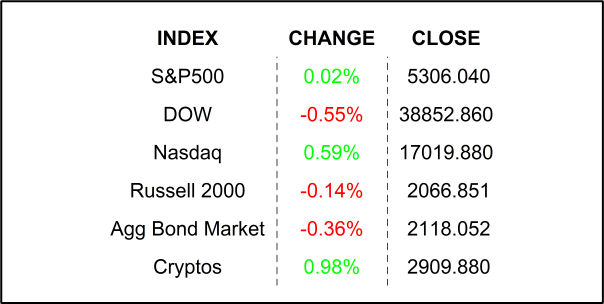

Stocks had a mixed close yesterday as rising bond yields collared any high hopes of solid gains. Consumer Confidence stages a comeback, beating economists’ estimates – praised be the almighty consumer.

Under the influence. I will admit that I am a bit frustrated. I am ever on the search for information that can help you get a leg up on the markets, perhaps get on a trend a bit earlier than your stock-picking rockstar friend (or so they claim 😉), or maybe get off a dying trend that is about to crumble into the straits below. I am awash with data and vigilance. Alas, my biggest enemy is something that I just cannot keep steady in my sights. That is, of course, crazy human emotions. I therefore see my role as being your ever-present sideline coach reminding you to stay focused. So, here we go. Pay close attention now, and don’t skip the pictures, they are important.

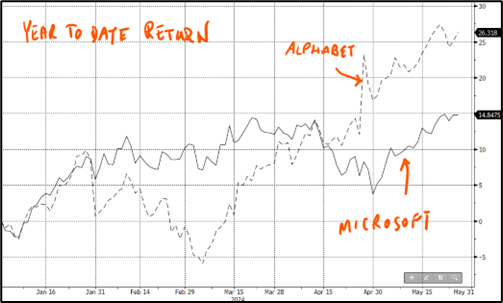

What does this:

US Treasury 10-Year Note Yield rising around +10 basis points in the last day or so, have to do with this?

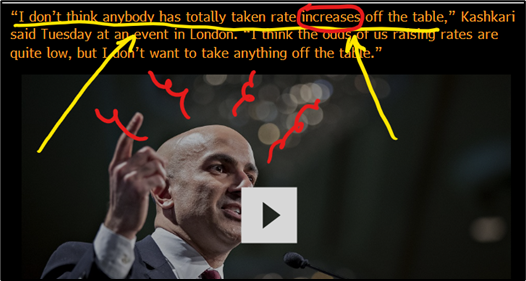

Year to date returns on Alphabet (GOOG) and Microsoft (MSFT), +26% and +15% respectively. Well, let’s start and try to understand, why the 10-year Note’s yield spiked yesterday. Ha, I know. It was most likely caused by this:

Ya, that is Minneapolis Fed President, and known hawk, Neel Kashkari saying that rate increases are not off the table. BUT WE ALREADY knew that based on the FOMC minutes released last week. Why does Neel and a few of his fellow hawks feel that way? Because inflation is still not at +2%, but rather, it is at +3.4%, which is not good. No, it’s not good for any of us. But why is inflation still so high given that interest rates have been at these levels for so long? Are we just buying too much stuff from Amazon? Is it that we need to see Taylor Swift so badly that we are willing to pay a hugely inflated premium to get nosebleed seats? No, sorry, it’s none of that. It is in services. No, it’s not your overpriced hair blowout or lawn-cutting service. It is in this:

Yes, indeed, Rent of Shelter is the culprit. What, you don’t rent, you own? I get it. Do you see those red bars that dominate the chart? Those represent what is called “Owners Equivalent Rent of Residences.” The Bureau of Labor Statistics calculates that by asking HOMEOWNERS how much they think it would cost to rent their homes. I am not making this up. That makes up 74% of the Rent of Shelter Category that makes up 60% of the Core Services category, which grew at +5.34% in the past year. In case you were wondering, Core Goods, which includes your Amazon purchases inflation, actually DECREASED by -1.27% in the past year.

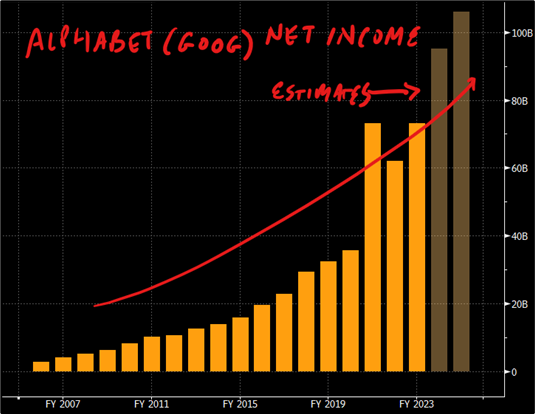

So, Neel, do you think that by raising interest rates, you will cause landlords to slow down rent hikes? Will higher rates cause homeowners to assess the rental value of their homes less aggressively? I hope not. So, I go back to my original question on what all this means to a company like, say Alphabet. I know, let’s see what Alphabet’s earnings have looked like and where analysts expect them to go in the next few quarters.

Hm, not too bad, eh? It seems to me that this last chart would be highly influential on your decision to invest in a company. Of course, you can always ask Neel Kashkari where to invest. Hopefully, he will tell you that he has provided bond investors with the greatest, low risk yield in decades. Folks, please stay focused on what is important.

WHAT IS ACTUALLY HAPPENING IN THE PREMARKET

American Airlines Group Inc (AAL) shares are lower by -8.41% in the premarket after the company cut its second quarter earnings outlook below analysts’ estimates. The cut is concerning to analysts because the summer season typically sees stronger demand. In the past 4 weeks, analysts have decreased their EPS estimates by -2.74%. Potential average analyst target upside: +25.7%.

Marathon Oil Corp (MRO) shares are higher by +8.3% in the premarket after ConocoPhillips (COP), down by -3.81%,agreed to acquire the company for $17 billion, a +14.7% premium of last night’s closing price.

Also, this morning: Dick’s Sporting Goods, Chewy, and Abercrombie & Fitch beat on EPS and Revenues while Advance Auto Parts came up short on Revenues.

YESTERDAY’S MARKETS

NEXT UP

- Richmond Fed Manufacturing (May) is expected to remain level at -7.

- Dallas Fed Services Activity (May) may have improved slightly to -9.4 from -10.6.

- Fed Beige Book will be released this afternoon with anecdotal economic information from the various Fed regions.

- Fed speakers: Williams and Bostic.

- Earnings after the closing bell: Agilent, Nutanix, Okta, C3.au, HP, UiPath, Salesforce, and Pure Storage.

.png)