Stocks posted a solid day of gains after languishing in the earlier part of the session. Producer prices came in hot and Roaring Kitty goosed the small cap index with a meme.

Peter piper picked a peck. Yesterday afternoon I had the privilege of spending some time with an owner of a large food importer and it didn’t take long before we were talking about the price of a gallon of olive oil and a barrel of pickled peppers. Without getting into too much detail, I can report to you that peppers recently doubled in price and olive oil more than tripled in price. His family has been in the business since the beginning of the 20th century, so he knows a thing or two about pricing, and he is aware that his customers are sensitive to prices, so naturally he resists raising prices as long as possible, hoping for a reprieve. I was thinking, “how much can we expect this business owner to give up in profits and for how long?” I mean, his family has been in business for over a century, and they didn’t get there by giving money away.

How did we get on that topic in the first place? I told him a story of how a few weeks ago, I ran into a friend of mine who owns a very popular, high-end Italian restaurant. Our conversation started with an upbeat disposition but quickly turned serious when he told me that it has been a struggle for him to maintain his margins. Without my pressing him further he offered up that the cost of beef had risen so significantly that he wondered if he might be losing money on his filet mignon, which by the way, is fantastic. He then rattled off a shopping list of other items and their costs, but what really upset him was how much the price of olive oil had risen. He said, and I quote, “we make Italian food, can you imagine how much olive oil we go through?” We have been friends for a long time and my family has had many celebrations with the chef at the hearth, so I offered him some sagely advice. I said, “why don’t you just raise your prices?” He laughed, as I expected him to, but then he said quite seriously, “my prices are already high, how much can I charge for a steak?”

What is the message in all this? Inflation is a messy business. Rational companies will hold off on raising prices to their customers as long as possible but cannot allow their margins to diminish endlessly. If you want to know where consumer prices are going to be, you need to understand what is happening to producer prices today. Yesterday, the Bureau of Labor Statistics released its Produce Price Index / PPI which tracks the prices paid for goods and services by manufacturers and retailers. At its height in 2022, the PPI was at +11.7%, but thankfully, pulled back to its normal range a year ago. Since then, it has been a bit volatile, and yesterday it came in at +2.2%, while March’s number was revised down to +1.8% from +2.1%. In either case, yesterday’s print was higher than the prior one, but markets took it in stride given the large downward revision. Let’s take a step back and look at the timeline. Yesterday’s numbers represent April, and the revisions were from March. The question remains, will consumer prices reflect the increases? If so, when?

Back to my chat, the business owner acknowledged that price rises had eased a bit last year and had begun to pick up again in recent months, which is right on track with the PPI. Then he explained that his costs for delivery had skyrocketed due to salary increases for delivery truck drivers. That is what happens when there is a tight labor market. That is what we have at the moment. And that is what the Fed is afraid of. The net effect of all this is, pickled pepper price inflation may be easing, but their delivery costs are going up. You cannot make Chicken Scarpariello without copious amounts of olive oil and pickled peppers. There is simply no substitute.

HOT OR NOT IN THE PREMARKET

The Boeing Corp (PM) shares are lower by -1.14% after numerous sources reported that the Justice Department is considering prosecuting the company for violating the terms of a 2021 agreement. In the past 30 days 16 analysts have lowered their price targets while 1 has increased. Potential average analyst target upside: +20.4%.

Accenture PLC (CAN) shares are lower by -0.96% in the premarket after Deutsche Bank downgraded the stock’s rating to HOLD from BUY and lowered its price target. Accenture’s 25.39x forward PE is greater than the 12.25x PE of its peer group. Dividend yield: 1.68%. Potential average analyst target upside: +23.9%.

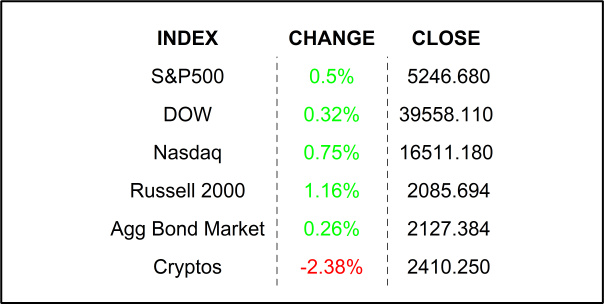

YESTERDAY’S MARKETS

NEXT UP

- Consumer Price Index / CPI (April) may have eased to +3.4% from +3.5%.

- Retail Sales (April) is expected to have grown by +0.4% after increasing by +0.7% in March.

- NAHB Housing Market Index (May) probably slipped to 50 from 51.

- Today’s Fed Speakers are Barr, Kashkari, and Bowman.

- After the closing bell earnings: Cisco Systems and B. Riley Financial.

.png)