Stocks rallied into solid gains yesterday, an afterthought about Wednesday’s not-so-bad Fed meeting. Traders are cued up for this morning’s big, monthly employment number, expected to show solid gains in new jobs.

These are not the numbers you are looking for. I know that it’s May 3rd and that May the 4th is tomorrow – a cruel trick played on me by the keepers of time. As it falls on a Saturday, I will miss my opportunity to fly my Star Wars freak flag, so I am just going to fly it a day early… and only in my tagline. Ok, back to the important market news on the day before May the 4th.

This morning, we are going to find out from the Bureau of Labor Statistics just how many new jobs were filled last month. This is always an important number, and it attracts much fanfare. Why? Because you need a job to make money if you want to buy stuff, silly. The only other way to survive is to maybe… maybe… get a check from the Government – a thank you gift to its citizens for being so loyal. That rarely happens, but it did during the pandemic. I know that it seems crazy, but the pandemic was like 4 years ago, so any of that stimulus money is either long gone or running really, really low. If you were out of a job as a result of the pandemic and you got government assistance to help you get back on your feet, now might be a good time to get out there and get back behind the plough.

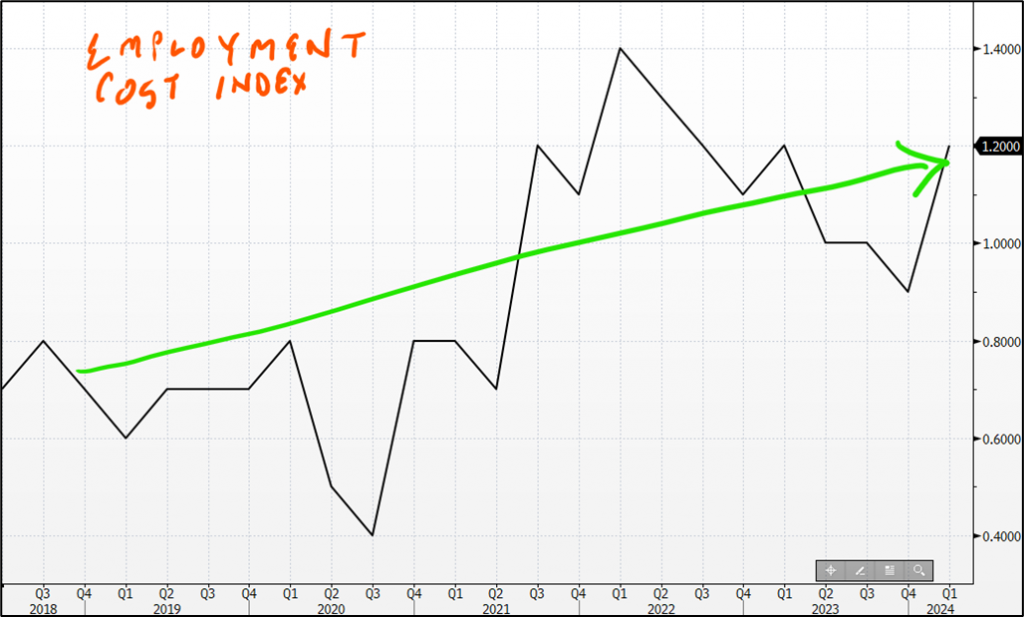

According to the last JOLTS Job Openings number from earlier this week, there are 8.68 million job openings! Included in that number are 1.944 million in Education and Health Services. Not for you? OK how about one of the 1.485 million openings in Professional and Business Services? You might even get one of those fancy, logoed, zip-up vests if you manage to snag one of those jobs. Hard hit in the pandemic, Leisure and Hospitality is back in business, and the group is looking to hire 1.153 million people. One might say that the labor market is strong at the moment with many employers seeking to hire. Another way to look at it is that demand for labor is high. Wait, don’t we know something about what happens when demand for a good or service is strong? Indeed, we do. The price of that good goes up. In this case, it is the wage that an employer must pay to fill a vacancy. So, labor costs may be bubbling higher. Well, not “may be,” actually “is” going up. See for yourself.

Who do you think is going to bear the brunt of this higher cost to producers of goods and services? Come on, you know the answer to that question is YOU AND ME, the consumers. That is a key driver of supply-push inflation. That can only be solved if workers become desperate and begin to accept lower wages, which clearly has not happened yet.

There is something else. Let’s say that companies get so cash-strapped that they actually have to lay off workers to stay afloat. Demand for labor would go down, and unemployed consumers would stop consuming, lowering demand for goods and services. Ah, we know what happens when demand declines. That’s right prices of goods and services go down, lessening demand-pull inflation. Are you seeing the picture emerge here? This is precisely why the Fed wants to see a weak labor market, hoping that it will ease inflation back to… well, its own prescribed target of +2.0%.

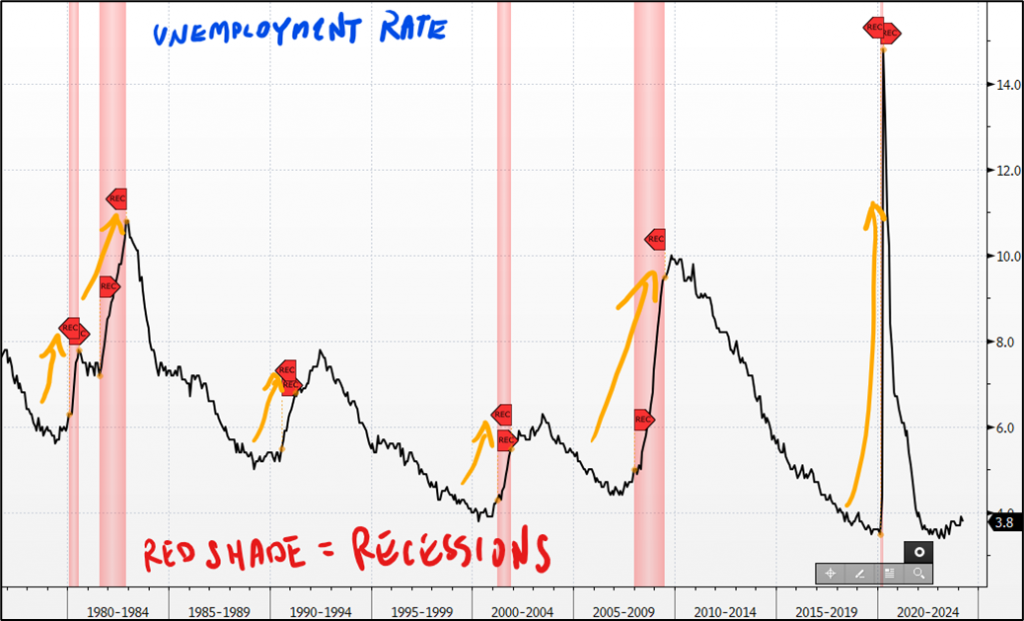

Clearly that has not happened yet. The labor market may be weaker than it was, say 18 months ago when the economy was still getting back to normal, post pandemic, but it is still relatively strong. Right now, inflation is not where the Fed wants it to be. So, what is a central bank to do? Keep its foot on the brake and hope for the best. The “best” would mean inflation at +2%, no recession, and no spike in unemployment. But can that really happen? I think we should consult history on this matter. Perhaps a chart will help out.

As you can probably gander from this chart, recessions are often accompanied by high unemployment. So, you see, the Fed wants to choke the economy to a point just before it loses consciousness into a recession. But if that does happen, it knows that it can quickly revive the economy with… rate cuts. Now, on this chart you may also notice that unemployment rates today are near the lows during the timeline of this chart, which dates back to 1994. If I extended farther back in time, we would have to go back to the late 1960s to see unemployment this low. I could show you that, but if I did, you would see that those levels shot up in the 12/1969 recession. It would be decades before unemployment returned to those levels… which we are just slightly above right now.

The Fed is in a tricky position, with its hands around the throat of a tender economy. Inflation has indeed improved, but there are still some sticky areas. You, my regular readers, know what the main perpetrator is: shelter, i.e., rent. You also know that higher interest rates only serve to keep rents high and higher. The only way to fix that problem would be a full-blown recession with high unemployment. As shelter is necessary to thrive, rent is usually the last thing to suffer when a consumer is struggling. Messy business, this inflation stuff. Anyway, pay attention to numbers this morning, because now you know what the reverberations might look like. May the force be with you… tomorrow.

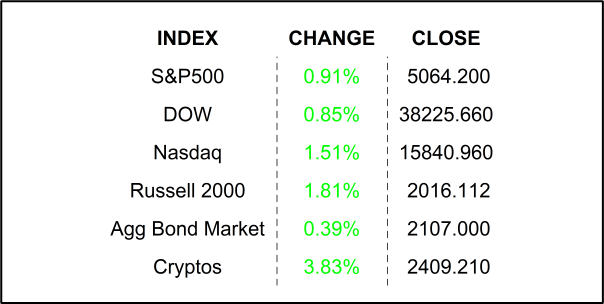

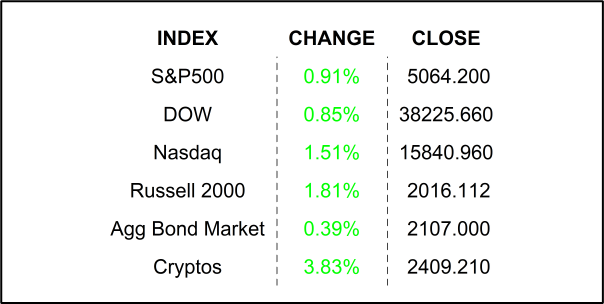

STOCKS ARE ON THE MOVE

Amgen is higher after its CEO was encouraged about trials in its own weight loss drug. Apple is higher after it announced better than expected earnings. Booking Holdings and DaVita are also higher this morning on announced earnings beats. Expedia is down big in the premarket after announcing a miss in bookings. Fortinet may have beaten solidly on EPS and Revenues, but its quarterly billings dropped. Right now, markets are pointing to a higher open.

YESTERDAY’S MARKETS

NEXT UP

- Change in Nonfarm Payrolls (April) is expected to be +240k, lower than last month’s +303k new hires.

- Unemployment Rate (April) may have remained at 3.8%.

- ISM Services Index (April) is expected to have ticked up slightly to 52.0 from 51.4.

- Next week will have plenty more earnings along with weekly employment numbers and Preliminary University of Michigan Sentiment. Check back in on Monday and download your weekly calendars for details.

.png)