Stocks slipped yesterday after the Dow could not hold on to its much-discussed 40k level as Fed bankers did everything they could to break the bulls’ will to survive. Industrial Production was flat in April – you may not care, but it is trending down which is bad for growth – which you do care about.

Mean old Fed. The iconic, all-powerful, omnipresent Federal Reserve Bank of the United States is unarguably THE most powerful institution in the world. You are probably thinking that I forgot about the military… um, no I didn’t. It is true that the Fed does not hurl bombs and bullets, nor do they have an underground command post deep in some mountain somewhere. No sprawling 5-sided HQ, nope, just a little grey, unassuming building with a big marble eagle perched over its front door.

So, what makes it so powerful without even one aircraft carrier to its name? The US boasts the largest economy in the world, the US dollar is the de facto currency for all major commodities transactions globally, and US sovereign bonds (despite any ratings agency’s opinion) are the foul weather go to. I am not saying that other central banks, currencies, and economies are not important and have no impact, but you can’t argue that the state of the US economy has a big impact the world over. And who do you think is in control over that economy? Is it the President? Is it Congress? Is it the generals? No, it is Jerome Powell and his band of economist-bankers at the Federal Reserve. Those bankers can fill your coffers with cash or drain them, leaving you destitute. They can make you feel like a rockstar or a friendless loser. How do you feel today? Aside from pain in your lower back, I am sure that if the Fed decided to cut interest rates, you would probably feel pretty good. You might even decide to buy something you have been holding off on. You may start making plans to do BIG THINGS in the future, now that your portfolio is on its way to doubling… in the future, of course. So, who are these bankers who control your emotions?

Of course, I am referring to the members of the Federal Open Market Committee, or FOMC. They vote on monetary policy under the shepherding of Jerome Powell. Not all of them vote all the time, as some of them rotate. One thing for sure is that they all have an opinion, and they are not afraid to share those opinions with the public. At the end of the day, it is their vote that matters, but there is good chance that their opinions will impact their votes, and assuming that the FOMC is a democratically run organization, they all have an opportunity to sway the votes of their fellow members. So, um, yes, the opinions of the people who run the most powerful organization in the world are, indeed, important. Why didn’t the Dow Jones Industrial Average close above 40,000 yesterday? Because Fed speakers were out in force warning that interest rates are not coming down anytime soon. Why did your portfolio value start to decrease in Q1 of 2022 before the Fed even started to raise interest rates? Because Fed members warned you that they were going to do it, in essence, declaring war; we know what happened after they launched their first sortie in March. Are you following me? If you are, you probably want to know where all those powerful bankers stand. Are they hawks or are they doves?

Bloomberg analyzes all the FOMC members’ public statements to come up with an index of sorts. They score each one across a spectrum ranging from -2 to +2 from most dovish to most hawkish with 0 being neutral. Check out the following Bloomberg chart with the ratings. The important ones are on the left-hand side of the chart. You can see that Governor Michelle Bowman is the biggest voting hawk and that Governors Lisa Cook and Adriana Kugler are the biggest doves. Minneapolis Fed President Neel Kashkari loves to talk, and he is quite hawkish, but he doesn’t have a vote this year. Anyway, if we add up all the voters’ ratings, we see that the net result is… neutral, which kind of means… anything goes at the moment. BUT it is important to note that those ratings can change at any time, because you never know what one of them might say into a hot mic at a town hall meeting in the middle of somewhere in the US you never heard of. If you are wondering how the conversation went behind closed doors at their May 1st confab, you can find out next week when the meeting minutes are released. I guarantee you that those minutes will be carefully looked over. Not just by economists and analysts, but also by presidents… and even generals.

STOCKS STANDING AT ATTENTION THIS MORNING

Take-Two Interactive Software Inc (TTWO) shares are off by -2.1% in the premarket after the company announced an earnings miss for last quarter. The company lowered its full-year guidance reflecting a later than expected launch of its next-generation Grand Theft Auto game. Deadlines are important 😉. Potential average analyst target upside: +19.1%.

Advanced Micro Devices Inc (AMD) shares are higher by +2.30% in the premarket after Microsoft announced plans to offer cloud customers AMD AI processors as an alternative to NVIDIA’s chips. In the past 30 days, 23 analysts have lowered their price targets while only 2 have raised them. Potential average analyst target upside: +16.3%.

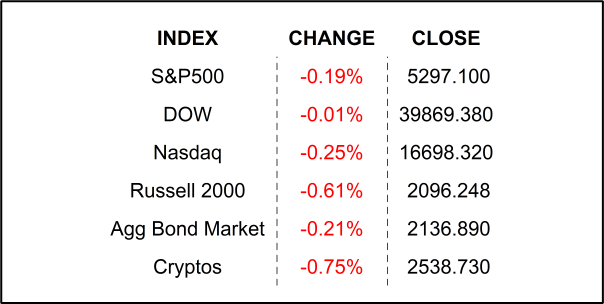

YESTERDAY’S MARKETS

NEXT UP

- Leading Economic Index (May) is expected to show a -0.3% decline for a second straight month.

- Fed Speakers: Waller (+1), Kashkari (+2), and Daly (-1). Wondering what those numbers are? Read the note above ⬆️.

- Next week: still more earnings along with more housing numbers, PMIs, Durable Goods Orders, University of Michigan Sentiment, and FOMC Meeting Minutes. Check back in on Monday for calendars and details.

.png)