Stocks were beaten down by higher bond yields attributed to confident consumers and a hawkish Minneapolis Fed Head. Beige Book provides very-beige view of regional economies growing at modest pace.

Silver lining. I am not going to post a chart of 10-year Treasury note yields so you can see just how peculiar the rising yields look given that inflation has clearly come down significantly since spiking just under 2 years ago. Well after the Fed made it clear that it was shifting from hiking to wait-and-see mode, 10-year yields spiked to almost 5% last fall; yields not seen since 2007, and yesterday those yields topped 4.6%.

Comments from super-hawk Neel Kashkari from 2 days ago sent long yields into a tailspin which ultimately punished. You may recall that Kashkari was a super-dove back in the day. Notice the emphasis on the word “super,” which I use to imply wide mood swings. In any case, though his words did damage to your portfolio these last 2 days and possibly will exact even more today, it is important to note that the Minneapolis Fed Banker doesn’t get to vote this year, so his words are just… um, words. One banker from Atlanta, Raphael Bostic, who is known as a centrist, and does get a vote this year, said yesterday that inflation is indeed improving in many areas and has a more positive view of the current situation. I am pretty sure that he didn’t get to read my post from yesterday, but I am glad that his opinion seems to be in line with mine… er, THE ACTUAL DATA.

Regardless of these differing opinions and ways of communicating them, it is clear that we are not going to get the rate cuts we were hoping for at the end of last year. The Fed has sufficient data at this point to put off doing just about anything other than talk until we see some bigger moves toward either its +2% target or economic disaster. Speaking of disaster, I saw some interesting statistics about adjustable-rate mortgages (ARMs) this morning that got me thinking.

ARMs typically have a fixed period before they reset annually. If a borrower took out a 5/1 ARM in 2019, they would have locked in something around a 3.5% rate for 5 years. As the pandemic struck and rates went to 0%, that borrower would have felt pretty good, though they were still fixed. Still more borrowers jumped in to lock in ARMs at less than 2% in 2021. The years that followed, 2022 and 2023, surely put those ARM lenders under stress as many approached the ends of their fixed period. SOFR or Secured Overnight Financing Rate (the new LIBOR) has been pretty much pegged at 5.3% since mid-2023 and will only move once the Fed changes the Funds rate. So, for our 5/1 ARM borrower in 2019, that means a big adjustment sometime this year… like DOUBLE, if there are no caps! Our 2021 borrowers have a bit more time on their hands, but they are also faced with a potentially painful reset in the next 2 years if the most hawkish FOMC member has his or her way. Based on the Fed’s last Dotplot, there is at least one anonymous FOMC member that expects Fed Funds to end 2025 unchanged from today and only -0.5% lower by the end of 2026. The good news, if you can even call it that, is that ARMs are typically used for higher priced homes and wealthier lenders, and they only make up around 5.5% of all mortgages. Still the absolute number of ARMs that are yet to move out of there fixed period is around 1.4 million. A good portion of those is likely to feel some pain in the next 2 years. Still, for the other 94% of borrowers, they are sitting tight with their fixed mortgages, unaffected by the Fed’s aggressive moves, and are not likely to make any big moves until rates and or home prices offer them some comfort.

So, the short of it is that higher for longer or higher yet (as Kashkari would like it) is about to put some pain on ARM borrowers who are typically wealthier and borrow $1million or more. While your rich friends are panicking, you may have an opportunity to capitalize on the present situation. US Treasury 12-month T-Bills currently offer 5.2% yield! If you bought that T-Bill in 2019 when your rich friend took out her ARM to buy that big house with the pool and pickleball court, you would have only gotten 1.5% yield. Her pain can be your gain!

WHAT’S ADJUSTING IN THE PREMARKET

Salesforce Inc (CRM) shares are lower by -15.88% in the premarket after the company provided current quarter guidance that was below analysts’ expectations. Full-year guidance, however, was raised to above estimates. The admission drew 2 analyst downgrades. In the past 30 days 27 analysts have lowered their targets while only 1 has raised them. Dividend yield: 0.58%. Potential average analyst target upside: +13.4%.

HP Inc (HPQ) shares are higher by +4.15% in the premarket after it announced strong sales results. HP’s forward PE of 9.51x is significantly lower than the median 19.66x forward PE of its peer group. Dividend yield: 3.35%. Potential average analyst target upside: +5.1%.

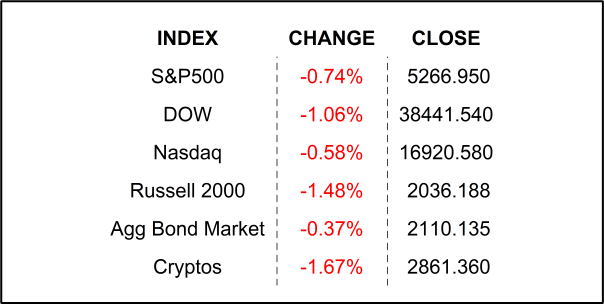

YESTERDAY’S MARKETS

NEXT UP

- Annualized Quarterly GDP (Q1) is expected to be revised down to +1.3% from +1.6%.

- Initial Jobless Claims (May 25) is expected to come in at 217k, slightly higher than last week’s 215k claims.

- Pending Home Sales (April) may have slipped by -1.0% after climbing by +3.4% in the prior month.

- Fed speakers: Williams and Logan

- After the closing bell earnings: Costco, The Gap, Dell, Veeva, MongoDB, Zscaler, Nordstrom, Ulta Beauty, HashiCorp, and Marvell.

.png)