Stocks posted a strong showing yesterday with Friday’s “win” still providing wind in their sails. This week’s dearth of economic numbers is the calm before next week’s inflation numbers storm.

Food for thought. Here is an off the cuff one for you. In my morning reading sprint, I came across an interesting and detailed analysis of how the magnificent seven’s magnificent margin growth cannot be maintained forever. I read all the analysis through and through and decided to do some checking myself.

First, let’s remember who makes up this Mag-7. Ready, here they are: Microsoft, Apple, NVIDIA, Alphabet, Amazon, Meta, and Tesla. All but rocket-stock NVIDIA has announced their Q1 earnings and all but Meta and Tesla surprised analysts positively so far. Meta was dinged for allocating too much spending to AI. I am a “hmmm” on that. Tesla missed the mark by a mile and hinted to weaker demand for EVs but promised a cheap model sometime in the next year. The cheap car announcement kept the stock from resuming its recent decline.

Digging into that Tesla announcement, I am thinking that management should be high fiving for pulling off that announcement with positive market reaction. Enough said? No, you know I have more. Tesla has increased competition in the EV market from… EVERYONE, including a bunch of Chinese producers you or I never even heard of but are now selling all over the world. Ok class, what happens when there is increased competition and greater supply? Good job, prices go down. And if costs of goods like batteries, steel, plastic, and electronics are not going down, what happens to profits? That’s right, margin goes down. Ah, but Tesla is coming out with a cheap car in the next year, and that should allow them to increase unit sales and revenues, right? Right, but “cheap” doesn’t just imply lower price point, it MEANS lower price points, which means… also, lower profit margins. See Tesla’s gross profits in the following chart and notice that they already look like they peaked and may be on the retreat.

Now, on to Microsoft, another card-carrying member of the Mag-7. The company breaks its revenues down into three segments: Productivity & Business Processes, Intelligent Cloud, and More Personal Computing. Simply put that is Microsoft Office, some cloud stuff, and… LinkedIn ( 🤔 ) for the first category. Azure and friends make up the second category, and Windows Operating System, devices, Xbox, and search advertising make up the third category. Microsoft has made a big bet on artificial intelligence, and you can imagine how robust and advanced AI can help increase sales in ALL its business lines. Notice that Microsoft’s business is predominantly reliant on software, which implies low cost of goods. That means that higher price points mean higher margins. To be clear, Xbox and Devices do rely on higher cost of goods and those businesses have lots of competition, so we would expect the margins of those business lines to have similar margin pressure to Tesla, but Microsoft with, very roughly… um, most of its revenue coming from higher margin products has a chance to defy gravity. Check out the Microsoft’s gross profit chart and compare it to the one above. As you can see, it looks like gross profits are far from peaking.

Can you spot the difference between these two charts? Of course, you can. Now a few words of reality. Of course, nothing can last forever in business. Competition eventually enters, markets get saturated, price growth slows, etc. Additionally, if we are talking about gross margin, which we are, we are not factoring the large capital investment involved in Azure infrastructure and R&D, which get amortized and subtracted in expenses impacting net margins, which we are not discussing here. If Microsoft never innovates again, those market pressures will eventually cause gross margins to diminish, and growth will, indeed slow. But you must ask yourself if Microsoft will stop innovating and finding new ways to make revenues… higher margin revenues. Did you ask yourself? I am sure that your and my answers were not exactly the same, but they were similar enough. I could post a chart to give you a visual reminder, but… but… but wait, I CANNOT CONTROL THE URGE. I am just going to post the same chart as above for Microsoft going back to its founding and let you decide for yourself. Now just visualize a similar chart for each of the Mag-7. Go ahead. Can you visualize it?

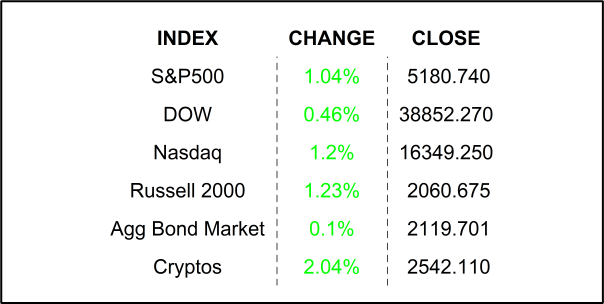

YESTERDAY’S MARKETS

NEXT UP

- Minneapolis Fed President Neel Kashkari, a known hawk, will speak twice today.

- The Treasury will auction off $58 billion 3-year Notes.

- Earnings after the closing bell: McKesson, Match Group, Reddit, Twilio, Coupang, Virgin Galactic, ZoomInfo, Electronic Arts, Envestnet, Lyft, Dutch Bros, and Wynn Resorts.

.png)