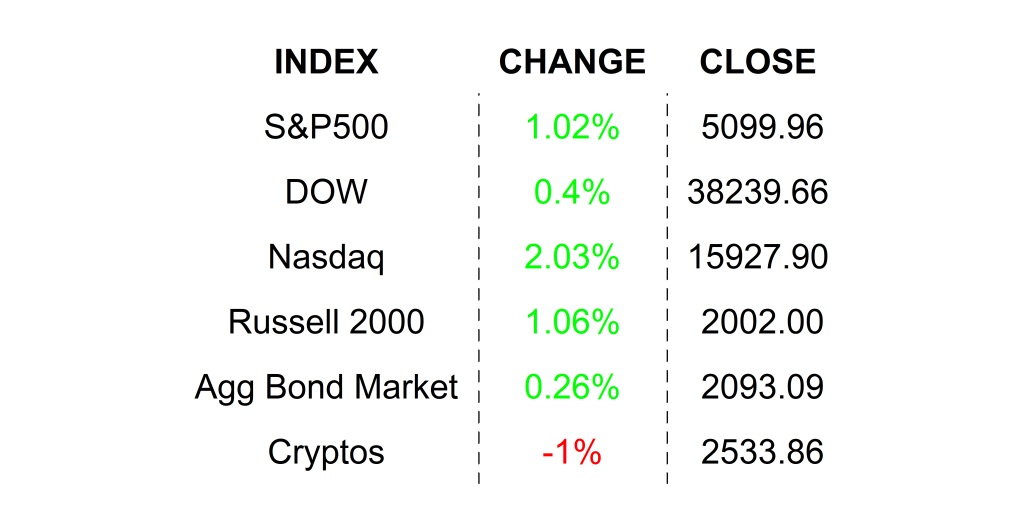

FRIDAY’S MARKETS

NEXT UP

- No economic release this morning, but it is the calm before the storm. This will be a busy earnings week, not to mention economic releases which include more housing numbers, Consumer Confidence, JOLTS Job Openings, ISM Manufacturing / Services, Factory Orders, Durable Goods Orders, and the monthly employment figures.Additionally, the FOMC will start its 2-day meeting tomorrow and deliver its decision and a whole lot of rhetoric on Wednesday. This is not a good week to give up on coffee. Get ahead of it and download the attached economic and earnings calendars for times and details.

.png)