Stocks declined for a second straight day on good economic data with investors fearing that the good news would further harden the Fed’s heart. Flash PMI data surged, surprising economists and hopeful stocks bulls in a good is bad trading session.

Carry that weight. Imagine if you could borrow money from one person at say, 2% and then take that money and lend it to another person at 3%. When your 3% friend makes a payment, you use the payment to pay your 2% friend and pocket the difference of 1%. How cool does that sound? Don’t worry, I am not going to tell you how to get into the loan sharking business. Neither am I going to bore you with another missive on how banks make money. No, today I want to talk about carry trades.

A carry trade is when you borrow money in a country with low interest rates and then use that money to buy sovereign bonds in another country with higher interest rates. Kind of like the loan shark example above, but without having to break any kneecaps. Carry trades are a legitimate investment strategy and they have gained in popularity over the past 6 months or so. The popularity is due to the fact that global interest rates have largely settled down since the Fed and the ECB pivoted, currency exchange rates have been less volatile, and there are discrepancies between sovereign bond yields. First, take a look at this snapshot of global 10-year maturity bond yields.

I know that this is a busy chart. I actually stare at tables like this all day, which is probably why I have so many different pairs of glasses, contact lenses, magnifying glasses, etc. (it’s true, lol). Anyway, I highlighted in green a currently popular carry trade for you. Let’s start with Swiss government bonds. On Wall Street, we call them Swissies, and in Switzerland they are called Eidengnossen, but we will just call them Swiss government bonds in this example 😉. You can see that Swiss Government bonds are yielding 0.78%. Now look at the top of the chart and notice that US Treasury 10-year Notes are yielding 4.47%. In an unrealistic and abstracted world, you can borrow at less than 1%, convert to US dollars, buy US Treasury notes, collect almost 4 ½ %, and simply collect the difference of 3 ½% without even using your own cash! That is a very, very simple carry trade.

I am sure you are picturing yourself sitting poolside in Ibiza, clad in a soft, supple robe, sipping a swanky cocktail while a famous DJ plays chill electronic music in the background, as money piles up in your bank account 🍸🎵🌴💲. Sorry to pop that beautiful bubble, but there is some fine print. You know, on Wall Street we have a famous saying that “there is no free lunch.” Trust me, nothing is free on Wall Street, even a free lunch. In this case there must be a cost for collecting that +3.5% carry interest, and that cost is, as usual on Wall Street, risk. So, what is the risk? Well, remember that you borrowed money in Switzerland, and you are making money in the US, so you have to convert your US Dollar earnings to pay your finance cost in Swiss Francs. If suddenly the Swiss Franc strengthens, you will have to spend more US Dollars to pay your Swiss banker, and that will eat into your profits and possibly even turn your profits into losses. Additionally, I showed you 10-year maturity yields, but you are not likely to keep this trade for 10-years until the bonds mature. If you plan to unwind the trade by selling your 10-year Notes and paying off your Swiss loan, you are at risk of selling that Treasury at a loss if it goes down. That would be a bummer. Oh, and did I mention that there are fees and commissions that also have the potential to eat into those carry profits?

So, you see, carry trades are interesting and very popular right now, but like everything else in the world of finance, those potentially juicy returns come with some very spicy risks. There really is no free lunch on Wall Street, and I am told that cocktails in Ibiza are really, really expensive as well.

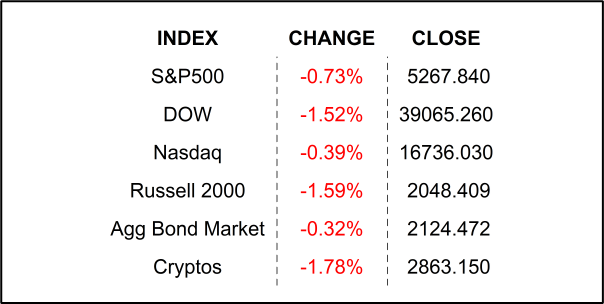

YESTERDAY’S MARKETS

NEXT UP

- Durable Goods Orders (April) may have slipped by -0.8% after climbing by +0.9% in March.

- University of Michigan Sentiment (May) is expected to be revised up to 67.8 from its preliminary read of 67.4.

- Markets are closed Monday for Memorial Day.

- Next week we will get still a few earnings stragglers in addition to some more housing numbers, Consumer Confidence, GDP, Personal Income, Personal Spending, and the Fed’s favorite inflation gauge PCE Deflator. Check back in on Tuesday for calendars and details.

.png)