Stocks rallied in a low-volume session as traders bought stocks on sale from the previous days’ carnage. Michigan sentiment gets an upward revision on confidence and a downward revision on expected inflation – 👍, says the market.

Just how confident are you? I heard something or other on the local news this morning that the summer season is the deadliest for drivers. The reporter speculated that the causes were less focused driving and more intoxicated drivers on the road. Somehow, and I know this is strange, it got me thinking about the markets. I mean, Memorial Day is the unofficial start to the summer and Friday was a pretty low volume session. I wondered if traders might somehow lose focus in the months ahead.

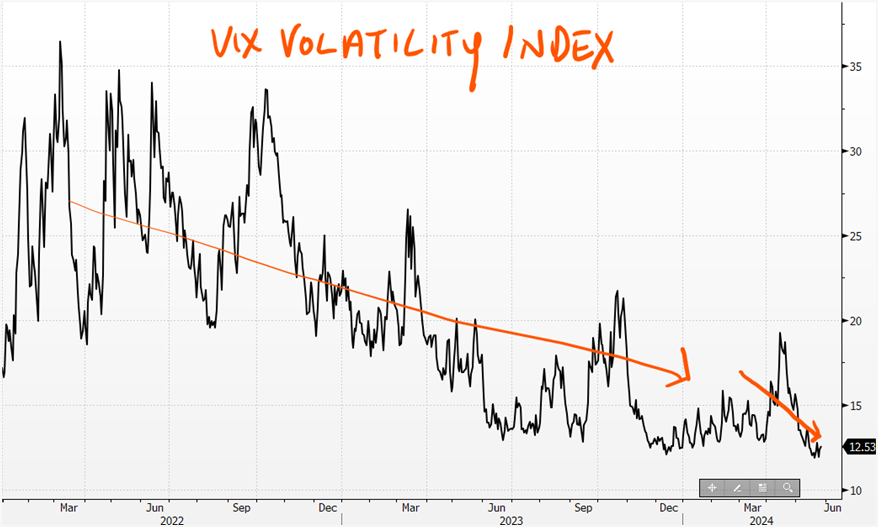

Still wondering, the first thing I did after sipping down espresso number 2 and firing up my Bloomberg was to plot a chart of the VIX Index. Remember the VIX Index measures expected volatility of S&P500 Index options to come up with a “fear” gauge of sorts. Stock indexes are near all-time highs and the Fed is doing its level best to curb investor excitement with tough talk. One would think that in this environment investors would be a bit on edge. Let’s check out the VIX chart and see what we can glean.

On this chart of the VIX Index, one can see that since 2022, stock volatility has clearly trended downward as one would expect. In 2023 the Fed began to make it clear that it was shifting away from further monetary tightening which took the VIX back to pre-pandemic levels. However, by March of this year, it became clear that the Fed was in no rush to deliver the interest rate cuts many were hoping for as inflation remained sticky, above the Fed’s target, and the economy remained strong. We see an initial spike in volatility as expected, but what followed may not be expected. The index quickly trended downward to find new lows. This may be a sign of complacency given the macro level risks that currently exist.

After last week’s FOMC minutes release, it was clear that the Fed was not in any rush to lower interest rates, with some FOMC members even considering raising interest rates, if necessary. Market expectation did adjust in response to the revelation with overnight interest rate swaps markets now predicting only around one 25 basis-point cut by yearend. Data continues to show a sturdy but not-too-hot economy; conditions that would justify the Fed’s keeping rates restrictive for a longer period of time. The big question is whether these benign macro conditions will persist and allow the Fed to engineer a so-called soft landing by eliminating the last bit of sticky inflation without pushing the economy into a recession.

My long-time readers know how obsessed I am with monitoring the consumption element of GDP. It is, after all, responsible for around 2/3 of domestic economic growth. A really good leading indicator of consumption is consumer confidence. Confident consumers… consume with confidence, which is good for… well, consumption, and GDP growth. So, how confident are consumers these days? Well, according to Friday’s University of Michigan Sentiment release, we got an upward revision of the month’s preliminary release, but the number was still markedly below readings from earlier in the year and nowhere near 2021 levels. This afternoon we will get the Conference Board’s Consumer Confidence release for April. Economists are expecting it to pull back slightly from the prior month… which was already below 2022 levels. I won’t bore you with another chart this morning, but if I did you would see that confidence appears to be trending in a downward direction, which does not portend great things for economic growth. If you add in a stubborn Fed which may only make 1 interest rate cut this year, unfortunately the probability of a harder landing increases. With stocks rallying the way they have been, one hopes that investors do not become too intoxicated with recent gains. Further, with lazy hazy days on the horizon, a loss of focus can lead to an increase in painful accidents. Stay focused, keep your eyes on the road.

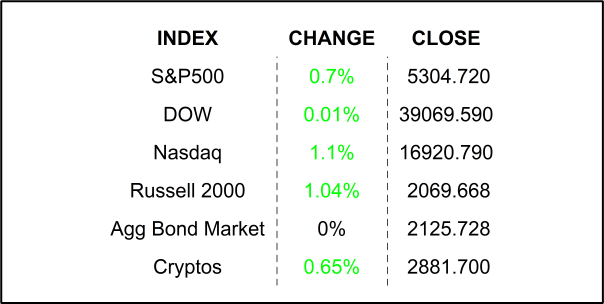

FRIDAY’S MARKETS

NEXT UP

- FHFA House Price Index (March) is expected to have increased by +0.5% after gaining +1.2% in February.

- S&P CoreLogic Case Shiller National Home Price Index YoY (March) may have climbed by +6.6% after increasing by +6.38% in the prior reading.

- Conference Board Consumer Confidence (May) probably slipped to 96.0 from 97.0.

- Today’s Fed Speakers: Mester, Bowman, Kashkari, Daly, and Cook.

- Later this week: still some more earnings releases along with more housing numbers, regional Fed reports, GDP, Personal Spending, Personal Income, and PCE Deflator. Download the attached earnings and economic calendars for details. Also don’t forget to check out my daily chartbook; I handcraft it for you daily (as its name implies) to give you some deeper insight into the markets.

.png)