Stocks closed higher on Friday after a late-day dip-buying rally. Core inflation cooled somewhat in April – expected by economists, probably unmoving to the Fed.

Where is it all going? Every month, the Bureau of Economic Analysis (BEA) comes out with a series of important economic data. It kicks off the release with Gross Domestic Product / GDP. Ya, that’s important, but not always so important. What in the world can I mean with an ambiguous statement like that? Well, BEA releases GDP 3 times per quarter. The first, or Advanced release is the bureau’s first, best estimate, and then they revise it over the following 3 months; I suppose they have to account for all the late-arriving data and Post-it notes sticking on their computer monitors. Anyway, as you might have guessed by now, the Advanced release is usually the most impactful one, because it is our first glimpse at how well the US economy performed… last quarter. Revisions are typically small if any. HOWEVER, if they are large, they can be influential, such as was last week’s DOWNWARD revision. I covered it last week, but as a reminder, consumers spent a bit less than BEA initially calculated and economists were largely expecting the downward revision. Still, it does highlight an important theme which I have been following very closely. That being that consumers are buying less STUFF. The technical term for STUFF is Durable Goods, as in something you can drop on your toe and feel it.

And here comes the repeating theme of our drama. We are, or were, spending more on services last quarter. We know this because aberrations of it appear in almost every economic number, specifically in inflation. Those aberrations are the very same that haunt the Fed… and your portfolio at night.

Day 2 of that monthly release by BEA features PCE Deflator, which, these days at least, are the headline grabbers for obvious reasons. More on that in a moment. But there are 2 other important ones which tend to get overlooked, Personal Consumption and Personal Income. Personal Consumption is really important for so many reasons. First, my regular readers, heads shaking right now, know that I am obsessed with consumption because it makes up… wait for it… 2/3 of the US economy, and second because it is a good early telltale for inflation, which is a big deal lately, in case you hadn’t noticed. When consumption is strong, it is good for economic growth, but during times of high inflation, it could fuel the flames. That said, when Personal Consumption slows and comes in below estimates, as it did on Friday, it is important to take notice. Also noticeable was a downward revision of the prior month’s figure. That was definitely noticed by Fed economists. Those looking for leading indicators that inflation is slowing will be happy. Those looking for early signs of a weaker economy may also be happy. For the record, I am never happy with lower spending or consumption, because really, that consumption fuels the income statements OF THE STOCKS WE OWN, despite inflation.

Do you want to guess how that spending number breaks down? Come on, this shouldn’t be hard. We spent less on goods but more on services. Notable increases were in Housing, Electricity, Healthcare, Hairdressing Salons and Personal Grooming Establishments, and Laundry and Dry-cleaning. Are you chuckling right now because you already know this based on your own expenditures? Of course, you are.

Finally, on to the Core PCE Deflator, which sported the smallest monthly increase year to date. First, it was expected by economists, and second, it was not enough to get FOMC members to jump out of their seats. Guess what that number showed? Durable goods dis-inflated. YOU SHOULD NOT BE SURPRISED, if you have been paying at least a little bit of attention to me. You should also not be surprised that the biggest culprit for gains on the services side came from… housing. There you have it. Housing, housing, housing, consistently across both major inflation gauges, output indicators, and personal spending. I leave you with the still unanswered question of whether higher interest rates for longer will fix this problem?

WHAT’S GOING ON IN THE PREMARKET

Roaring Kitty is back and roaring about his oversized position in GameStop causing the stock to jump by +92% in the premarket. Please take this with a grain of salt; you will end up with a nasty catnip hangover.

NVIDIA Corp (NVDA) shares are higher by +2.47% on high volume in the premarket after the company unveiled its next generation AI platform drawing a target upgrade by BofA to $1320. The company’s forward PE is 40.51x, only slightly higher than the 37.21x median of its peers. Would you believe it is cheaper than the 47.7x forward PE of rival AMD? Dividend yield: 0.004% Potential average analyst target upside: +9.1%.

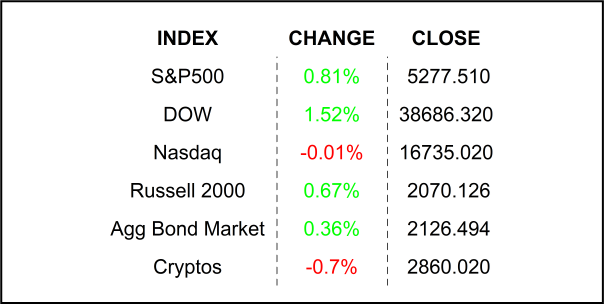

FRIDAY’S MARKETS

NEXT UP

- ISM Manufacturing Index (May) may have inched higher to 49.6 from 49.2 but still in contractionary zone below 50.

- S&P Global US Manufacturing PMI (May) is expected to come in at 50.9 in line with earlier, flash estimates.

- Later this week: still some important earnings announcements, JOLTS Job Openings, Durable Goods Orders, Factory Orders, ISM Services Index, and monthly employment numbers. Download the attached economic and earnings calendars for times and details.

.png)