Stocks gave up ground yesterday largely in response to the hawkish tone of the May 1st FOMC meeting minutes. Existing Home Sales unexpectedly declined in April where the Northeast region remains softer than pre-pandemic levels.

Yak it up now, these guys are serious… and dangerous. How was that for a long… telling tagline. I wanted to write about something interesting, like how NVIDIA knocked the ball out of the park, even with high expectations. The company’s CEO heralded the beginning of a new industrial revolution; I’m not so sure that I don’t agree with him, but he certainly raised the bar… for himself with those comments. No, I have to write about the Fed once again.

Yesterday, I gave you some insight into the process of Fed communication, and how they toil, and toil to only edit out a few words to get their message out to the world. The real message of yesterday’s note was that what you see is not exactly what you get. To really get into the minds of these white shirt and suited bankers, you must be a fly on the wall… and sit through 2 days of presentations run by upwards of 50 government economists, all of whom are at least a director, associate director, or a deputy something or other. Oh, and there are “special advisors” as well. You can do that, OR, you can read the minutes of the meeting to get a sense of how the policymakers are reacting to all those various reports and presentations.

It is important to note that the FOMC members themselves are well aware of the fact that their deliberations will be made public after several weeks, so it’s not like you are catching them itching a scratch while driving and unaware that you are watching them from the next car 😉. No, any comments are quite purposeful, and Secretary Josh Gallin is there, pencil in hand to write it all down. Notice, I chose to use “pencil” and not my usual “quill,” that is because it is likely that Josh may say something like, “are you sure you want me to use THOSE words,” before committing them to the permanent record.

Knowing that, what would you say if the minutes had a quote like, “various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.” Yep, exactly what I thought you would say. You see, these participants thought that “although monetary policy was seen as restrictive, many participants commented on their uncertainty about the degree of restrictiveness.” Now, that is somewhat disconcerting… for obvious reasons.

Let’s remember that slowing inflation is the primary goal for the Fed right now. It has slowed, but perhaps not as much as the bankers would like. I have meticulously shown you more times than you probably enjoy, that the last bit of inflation stickiness is in Rent of Shelter, which itself is a weirdly calculated number, though I know for a fact that rents indeed continue to climb the steep climb. The people who charge rents rely heavily on borrowing money, and the rates of borrowing that money are high BECAUSE OF THE FED, so they must raise rents to maintain margins. The good news is that it won’t last forever, because those landlords will eventually default on their loans and have to sell their properties at a distressed level so that the new landlord can get better margins. That is actually not good news, but it is beginning to happen, and it will continue to happen.

The economy is thankfully holding its own. Is it strong? No, but it is moving along. Consumer confidence is weakening, which portends lower consumption and GDP growth in the near term. Purchasing manager indexes or PMIs, are reflecting distress amongst products and services businesses as well. This foreshadows lower corporate investment and GDP growth in the near term.

We don’t know exactly who those “participants” that suggested rate hikes were, but I have to take my hat off to them, because raising rates further is certainly likely to kill inflation… along with economic growth, because, you know, recessions tend to do that. One final word. Those participants know that raising rates will push the economy into recession, so it is not likely that they would ever do that, but as you can see that just saying it… and allowing Josh to report it, can have an impact on the markets.

THE MINUTES FOR THIS MORNING’S PREMARKET

NVIDIA Inc (NVDA) shares are higher by +7.00% in the premarket after the company announced that it handily beat EPS and Revenues. The company provided current quarter guidance that was higher than analysts’ estimates. The company also announced a 10 for 1 stock split and increased its dividend by +150% to $0.10 per share. Dividend yield: 0.04%. Potential average analyst target upside: +20.4%.

Live Nation Entertainment Inc (LYV) shares are lower by -6.14% in the premarket after it was reported that the Department of Justice along with several states are suing the company seeking a breakup, specifically focused on the company’s dominance in ticket sales through its Ticketmaster business. I would tell you what the company’s PE is relative to its competition… but apparently, there is none, LOL.

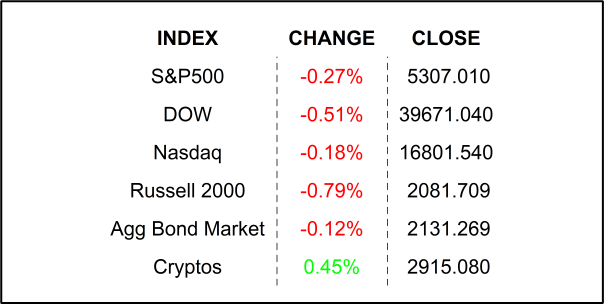

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (May 18) are expected to come in at 220k, slightly lower than last week’s 222k claims.

- S&P Global flash US Manufacturing PMI (May) may have slipped below 50 to 49.9. The Service PMI probably slipped to 51.2 from 51.3.

- New Home Sales (April) are expected to have declined by -2.2% after climbing by +8.8% in March.

- After the closing bell earnings: Ross Stores, Intuit, Workday, and Deckers Outdoors.

.png)